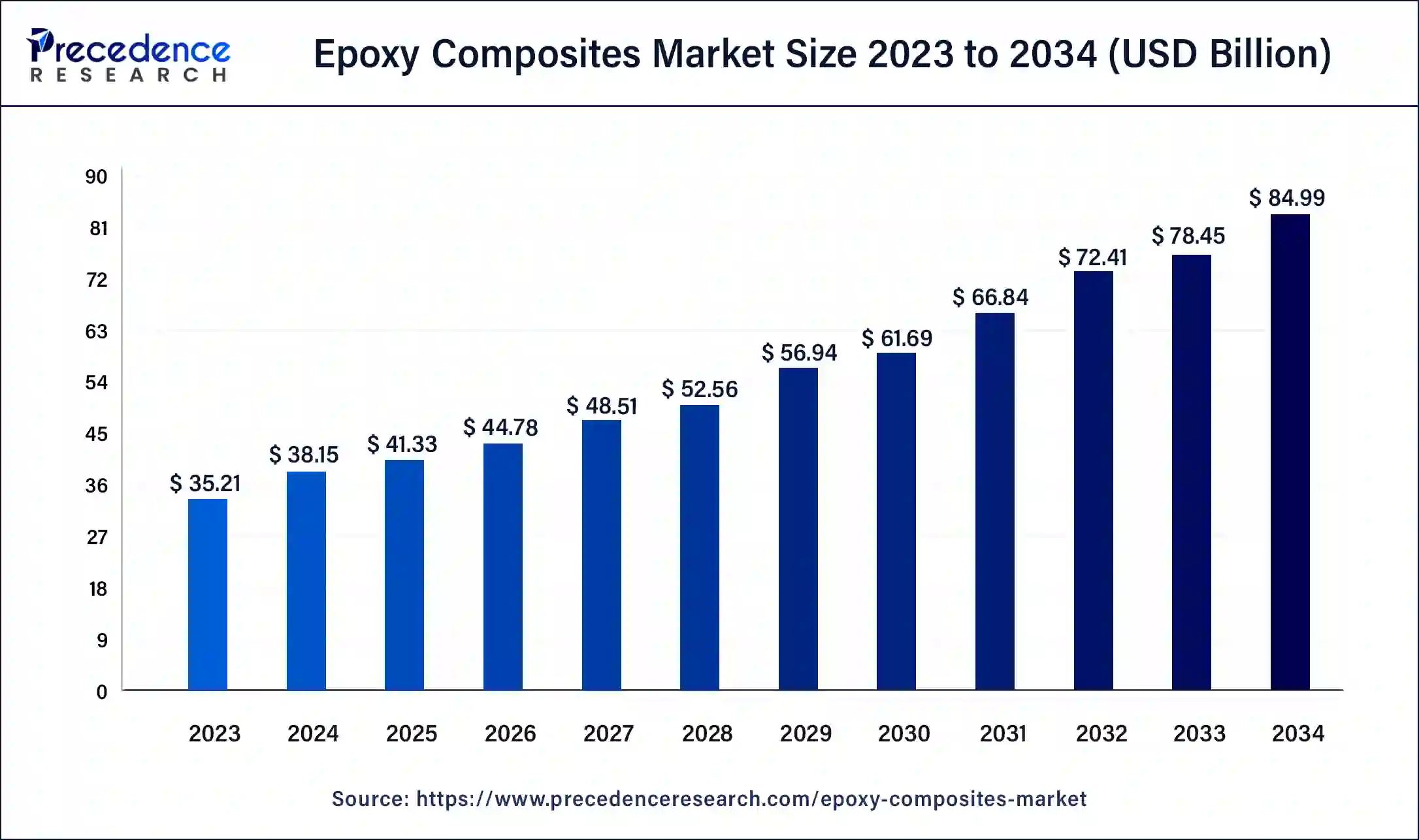

The global epoxy composites market size was valued at USD 35.21 billion in 2023 and is expected to expand around USD 84.99 billion by 2034, at a CAGR of 8.34% from 2024 to 2034.

The epoxy composites market is experiencing robust growth driven by their increasing adoption in various industries such as aerospace, automotive, construction, and electronics. Epoxy composites are preferred due to their superior mechanical properties, lightweight nature, corrosion resistance, and ability to be molded into complex shapes. These materials are composed of epoxy resin matrices reinforced with fibers like carbon, glass, or aramid, enhancing their strength and durability.

Get a Sample: https://www.precedenceresearch.com/sample/4679

Epoxy Composites Market Key Points

- Asia Pacific dominated the epoxy composites market with the largest revenue share of 39% in 2023.

- North America is expected to host the fastest-growing market during the forecast period.

- By fiber type, the glass fiber segment has held a major revenue share of 63% of revenue share in 2023.

- By fiber type, the carbon fiber segment is expected to grow at a fastest CAGR of 8.53% during the forecast period.

- By end use, the automotive & transportation segment has generated more than 28% of revenue share in 2023.

- By end use, the aerospace segment is expected to grow at the fastest rate in the market during the forecast period.

Epoxy Composites Market Trends

One prominent trend in the epoxy composites market is the shift towards sustainable materials. Manufacturers are focusing on developing bio-based epoxy resins derived from renewable sources, reducing environmental impact. Additionally, advancements in nanotechnology are leading to the development of epoxy nanocomposites with enhanced mechanical and thermal properties, catering to high-performance applications.

Regional Insights:

Regionally, North America and Europe dominate the epoxy composites market due to strong aerospace and automotive sectors. Asia-Pacific is emerging as a significant market owing to rapid industrialization, infrastructure development, and increasing investments in wind energy projects. Countries like China, India, and Japan are key contributors to market growth in this region.

Epoxy Composites Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 84.99 Billion |

| Market Size in 2023 | USD 35.21 Billion |

| Market Size in 2024 | USD 38.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.34% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fiber Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Epoxy Composites Market Dynamics

Drivers:

Key drivers include the growing demand for lightweight materials to improve fuel efficiency in automotive and aerospace industries. Epoxy composites offer weight reduction benefits without compromising on strength, making them ideal for applications in electric vehicles and aircraft components. Moreover, increasing construction activities globally are driving the demand for epoxy composites in structural applications.

Opportunities:

The expanding wind energy sector presents substantial opportunities for epoxy composites, especially in manufacturing wind turbine blades. Additionally, the rising demand for electronic devices and components is creating opportunities for epoxy-based materials in PCBs and electronic encapsulation due to their electrical insulation properties.

Challenges:

Despite their advantages, the epoxy composites market faces challenges such as high manufacturing costs associated with raw materials and production processes. Moreover, concerns regarding recyclability and disposal of composite materials pose environmental challenges, prompting research into sustainable end-of-life solutions.

Read Also: Clinical Documentation Improvement Market Size, Trends, Report by 2034

Epoxy Composites Market Companies

- Axiom Materials.

- Barr day.

- Hexcel Corporation.

- Mitsubishi Chemical Corporation.

- Park Aerospace Corp.

- Sanders Composites.

- SGL Carbon.

Recent Developments

- In July 2024, Solvay launched the epoxy-based CYCOM® EP2190 system, which offers exceptional durability in thick and thin structures together with good in-plane performance in hot/wet and cold/dry situations. The material, which is the company’s new flagship product for aerospace primary structures, competes with existing solutions for wing and fuselage applications in the majority of aviation market segments, from defense and rotorcraft to urban air mobility (UAM) and private and commercial aerospace segments (sub and supersonic).

- In June 2024, With the introduction of its new NE7 low-temperature curing prepreg system, Notus Composites (UAE), the distinguished manufacturer of epoxy prepreg materials, is pleased to announce the newest addition to its high-performance epoxy portfolio. With the completely new Notus NE7 formulation, producers of composites can cure components at as low as 70ËšC, saving energy and opening up more affordable tooling possibilities.

Segment Covered in the Report

By Fiber Type

- Glass Fiber

- Carbon Fiber

- Other Fiber

By End-use

- Automotive & Transportation

- Aerospace & Defense

- Wind Energy

- Electrical & Electronics

- Sporting & Consumer Goods

- Other End-Use (Oil & Gas, Marine, Construction)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/