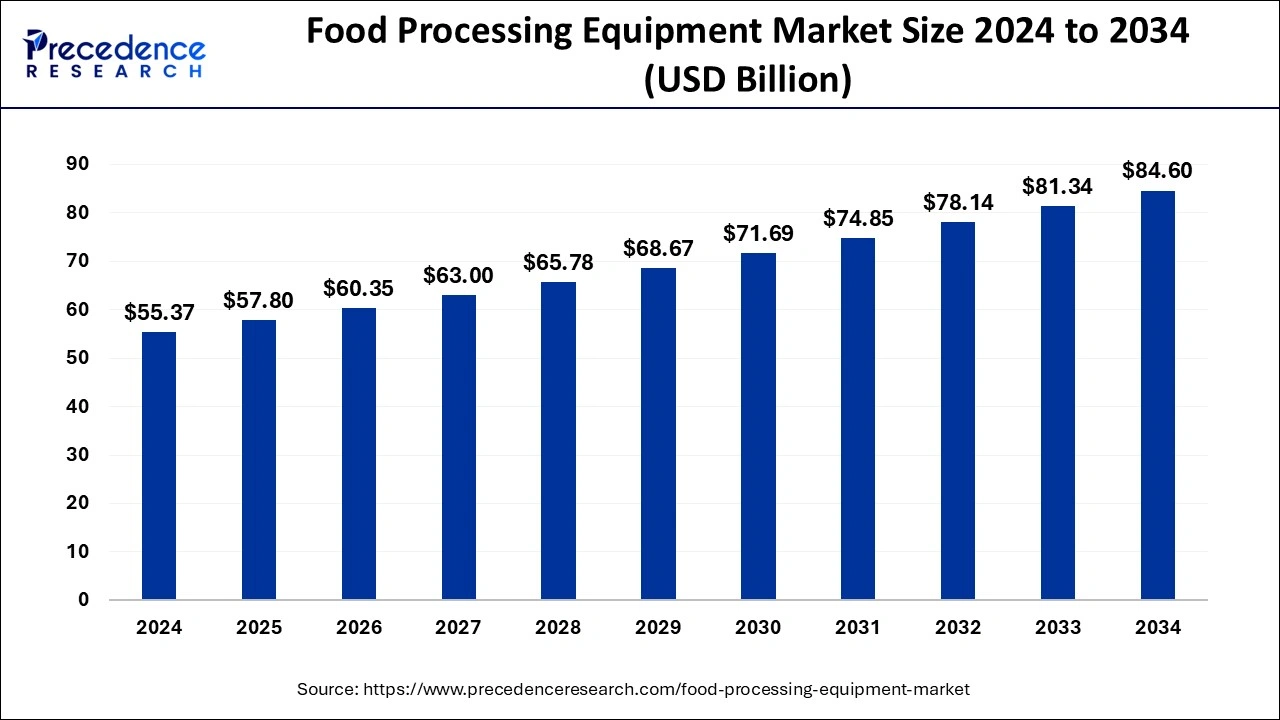

Food processing equipment market size is set to grow from USD 55.37 billion in 2024 to USD 84.60 billion by 2034, with a steady 4.3% CAGR.

Food Processing Equipment Market Key Takeaways

- In 2024, Asia Pacific emerged as the leading region, capturing 36% of the market.

- The processing segment was the largest contributor by type in 2024.

- Automatic food processing equipment held the maximum market share based on the mode of operation in 2024.

- Among applications, the meat, poultry, and seafood segment had the highest market share in 2024.

Food Processing Equipment Market Overview

The food processing equipment market continues to grow steadily, driven by the rising demand for processed and packaged foods across the globe. Changing consumer dietary habits, rapid urbanization, and the expansion of the food and beverage sector are key contributors to market growth. Additionally, technological advancements in automation and processing equipment are enhancing efficiency, improving food safety, and ensuring superior product quality. The increasing adoption of automated systems by food manufacturers to optimize production processes is further fueling market expansion.

Key Drivers of the Food Processing Equipment Market

A major factor driving the food processing equipment market is the growing global population and the increasing demand for convenient, ready-to-eat food products. The rise of quick-service restaurants and the growing consumption of packaged foods have significantly increased the need for advanced processing machinery. Additionally, stringent food safety regulations and hygiene standards have pushed manufacturers to invest in high-quality equipment that meets compliance requirements. Innovations in food processing technologies, including AI-driven automation and energy-efficient machinery, are also playing a crucial role in boosting market growth.

Opportunities

Several opportunities exist in this market, particularly with the growing demand for plant-based and alternative protein products. As the popularity of vegan and vegetarian diets rises, food manufacturers are increasingly investing in specialized processing equipment to cater to this evolving consumer base. Furthermore, the rapid expansion of e-commerce platforms for food distribution is opening new avenues for food processing companies to meet the growing demand for packaged and processed foods. Emerging economies in Asia Pacific and Latin America, where urbanization and disposable incomes are rising, present significant growth prospects for the food processing equipment industry.

Challenges

Despite its growth potential, the food processing equipment market faces several challenges. The high initial investment required for advanced machinery can be a hurdle for small and medium-sized food manufacturers. Additionally, fluctuations in raw material prices and supply chain disruptions can impact equipment production and affordability. Sustainability and energy consumption concerns also pose challenges, as manufacturers work towards developing eco-friendly and energy-efficient processing solutions. Moreover, strict regulatory requirements and government policies regarding food safety and equipment standards add complexity to market operations.

Regional Insights

Asia Pacific holds the largest share of the global food processing equipment market, driven by the rapidly expanding food and beverage industry. Countries like China, India, and Japan are experiencing increasing demand for processed foods, leading to higher investments in advanced food processing machinery. North America remains a key market, supported by technological advancements and the presence of major food processing equipment manufacturers. Europe is also witnessing steady growth, with a rising preference for organic and healthier processed food options. Meanwhile, emerging markets in the Middle East, Africa, and Latin America offer untapped potential due to rising urbanization and shifting dietary patterns.

Latest Developments

The food processing equipment market has seen notable advancements, with leading companies emphasizing innovation and expansion. Manufacturers are integrating automation and smart processing technologies to improve efficiency and sustainability. Several companies have introduced energy-efficient solutions to reduce operational costs and minimize environmental impact. Additionally, mergers and acquisitions among major industry players are reshaping the competitive landscape, enabling businesses to strengthen their market presence and broaden their product offerings. Growing concerns about food safety and hygiene have also led to the introduction of advanced cleaning and sanitation systems in food processing facilities.

Food Processing Equipment Market Companies

- GEA Group AG

- Bettcher Industries Incorporated

- Anko Food Machine Company Limited

- Berkshire Hathaway Incorporated

- Atlas Pacific Engineering Company Incorporated

- Bucher Industries AG

- Hosokawa Micron Corporation

Segments Covered in the Report

By Type

- Processing

- Pre-processing

By Mode of Operation

- Semi-automatic

- Automatic

By Application

- Bakery & Confectionery

- Meat, Poultry & Seafood

- Dairy

- Beverages

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/