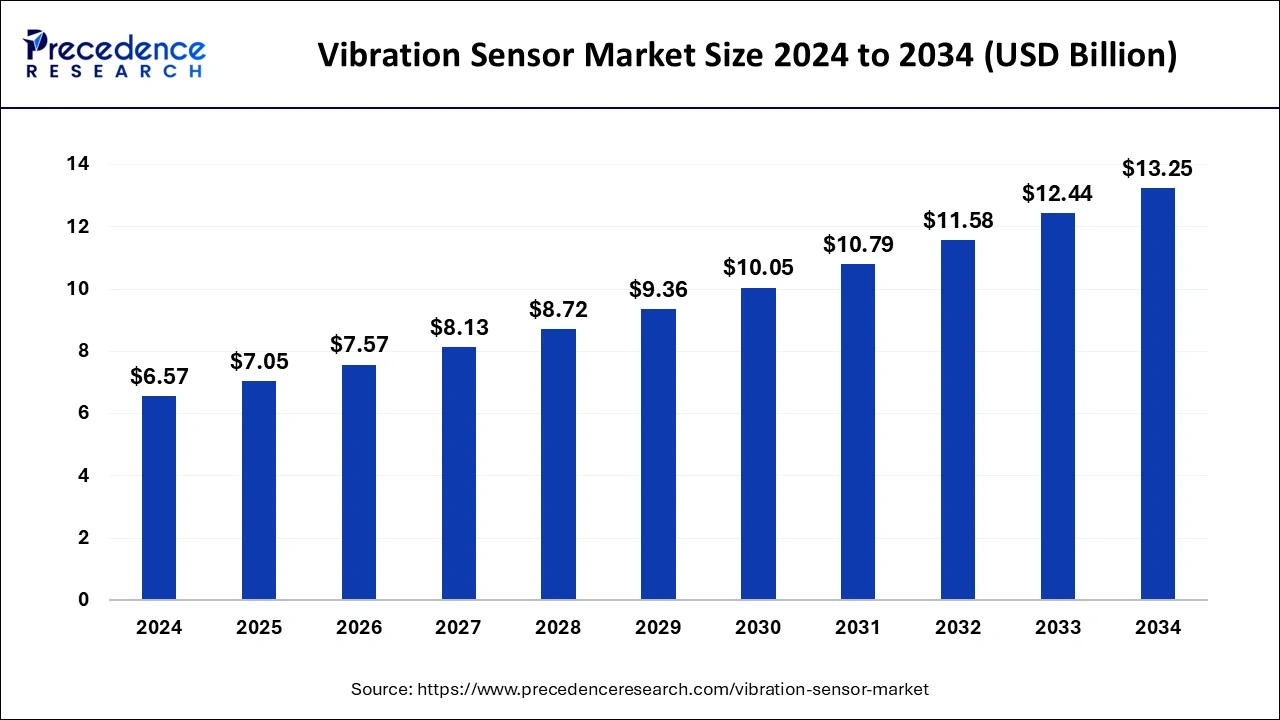

The global vibration sensor market size accounted for USD 6.12 billion in 2023 and is anticipated to hit around USD 12.44 billion by 2033, growing at a CAGR of 7.35% from 2024 to 2033.

Key Points

- North America dominated the market with the largest market share of 38% in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 8.62% between 2024 and 2033

- By type, the accelerometers segment has captured more than 45% in 2023.

- By type, the displacement sensors segment is expected to expand at a CAGR of 8.4% between 2024 and 2033.

- By technology, the piezoresistive sensors segment has generated 25% of market share in 2023.

- By technology, the tri-axial sensors segment is projected to grow at the fastest CAGR of 8.92% between 2024 and 2033.

- By end-use, the automobile segment has held the significant market share of 28% in 2023.

- By material, the quartz-based sensors segment has recorded more than 44% of the market share in 2023.

The vibration sensor market has experienced remarkable growth in recent years, driven by the increasing adoption of vibration sensors across various industries such as automotive, aerospace, manufacturing, and healthcare. Vibration sensors, also known as accelerometers, are devices used to measure vibrations and oscillations in machines, structures, and systems. They play a crucial role in monitoring equipment health, detecting faults, and preventing mechanical failures, thereby enhancing operational efficiency and safety.

Get a Sample: https://www.precedenceresearch.com/sample/3969

Growth Factors

Several factors have contributed to the growth of the vibration sensor market. Firstly, the rising demand for predictive maintenance solutions has fueled the adoption of vibration sensors in industrial applications. By continuously monitoring equipment vibrations, these sensors enable early detection of abnormalities and potential failures, allowing for timely maintenance and minimizing downtime.

Moreover, advancements in sensor technology, including microelectromechanical systems (MEMS) and wireless connectivity, have made vibration sensors more compact, affordable, and energy-efficient. This has expanded their applicability across a wide range of industries and enabled real-time monitoring of machinery and infrastructure.

Furthermore, stringent regulatory requirements and industry standards pertaining to equipment safety and reliability have increased the need for vibration monitoring solutions. Industries such as aerospace, automotive, and energy adhere to strict quality and safety standards, driving the demand for high-performance vibration sensors capable of detecting even subtle changes in machine behavior.

Additionally, the growing emphasis on asset optimization and operational efficiency has led to increased investments in condition monitoring systems, of which vibration sensors are a key component. Companies are leveraging data analytics and predictive maintenance algorithms to optimize equipment performance, reduce maintenance costs, and extend asset lifespan, thereby driving the demand for vibration sensor solutions.

Region Insights:

The vibration sensor market exhibits regional variations influenced by factors such as industrialization, technological advancement, and regulatory environment. In North America, the presence of key industries such as automotive, aerospace, and manufacturing drives the demand for vibration sensors. The region is characterized by a high level of adoption of advanced monitoring technologies, with companies investing in predictive maintenance solutions to improve operational efficiency and reduce downtime.

In Europe, stringent regulations related to workplace safety and environmental protection propel the adoption of vibration sensor solutions across industries. Countries like Germany, France, and the UK are leading the market with significant investments in industrial automation and smart manufacturing technologies. Additionally, the automotive sector in Europe drives demand for vibration sensors used in vehicle health monitoring and driver assistance systems.

The Asia Pacific region is witnessing rapid industrialization and infrastructure development, driving the demand for vibration sensors in sectors such as automotive, construction, and electronics manufacturing. Countries like China, Japan, and South Korea are major contributors to the market growth, with a focus on technology innovation and industrial automation. Moreover, the burgeoning automotive industry in countries like India and Thailand presents lucrative opportunities for vibration sensor manufacturers.

In Latin America and the Middle East & Africa, industries such as oil & gas, mining, and energy utilities drive the demand for vibration sensor solutions. These regions are characterized by a growing emphasis on asset reliability and safety, particularly in hazardous work environments. Governments and industry regulators are increasingly mandating the use of vibration monitoring systems to ensure compliance with safety standards and prevent equipment failures.

Vibration Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.35% |

| Global Market Size in 2023 | USD 6.12 Billion |

| Global Market Size by 2033 | USD 12.44 Billion |

| U.S. Market Size in 2023 | USD 1.74 Billion |

| U.S. Market Size by 2033 | USD 3.55 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, By End-use, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vibration Sensor Market Dynamics

Drivers:

Several drivers are propelling the growth of the vibration sensor market. Firstly, the increasing adoption of Industry 4.0 technologies and the Internet of Things (IoT) is driving demand for vibration sensors as part of connected industrial systems. Integrating vibration sensors with IoT platforms enables real-time monitoring of equipment health and facilitates predictive maintenance, leading to improved productivity and cost savings.

Moreover, the growing awareness of the benefits of predictive maintenance and condition monitoring is encouraging industries to invest in vibration sensor solutions. By proactively monitoring equipment vibrations and identifying potential issues before they escalate, companies can avoid costly downtime, reduce maintenance expenses, and optimize asset performance.

Furthermore, the proliferation of smart devices and wearable technology is expanding the application scope of vibration sensors beyond traditional industrial settings. These sensors are increasingly integrated into smartphones, fitness trackers, and medical devices to detect motion, measure physical activity, and monitor health conditions, driving demand for miniaturized and low-power sensor solutions.

Additionally, the automotive industry’s focus on vehicle safety and driver assistance systems is driving the adoption of vibration sensors for applications such as tire pressure monitoring, anti-lock braking systems (ABS), and electronic stability control (ESC). As automotive manufacturers strive to enhance vehicle performance and safety features, the demand for high-precision vibration sensors is expected to increase.

Furthermore, advancements in sensor technology, such as the development of MEMS-based vibration sensors and wireless sensor networks, are enabling cost-effective and scalable solutions for vibration monitoring. These technological innovations improve sensor accuracy, reliability, and data transmission capabilities, making vibration sensors more accessible to a wider range of industries and applications.

Opportunities:

The vibration sensor market presents several opportunities for stakeholders across the value chain. Firstly, the adoption of vibration sensors in emerging industries such as renewable energy, smart infrastructure, and healthcare is expected to drive market growth. In the renewable energy sector, vibration sensors are used to monitor the performance of wind turbines, solar panels, and hydroelectric generators, optimizing energy production and ensuring equipment reliability.

Moreover, the integration of vibration sensors with artificial intelligence (AI) and machine learning algorithms offers opportunities for advanced predictive maintenance solutions. By analyzing vibration data patterns and identifying anomalies, AI-powered vibration monitoring systems can predict equipment failures with greater accuracy, enabling proactive maintenance interventions and minimizing downtime.

Furthermore, the development of wireless and battery-free vibration sensor solutions opens up opportunities for remote monitoring and IoT applications in challenging environments. These sensors can be deployed in inaccessible or hazardous locations, providing real-time data insights and enabling predictive maintenance strategies without the need for wired connectivity or external power sources.

Additionally, the increasing demand for vibration sensors in consumer electronics, wearable devices, and medical applications presents opportunities for sensor manufacturers to diversify their product portfolios and target new market segments. Miniaturized and low-power vibration sensors are in high demand for applications such as gesture recognition, haptic feedback, and health monitoring, driving innovation in sensor design and manufacturing.

Furthermore, partnerships and collaborations between sensor manufacturers, software developers, and end-users can drive innovation and accelerate market growth. By leveraging complementary expertise and resources, companies can develop integrated solutions that address specific industry challenges and deliver greater value to customers.

Challenges:

Despite the opportunities, the vibration sensor market faces several challenges that could impede its growth. Firstly, concerns related to data privacy and cybersecurity pose risks to the adoption of IoT-enabled vibration sensor solutions. As industrial systems become increasingly interconnected and data-driven, protecting sensitive information and ensuring the integrity of sensor data becomes paramount to maintaining trust and compliance with regulatory requirements.

Moreover, interoperability issues and compatibility concerns may arise in complex industrial environments where multiple sensor networks and data systems coexist. Standardization efforts and interoperability protocols are needed to ensure seamless integration and communication between different sensor platforms, control systems, and analytics software.

Furthermore, the high upfront costs associated with implementing vibration monitoring systems, including sensor hardware, software infrastructure, and installation expenses, may deter small and medium-sized enterprises (SMEs) from investing in these solutions. To address this challenge, sensor manufacturers and solution providers need to offer flexible pricing models, financing options, and value-added services that cater to the needs and budget constraints of SME customers.

Additionally, the lack of skilled personnel capable of interpreting vibration data and implementing predictive maintenance strategies poses a barrier to the adoption of vibration sensor solutions. Companies need access to trained technicians, engineers, and data analysts who can effectively utilize sensor data insights to optimize equipment performance and maintenance practices.

Read Also: Cardiac Rhythm Management Devices Market Size, Share Report by 2033

Recent Developments

- In January 2023, HARMAN International unveiled its sound and vibration sensor and external microphone products, designed to enhance the auditory experience in and around vehicles for various applications, including identifying emergency vehicle sirens and detecting glass breakage or collisions.

- In March 2022, SAMSUNG released the Galaxy A53 5G smartphone, which features an octa-core processor, a 120 Hz refresh rate display, and a sharp resolution of 1080 x 2400 pixels.

- In May 2022, Sensoteq announced the Kappa X Wireless Vibration Sensor. This compact sensor has a replaceable battery and can detect faults, making it suitable for various industrial applications.

Vibration Sensor Market Companies

- Dytran Instruments, Inc.

- PCB Piezotronics, Inc. (IMI Sensors division)

- Hansford Sensors Ltd.

- TE Connectivity Ltd. (formerly Measurement Specialties, Inc.)

- Honeywell International Inc.

- Robert Bosch GmbH

- National Instruments Corporation

- Analog Devices, Inc.

- Meggitt PLC

Segment Covered in the Report

By Type

- Accelerometers

- Velocity Sensors

- Displacement Sensors

By Technology

- Piezoresistive Sensors

- Tri-Axial Sensors

By End-use

- Automotive Sector

- Aerospace And Defense

- Consumer Electronics

By Material

- Quartz-based Sensors

- Doped Silicon Sensors

- Piezoelectric Ceramics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/