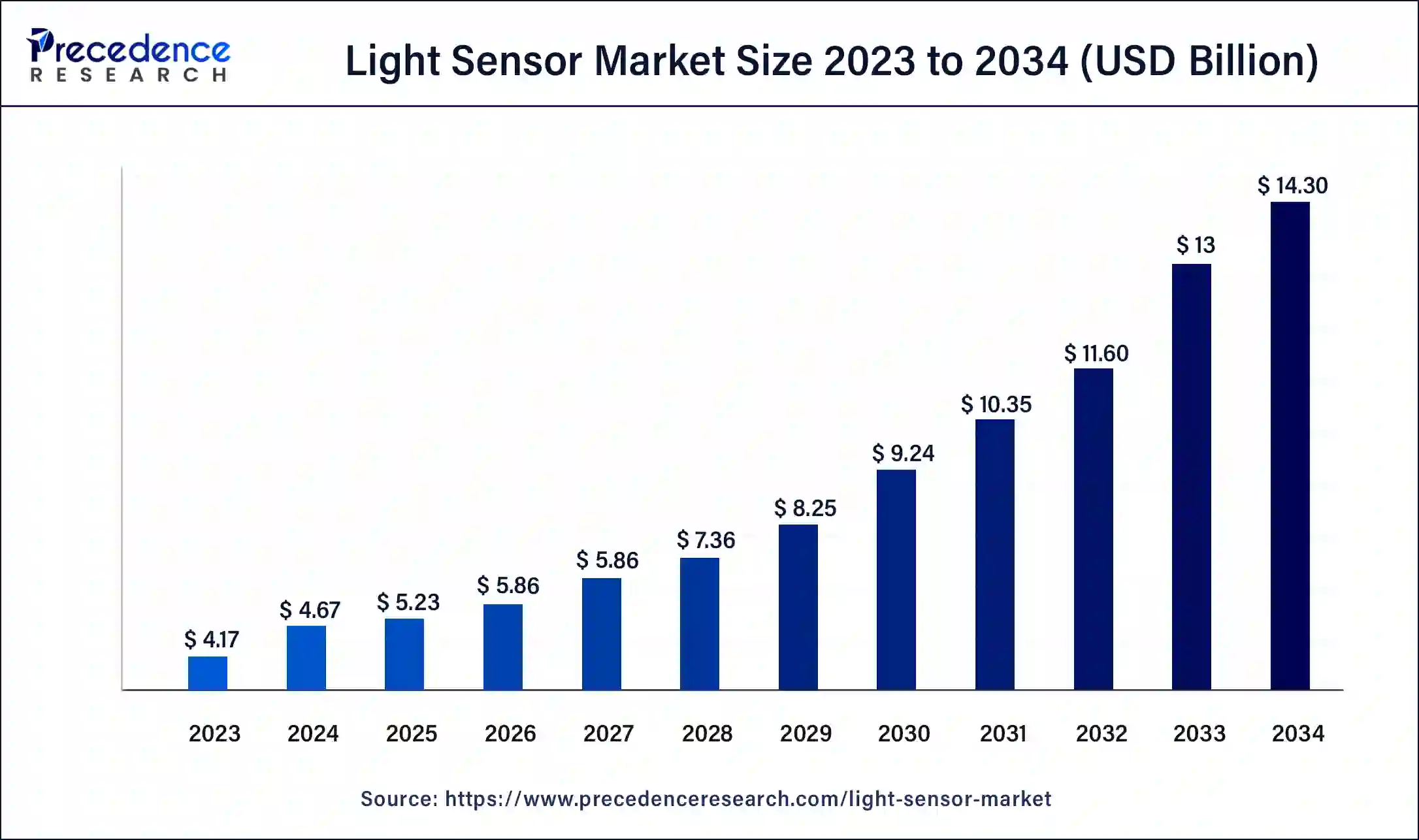

The global light sensor market size accounted for USD 4.17 billion in 2023 and is anticipated to rake around USD 12.99 billion by 2033, expanding at a CAGR of 12.04% from 2024 to 2033.

Key Points

- Asia Pacific has generated more than 36% of market share in 2023.

- North America is expected to expand at the notable CAGR of 12.15% in the coming years.

- By output, the digital segment has contributed more than 60% in 2023.

- By output, the analog segment is expected to grow at a significant CAGR of 10.34% during the projected period.

- By function, the ambient light sensing segment has recorded over 30% of market share in 2023.

- By function, the proximity detection segment is projected to grow at the fastest CAGR of 13.08% between 2024 and 2033.

- By application, the consumer electronics segment has accounted more than 36% of market share in 2023.

- By application, the healthcare segment is anticipated to witness the remarkable CAGR of 13.26% during the forecast period.

The light sensor market has witnessed significant growth in recent years, driven by the increasing demand for energy-efficient lighting solutions, advancements in smart technology, and the proliferation of Internet of Things (IoT) devices. Light sensors, also known as photodetectors, are electronic devices that detect light and convert it into an electrical signal. They find applications across various industries such as consumer electronics, automotive, industrial, and healthcare. The market is characterized by a growing emphasis on sustainability, coupled with the rising adoption of automation and smart lighting systems.

Get a Sample:https://www.precedenceresearch.com/sample/4007

Growth Factors:

Several factors contribute to the growth of the light sensor market. Firstly, the increasing awareness about energy conservation and environmental sustainability is driving the demand for energy-efficient lighting solutions. Light sensors play a crucial role in optimizing energy usage by automatically adjusting the intensity of lighting based on ambient light levels. Additionally, the growing penetration of smartphones and tablets equipped with ambient light sensors has boosted market growth. Moreover, the integration of light sensors in automotive applications for adaptive lighting and driver assistance systems has further propelled market expansion.

Region Insights:

The light sensor market exhibits a diverse regional landscape, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America and Europe dominate the market, attributed to the presence of established semiconductor manufacturers, technological advancements, and stringent regulations promoting energy efficiency. Asia Pacific is witnessing rapid growth, driven by the expanding consumer electronics industry, urbanization, and government initiatives to promote energy conservation. Furthermore, emerging economies in Latin America and the Middle East & Africa are experiencing increasing adoption of light sensors in various applications.

Light Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.04% |

| Global Market Size in 2023 | USD 4.17 Billion |

| Global Market Size by 2033 | USD 12.99 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Function, By Output, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Light Sensor Market Dynamics

Drivers:

Several drivers are driving the growth of the light sensor market. One of the primary drivers is the proliferation of IoT devices and smart technologies. Light sensors are integral components of IoT devices used in smart homes, smart cities, and industrial automation, driving market demand. Additionally, the automotive industry’s emphasis on safety and comfort features, such as adaptive lighting and driver monitoring systems, is fueling the adoption of light sensors. Furthermore, the growing demand for consumer electronics, including smartphones, tablets, and wearable devices, is contributing to market growth.

Opportunities:

The light sensor market presents several opportunities for growth and innovation. With the increasing focus on sustainability and energy efficiency, there is a growing demand for advanced light sensing technologies capable of precise detection and control of light levels. Opportunities exist for companies to develop innovative solutions that offer higher accuracy, reliability, and integration capabilities. Moreover, the emergence of applications such as smart agriculture, healthcare monitoring, and autonomous vehicles presents new avenues for market expansion. Furthermore, collaborations and partnerships between sensor manufacturers, technology providers, and end-users can facilitate the development of tailored solutions to address specific industry needs.

Challenges:

Despite the favorable market conditions, the light sensor market faces several challenges. One of the primary challenges is the price sensitivity of end-users, especially in emerging economies, which may hinder market penetration. Additionally, interoperability issues and compatibility constraints with existing lighting systems pose challenges to widespread adoption. Moreover, concerns regarding data privacy and security in IoT-enabled lighting systems raise apprehensions among consumers and businesses. Furthermore, the rapid pace of technological advancements necessitates continuous research and development efforts to stay competitive in the market.

Read Also: Homeland Security Market Size to Worth USD 950.16 Bn by 2033

Recent Developments

- In May 2023, DANLERS, an energy-saving lighting company, CALUMINO, a hardware and AI startup, and INGY joined forces to create an innovative, intelligent lighting control sensor. The groundbreaking DANLER’s CAL-CEFL12V incorporates CALUMINO’s advanced thermal sensor technology, embedded AI, and computer vision.

- In November 2022, ams-OSRAM AG introduced a three-channel UV-A/B/C Sensor AS7331. The AS7331 measures radiations at UV-C, UV-B, and UV-A wavelengths. It has applications in coffee brewing machines, robotic floor cleaners, and water and air purifiers. In addition, it has applications in healthcare for UV curing and Phototherapy.

- In July 2022, Vishay Intertechnology, Inc.’s Optoelectronics group unveiled a reflective optical sensor suitable for automotive, smart home, industrial, and office purposes. This AEC-Q101-qualified sensor boasts a compact design with the emitting light source and detector positioned in the same plane.

- In May 2022, AMS AG, a leading sensor manufacturer, announced the launch of a new high-precision ambient light sensor with improved sensitivity and dynamic range. This sensor targets applications like automatic brightness control in smartphones and wearables.

- In January 2022, Panasonic launched a flagship OLED TV, the LZ2000. The TV is available in 55-inch, 65-inch, and 77-inch sizes. It features a new ambient light sensor that adjusts the picture quality based on the time of day.

Light Sensor Market Companies

- ams-OSRAM AG

- Analog Devices, Inc.

- Broadcom

- ELAN Microelectronics Corp.

- Everlight Electronics Co., Ltd.

- Rohm Co. Ltd.

- Samsung

- Sharp Corporation

- Sitronix Technology Corporation

- STMicroelectronics

- Vishay Intertechnology, Inc.

Segments Covered in the Report

By Function

- Ambient Light Sensing

- Proximity Detection

- RGB Color Sensing

- Gesture Recognition

- IR Detection

By Output

- Analog

- Digital

By Application

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/