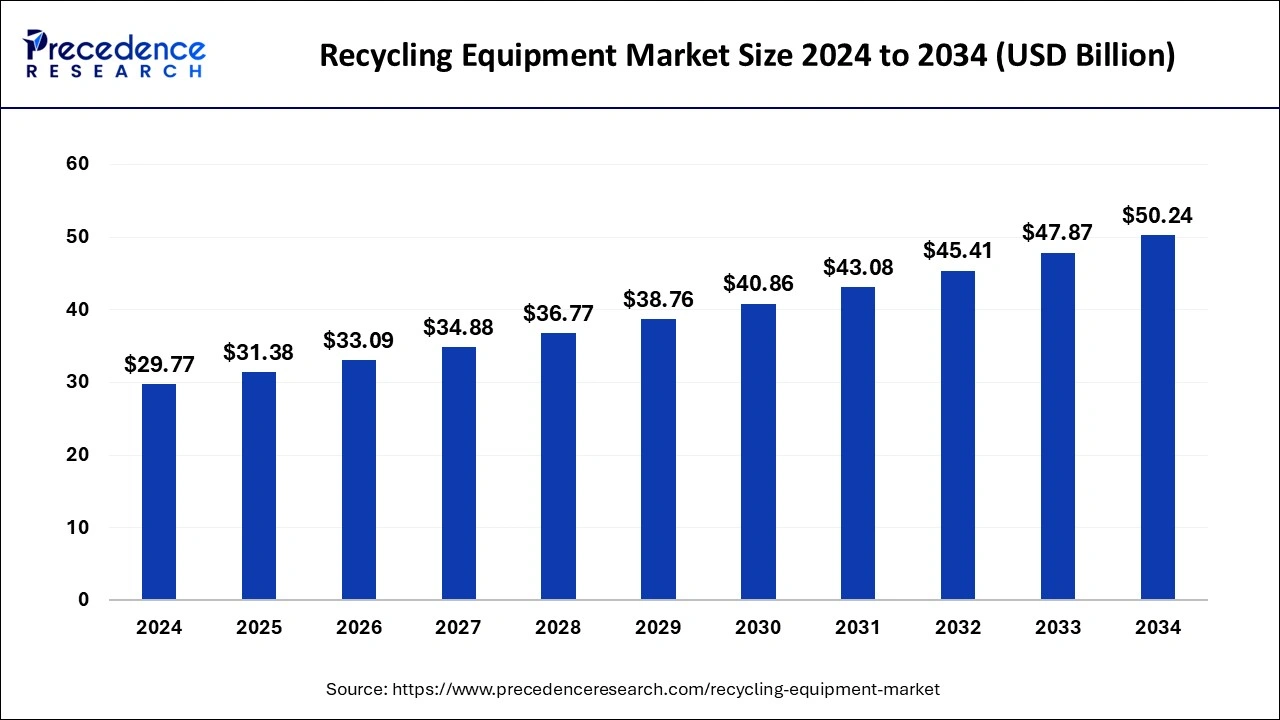

The global recycling equipment market size accounted for USD 28.24 billion in 2023 and is predicted to attain around USD 47.87 billion by 2033, growing at a CAGR of 5.42% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the major market share of 41% in 2023.

- In the North America, the U.S. has recorded for more than 77% of the market share in 2023.

- By equipment, the baler press segment has held the largest market share in 2023.

- By equipment, the separator segment is expected to grow at a significant rate equipment during the forecast period.

- By processed material, the plastic segment has contributed more than 35% of market share in 2023.

- By processed material, the rubber segment is expected to expand rapidly during the forecast period.

The global recycling equipment market is experiencing steady growth driven by increasing environmental awareness, stringent regulations on waste management, and a growing emphasis on sustainable practices. This market encompasses a diverse range of equipment used for processing and sorting recyclable materials such as plastics, metals, paper, and glass. Key players in the market include manufacturers of shredders, balers, sorting systems, and compactors. The market is characterized by technological advancements aimed at improving efficiency and reducing environmental impact.

Get a Sample: https://www.precedenceresearch.com/sample/4246

Growth Factors

Several factors contribute to the growth of the recycling equipment market. Rising concerns over landfill usage and greenhouse gas emissions are pushing governments and industries to adopt recycling solutions. Technological advancements in waste sorting and processing equipment are enhancing productivity and reducing operational costs. Moreover, increasing investments in recycling infrastructure and the expansion of recycling programs globally are driving market growth. The circular economy concept, which promotes resource efficiency through recycling and reuse, is further bolstering demand for recycling equipment.

Region Insights

The market for recycling equipment varies across regions. Developed economies such as North America and Europe have well-established recycling infrastructures supported by stringent regulations and environmental policies. These regions witness high adoption rates of advanced recycling equipment. In contrast, emerging economies in Asia Pacific and Latin America are experiencing rapid industrialization and urbanization, leading to increased waste generation. As a result, there’s a growing demand for recycling equipment in these regions to address environmental concerns and optimize resource utilization.

Recycling Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.42% |

| Recycling Equipment Market Size in 2023 | USD 28.24 Billion |

| Recycling Equipment Market Size in 2024 | USD 29.77 Billion |

| Recycling Equipment Market Size by 2033 | USD 47.87 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Equipment, and By Processed Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recycling Equipment Market Dynamics

Drivers

Key drivers of the recycling equipment market include growing public awareness about sustainable practices and the environmental impact of waste. Governments worldwide are implementing regulations and incentives to promote recycling, creating a favorable market environment. Additionally, advancements in sensor technology, robotics, and artificial intelligence are revolutionizing recycling processes, enabling efficient sorting and separation of recyclable materials. Cost savings associated with recycling compared to raw material extraction also drive adoption of recycling equipment across industries.

Opportunities

The market presents opportunities for manufacturers to innovate and develop technologically advanced recycling solutions tailored to specific waste streams. Collaboration with waste management companies and municipalities to develop integrated recycling systems can unlock new avenues for market expansion. Expanding into emerging markets with growing industrial sectors offers significant growth potential. Furthermore, leveraging data analytics and IoT solutions to optimize equipment performance and maintenance can enhance competitiveness in the market.

Challenges

Despite growth prospects, the recycling equipment market faces challenges such as high initial investment costs associated with advanced equipment. Inconsistent quality and composition of recyclable materials pose challenges for effective sorting and processing. Limited infrastructure and logistical constraints in certain regions hinder market penetration. Moreover, fluctuations in commodity prices and trade policies impact the profitability of recycling operations, affecting the demand for recycling equipment.

Read Also: Digital Health for Obesity Market Size, Trends, Report By 2033

Recycling Equipment Market Recent Developments

- In February 2024, Lidl launches a city-wide drinks packaging recycling scheme. The launch of the scheme is intended to go some way to preparing customers for Scotland’s nationwide deposit return scheme (DRS) for drinks packaging, which was due to be launched last August but was delayed until March 2024.

- In November 2023, Tomra Recycling Sorting, a business unit of Norway-based Tomra, launched the Innosort Flake for high throughput purification of plastic flakes. The Innosort Flake enables simultaneous flake sorting by color, polymer, and transparency, the company says. “The new Innosort Flake is designed to sort any color, any polymer, at the same time,” says Alberto Piovesan, global segment manager of plastics at Tomra Recycling Sorting. “It levels the playing field for recyclers and gives them maximum flexibility to respond to the respective market demands.

- In August 2023, Genius Machinery announced its highly sophisticated plastic washing recycling machine line. The plastic washing recycling machine line includes rigid washing plants as well as film washing plants. The rigid washing plants are designed to recycle post-consumer hard materials such as bottles, injection molding waste or scrap, pipes, e-waste, and other rigid materials. These systems produce uniform plastic flakes with high purity and low moisture content.

- In October 2022, the EREMA Group company was offering not only previously owned, customized plastics recycling machines but also a new machine that is made to stock and is therefore readily available at short notice. Launched in K 2022, the READYMAC system handles many standard applications in the post-consumer recycling segment and is an attractive option for customers who need a recycling solution on short notice without custom configuration.

Recycling Equipment Market Companies

- Recycling Equipment Manufacturing

- The CP Group

- American Baler

- Kiverco

- General Kinematics

- MHM Recycling Equipment

- Marathon Equipment

- Ceco Equipment Ltd.

- Danieli Centro Recycling

- ELDAN Recycling

- Metso

- Suny Group

- Forrec Srl Recycling

- BHS Sonthofen

- LEFORT GROUP

Segments Covered in the Report

By Equipment

- Baler Press

- Shredders

- Granulators

- Agglomerators

- Shears

- Separators

- Extruders

- Others

By Processed Material

- Metal

- Plastic

- Construction Waste

- Paper

- Rubber

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/