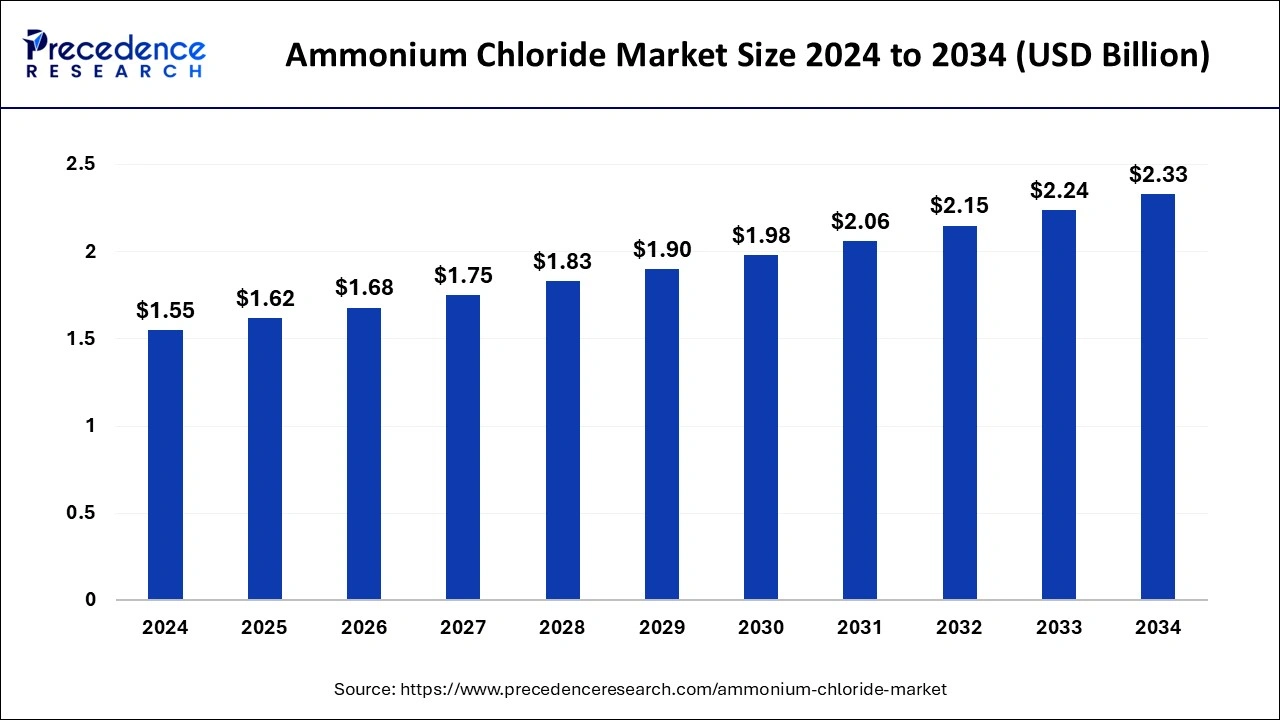

The global ammonium chloride market size accounted for USD 1.49 billion in 2023 and is predicted to reach around USD 2.24 billion by 2033, growing at a CAGR of 4.14% from 2024 to 2033.

Key Points

- Asia Pacific held the largest market share of 51% in 2023.

- North America is poised to be the second-largest position holder in the market over the forecast period.

- By grade, in 2023, the agriculture grade segment held the highest market share of 28%.

- By grade, the food grade segment is anticipated to witness rapid growth at a significant CAGR of 4.9% during the projected period.

- By application, the fertilizer segment has held 24% of the market share in 2023.

- By application, the medical/pharmaceutical segment is anticipated to witness rapid growth of 3.5% over the projected period.

The ammonium chloride market is a vital segment of the global chemical industry, experiencing steady growth due to its diverse applications across various sectors. Ammonium chloride, a white crystalline salt, is primarily produced through the reaction of ammonia and hydrochloric acid. It finds extensive use in industries such as agriculture, pharmaceuticals, food processing, textiles, and electronics. The market’s growth is driven by factors such as increasing demand for fertilizers, rising applications in the pharmaceutical sector, and expanding usage in various industrial processes. However, challenges such as volatile raw material prices, environmental concerns, and regulatory constraints pose significant hurdles to market expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3967

Growth Factors:

The growth of the ammonium chloride market is propelled by several key factors. Firstly, the agriculture sector accounts for a substantial portion of the market demand, driven by the widespread use of ammonium chloride-based fertilizers. As global population rises and arable land diminishes, farmers seek to enhance crop yields and improve soil fertility, thereby increasing the demand for fertilizers containing ammonium chloride.

Moreover, the pharmaceutical industry represents a significant growth avenue for the market. Ammonium chloride is utilized in various pharmaceutical formulations, including expectorants, diuretics, and systemic acidifiers. With the growing prevalence of chronic diseases and increasing healthcare spending worldwide, the demand for pharmaceuticals incorporating ammonium chloride as an active ingredient is expected to rise steadily.

Additionally, the industrial sector contributes to market growth through the utilization of ammonium chloride in diverse processes such as metal finishing, galvanizing, soldering fluxes, and wastewater treatment. The chemical’s properties, including its ability to act as a flux in soldering and its effectiveness in removing impurities from metal surfaces, make it indispensable in industrial applications.

Furthermore, the electronics industry represents a significant growth opportunity for the market. Ammonium chloride is employed in the production of printed circuit boards (PCBs) as a flux for soldering and etchant for copper. With the proliferation of electronic devices and the increasing demand for high-performance PCBs, the demand for ammonium chloride in the electronics sector is expected to witness steady growth.

Region Insights:

The demand for ammonium chloride varies across regions, influenced by factors such as agricultural practices, industrial activities, and economic development. In Asia Pacific, countries such as China, India, and Japan dominate the market due to their large agricultural sectors and extensive industrial activities. China, in particular, is a major producer and consumer of ammonium chloride, driven by its significant agricultural output and robust chemical manufacturing sector.

In North America, the United States and Canada are significant markets for ammonium chloride, with applications ranging from agriculture to pharmaceuticals and industrial processes. The presence of a well-established agricultural industry, coupled with a thriving pharmaceutical and chemical sector, contributes to the region’s demand for ammonium chloride.

In Europe, countries like Germany, France, and the Netherlands are key consumers of ammonium chloride, driven by the agricultural sector’s need for fertilizers and the chemical industry’s demand for various industrial applications. Despite stringent environmental regulations and increasing emphasis on sustainable agricultural practices, the demand for ammonium chloride remains steady in the region.

In Latin America and the Middle East & Africa, the market for ammonium chloride is relatively smaller but is expected to witness growth due to increasing agricultural activities and industrialization. Countries such as Brazil, Mexico, South Africa, and Saudi Arabia present opportunities for market expansion, driven by their growing economies and evolving industrial landscapes.

Ammonium Chloride Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 1.49 Billion |

| Global Market Size by 2033 | USD 2.24 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Grade and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ammonium Chloride Market Dynamics

Drivers:

Several drivers contribute to the growth of the global ammonium chloride market. Firstly, the agricultural sector’s reliance on fertilizers containing ammonium chloride as a nitrogen source fuels market demand. With the increasing need to improve crop yields and ensure food security amidst a growing population, farmers continue to utilize fertilizers to enhance soil fertility and boost agricultural productivity.

Moreover, the pharmaceutical industry’s demand for active pharmaceutical ingredients (APIs) incorporating ammonium chloride drives market growth. As healthcare spending increases and the prevalence of chronic diseases rises globally, pharmaceutical manufacturers seek reliable and cost-effective ingredients for drug formulations, thereby boosting the demand for ammonium chloride.

Additionally, the industrial sector’s utilization of ammonium chloride in various processes such as metal treatment, textiles, and electronics contributes to market expansion. The chemical’s properties, including its corrosion inhibition and fluxing capabilities, make it indispensable in industrial applications such as metal finishing, soldering, and PCB manufacturing.

Furthermore, technological advancements and innovations in manufacturing processes have enhanced the efficiency and cost-effectiveness of producing ammonium chloride, thereby driving market growth. Improved production methods, coupled with economies of scale, have led to lower production costs and increased supply, further fueling market expansion.

Opportunities:

The global ammonium chloride market presents several opportunities for stakeholders across the value chain. Firstly, the growing demand for specialty fertilizers, including those tailored for specific crops and soil types, presents opportunities for fertilizer manufacturers to innovate and develop new formulations incorporating ammonium chloride. By leveraging advanced nutrient delivery systems and precision agriculture techniques, companies can cater to the evolving needs of farmers and agronomic challenges.

Moreover, the pharmaceutical sector offers significant growth potential for manufacturers of pharmaceutical-grade ammonium chloride. With the increasing prevalence of respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD), there is a growing demand for expectorants and respiratory medications containing ammonium chloride as an active ingredient. Additionally, opportunities exist for the development of novel drug formulations and combination therapies utilizing ammonium chloride for various therapeutic indications.

Furthermore, the industrial sector presents opportunities for manufacturers of specialty chemicals and industrial-grade ammonium chloride. With the expanding electronics industry and the proliferation of electronic devices, there is a growing demand for high-purity ammonium chloride for PCB manufacturing and semiconductor processing. Moreover, the increasing focus on sustainable manufacturing practices and environmental regulations present opportunities for companies to develop eco-friendly alternatives and green technologies for industrial applications.

Additionally, investments in research and development (R&D) aimed at improving the efficiency and sustainability of ammonium chloride production processes can unlock new opportunities for market growth. By leveraging advanced technologies such as membrane electrolysis and electrochemical synthesis, companies can enhance production yields, reduce energy consumption, and minimize environmental impact, thereby strengthening their competitive position in the market.

Challenges:

Despite the favorable market outlook, the global ammonium chloride market faces several challenges that could hinder its growth trajectory. Firstly, volatility in raw material prices, particularly ammonia and hydrochloric acid, poses a significant challenge for manufacturers, impacting production costs and profit margins. Fluctuations in feedstock prices are influenced by factors such as global supply-demand dynamics, energy prices, and geopolitical tensions, making it challenging for companies to forecast and manage production costs effectively.

Moreover, environmental concerns surrounding the use of ammonium chloride-based fertilizers and industrial processes pose challenges for market growth. The overuse of nitrogen-based fertilizers can lead to soil acidification, nutrient imbalances, and environmental pollution, resulting in adverse effects on soil health, water quality, and biodiversity. Additionally, emissions of ammonia and greenhouse gases from industrial processes involving ammonium chloride contribute to air and water pollution, necessitating stringent environmental regulations and pollution control measures.

Furthermore, regulatory constraints and compliance requirements present challenges for market participants, particularly in regions with stringent environmental standards and safety regulations. Manufacturers must adhere to regulatory guidelines governing product quality, safety, labeling, packaging, and transportation to ensure compliance and market access. Additionally, evolving regulatory frameworks aimed at reducing greenhouse gas emissions and promoting sustainable practices could impact the market’s dynamics and require companies to invest in technology upgrades and emission reduction measures.

Read Also: Nanosensors Market Size to Grow USD 1,712.89 Million by 2033

Recent Developments

- In March 2023, Yara Clean Ammonia and Enbridge Inc. penned a letter of intent to collaboratively develop and build a low-carbon blue ammonia production plant in Texas, USA. The facility, anticipated to have a capacity ranging from 1.2 to 1.4 million tons per annum, will employ auto-thermal reforming coupled with carbon capture technology. Its objective is to address the increasing global demand for low-carbon ammonia. Subject to approval, the project entails an investment ranging between $2.6 and $2.9 billion.

- In May 2022, BASF unveiled the expansion of its Automotive Coatings Application Center in Mangalore, India. The facility has been meticulously designed to facilitate customer-centric R&D operations and provide an authentic simulation of OEM paint shops.

Ammonium Chloride Market Companies

- BASF SE (Germany)

- The Dallas Group of America (U.S.)

- Central Glass Co., Ltd (Japan)

- Tuticorin Alkali Chemicals And Fertilizers Limited (India)

- Tinco Chemicals Private Limited (India)

- Hubei Yihua Chemical Industry Co Ltd (China)

- Jinshan Chemical (China)

- CNSG (China)

- HEBANG (China)

- Tianjin Bohua YongLi Chemical (China)

- Shannxi Xinghua (China)

- Shijiazhuang Shuanglian Chemical (China)

- Liuzhou Chemical (China)

- Hangzhou Longshan Chemical (China)

- Sichuan Guangzhou (China)

- Guangyu Chemical Co Ltd (China)

- Shanxi Yangmei Fengxi Fertilizer Industry (Group) Co., Ltd (China)

- YNCC (South Korea)

Segments Covered in the Report

By Grade

- Food Grade

- Industrial Grade

- Agriculture Grade

- Metal Works Grade

By Application

- Agrochemical

- Medical/Pharmaceutical

- Food Additives

- Leather & Textiles

- Batteries

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/