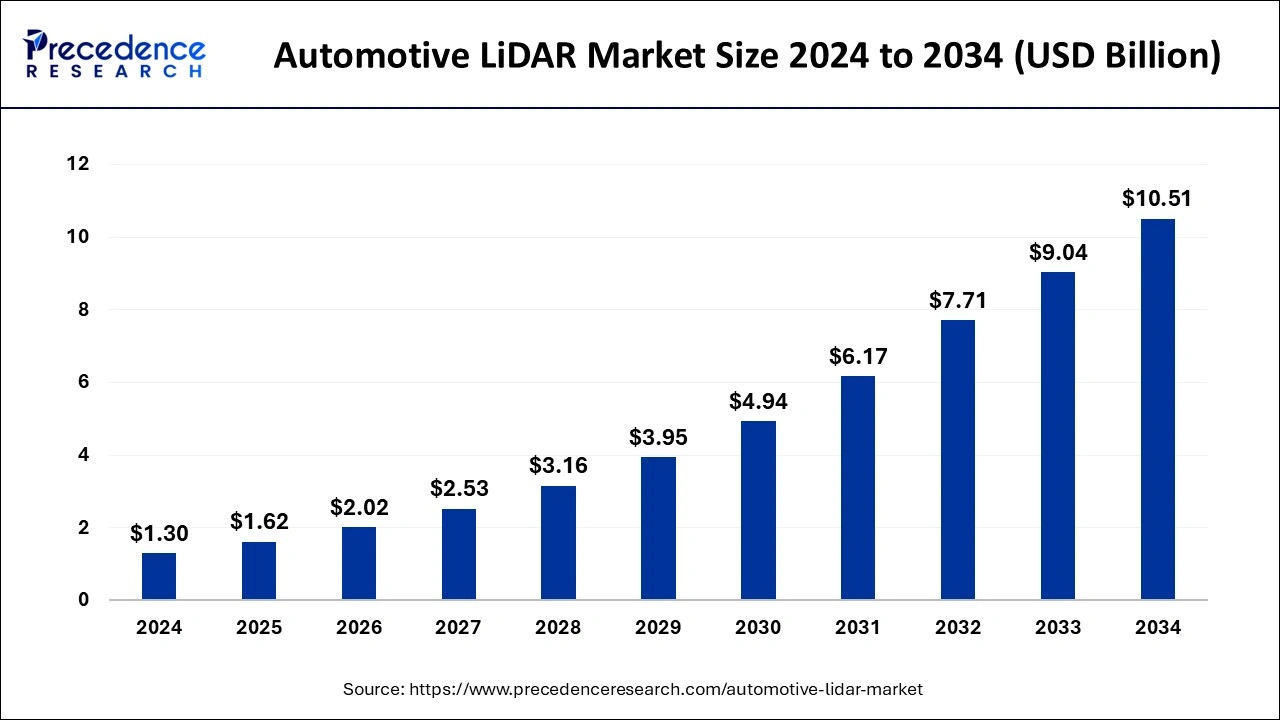

Automotive LiDAR market size is projected to rise from USD 1.30 billion in 2024 to USD 10.51 billion by 2034, growing at a strong 23% CAGR.

Automotive LiDAR Market Key Takeaways

- North America Leads: Captured 38% market share in 2024, the highest globally.

- Europe’s Expansion: Poised for significant growth with a strong CAGR from 2025-2034.

- ADAS Dominance: The ADAS segment held the largest share in 2024, driving market demand.

Overview

The automotive LiDAR market is experiencing rapid expansion, driven by the increasing adoption of autonomous and semi-autonomous vehicles. LiDAR (Light Detection and Ranging) technology plays a crucial role in enabling advanced driver assistance systems (ADAS) by providing precise 3D mapping of the environment. The technology is being integrated into various vehicle models, including electric and high-end passenger cars, as automakers strive to enhance safety and automation. The market is expected to grow at a significant compound annual growth rate (CAGR) due to rising investments from automotive manufacturers, technology firms, and government initiatives promoting self-driving technology.

Drivers

The key drivers fueling the automotive LiDAR market include the growing demand for enhanced road safety and accident prevention. Governments worldwide are enforcing strict safety regulations, which encourage automakers to adopt LiDAR-based ADAS. The increasing research and development activities in the field of autonomous mobility, coupled with strategic collaborations between LiDAR manufacturers and automotive companies, further accelerate market growth. Additionally, the declining costs of LiDAR sensors, attributed to technological advancements and economies of scale, make them more accessible for mainstream vehicles. Furthermore, the increasing investments from venture capital firms and technology giants in LiDAR startups are accelerating innovation in this field.

Opportunities

Opportunities in the automotive LiDAR market lie in the development of cost-effective, compact, and high-performance solid-state LiDAR systems. These innovations can significantly reduce manufacturing costs and enhance vehicle design integration. The rising adoption of LiDAR in smart transportation and infrastructure projects, such as autonomous ride-hailing services and connected vehicle ecosystems, presents further market expansion prospects. Moreover, emerging economies in Asia-Pacific and Latin America are expected to offer lucrative growth opportunities due to increasing vehicle electrification and smart city initiatives.

Challenges

Despite its growth potential, the automotive LiDAR market faces challenges such as the high initial costs of integration and the need for seamless compatibility with existing vehicle systems. Another major hurdle is the performance of LiDAR in adverse weather conditions, including heavy rain, fog, and snow, which can impact sensor accuracy. Additionally, competition from alternative sensing technologies like cameras and radar, which offer cost-effective solutions for automation, poses a challenge to widespread LiDAR adoption. Addressing these concerns through continuous innovation and improved sensor fusion techniques is crucial for overcoming these obstacles.

Regional Insights

North America and Europe currently lead the automotive LiDAR market, driven by strong investments in autonomous vehicle technology and government regulations promoting vehicle safety. The United States is at the forefront of LiDAR integration, with major tech companies and automakers investing in self-driving technology. Europe is also seeing significant growth due to strict safety mandates from regulatory bodies such as the European New Car Assessment Programme (Euro NCAP). Meanwhile, Asia-Pacific is expected to witness the fastest growth, fueled by government support for smart mobility and a strong automotive manufacturing base in countries like China, Japan, and South Korea.

Recent News

In recent developments, leading LiDAR manufacturers have announced strategic partnerships with major automotive brands to integrate LiDAR technology into upcoming autonomous vehicle models. Additionally, several companies have introduced next-generation solid-state LiDAR sensors with improved accuracy and reduced costs, making them more viable for commercial use. Recent regulatory approvals for testing autonomous vehicles on public roads in various regions have also accelerated LiDAR deployment in real-world applications.

Automotive LiDAR Market Companies

- LeosphereSaS

- Airborne Hydrography AB

- Faro Technologies Inc.

- Aerometric Inc.

- 3D Laser Mapping Inc.

- Mira Solutions Inc.

- Quanergy Systems, Inc.

Segments Covered in the Report

By Product Type

- Aerial

- Mobile

- Terrestrial/Static

- Short-range

By Components

- Laser

- GPS/GNSS Receiver

- Camera

- Inertial Navigation System

- Micro Electro Mechanical System

By Application

- Advanced Driver Assistance System (ADAS)

- Adaptive Cruise Control

- Automatic Emergency Braking

- Autonomous Cars

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World