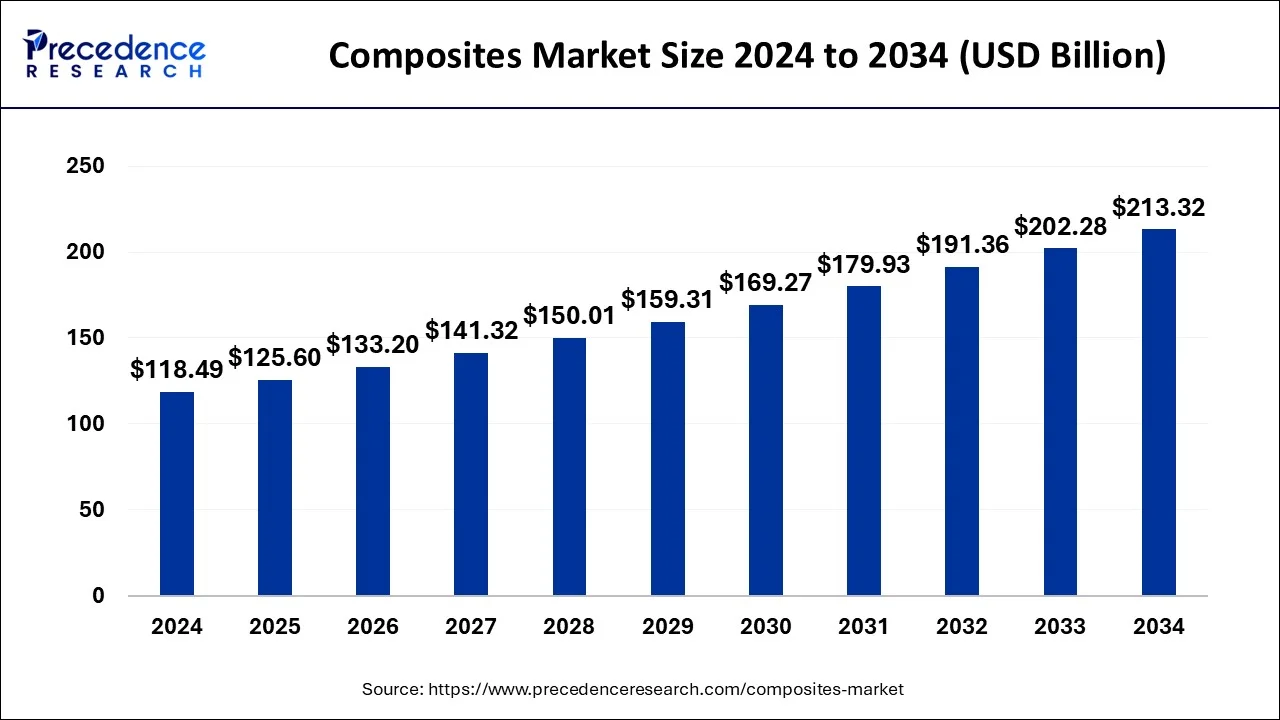

Composites market size to expand from USD 118.49 billion in 2024 to USD 213.32 billion by 2034 at a CAGR of 6.05%.

- Asia Pacific led the global composites market in 2024, holding a dominant 46% market share.

- Glass fiber emerged as the top product segment, contributing 61% of the total market share in 2024.

- The layup process was the leading manufacturing method, capturing a 36% market share in 2024.

- The automotive and transportation sector dominated end-use applications, accounting for 22% of the market share in 2024.

Market Overview

The composites market has grown significantly over the years due to its diverse applications in industries such as automotive, aerospace, construction, marine, and renewable energy. Composites, which include materials like carbon fiber, glass fiber, and aramid fiber, offer superior strength-to-weight ratios, corrosion resistance, and high durability compared to conventional materials. With the market valued at USD 118.49 billion in 2024, it is set to reach USD 213.32 billion by 2034, expanding at a CAGR of 6.05%.

Key Market Drivers

The rise in demand for fuel-efficient vehicles and aircraft has propelled the need for lightweight composite materials. The growing wind energy sector is another crucial driver, as composite materials are extensively used in wind turbine blades to enhance performance and efficiency. Additionally, increasing urbanization and infrastructure projects have led to higher adoption of composites in construction due to their durability and low maintenance requirements. The aerospace industry’s ongoing innovations in composite applications, particularly for next-generation aircraft, continue to boost market expansion.

Opportunities for Growth

The composites market presents numerous opportunities, especially with advancements in automated manufacturing and 3D printing technologies. The increasing use of thermoplastic composites, which offer recyclability and cost efficiency, is gaining traction in various industries. The healthcare sector is also exploring the potential of composites for medical devices and prosthetics. Emerging markets in Asia, Africa, and the Middle East are expected to drive demand, fueled by infrastructure growth and a rising preference for lightweight, durable materials.

Challenges Facing the Industry

While the composites market continues to expand, certain challenges persist. High initial costs and complex manufacturing processes remain significant barriers to widespread adoption. Recycling composite materials is another major concern, as many traditional composites are difficult to break down and reuse. The industry also faces supply chain disruptions due to fluctuating raw material prices and geopolitical uncertainties. Addressing these challenges requires ongoing research and investment in new, sustainable composite solutions.

Regional Insights

Asia Pacific leads the composites market, accounting for the largest market share at 46% in 2024. Countries like China, India, and Japan are driving regional growth due to strong manufacturing capabilities and high demand for composites in the automotive and construction industries. North America follows closely, with significant contributions from the aerospace and defense sectors. Europe remains a key player in composite innovation, particularly in the automotive and wind energy markets. Meanwhile, emerging economies in Latin America and the Middle East are gradually increasing their adoption of composite materials in various sectors.

Recent Market Developments

Recent developments in the composites market include breakthroughs in sustainable materials, with companies investing in biodegradable and bio-based composites. The automotive industry has seen an increased shift toward carbon fiber composites to enhance electric vehicle performance. Aerospace giants are integrating advanced composites into aircraft design to reduce fuel consumption. Furthermore, strategic partnerships and acquisitions among key players are reshaping the competitive landscape, ensuring steady growth in the coming years.

Composites Market Companies

- Teijin Ltd

- PPG Industries, Inc.

- Toray Industries, Inc.

- Owens Corning

- Hexcel Corporation

- DuPont

- Momentive Performance Materials, Inc.

Segments Covered in the Report

By Product Type

- Glass Fiber

- Carbon Fiber

- Others

By Resin Type

- Thermoplastic

- Thermosetting

- Others

By Manufacturing Process Type

- Injection Molding Process

- Resin Transfer Molding Process

- Pultrusion Process

- Layup Process

- Filament Winding Process

- Compression Molding Process

- Others

By End Use

- Electrical & Electronics

- Automotive & Transportation

- Wind Energy

- Aerospace & Defense

- Pipes & Tanks

- Construction & Infrastructure

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/