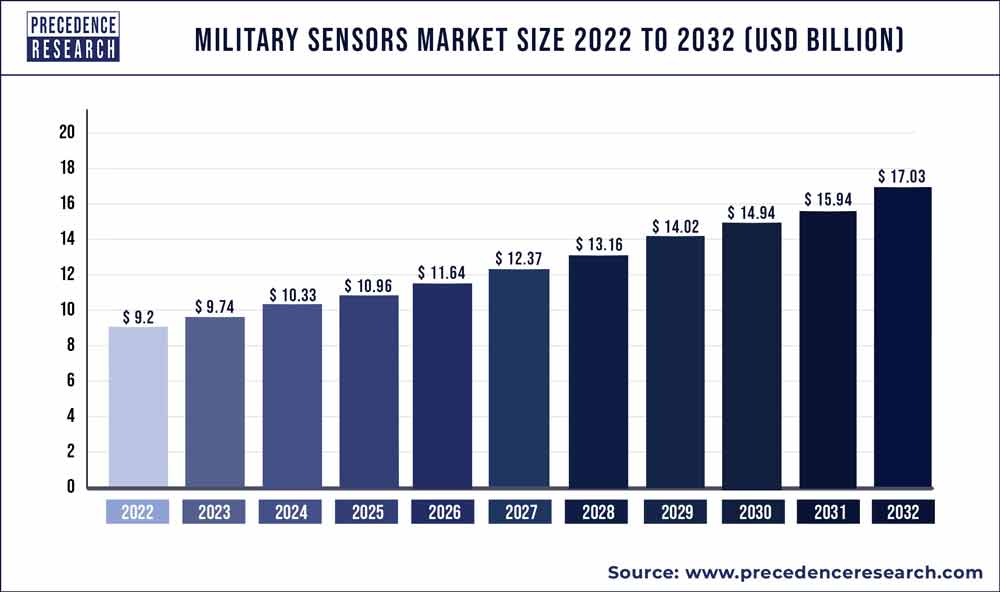

The global military sensors market size was estimated to be around US$ 9.2 billion in 2022. It is projected to reach US$ 17.03 billion by 2032, indicating a CAGR of 6.4% from 2023 to 2032.

Key Takeaways

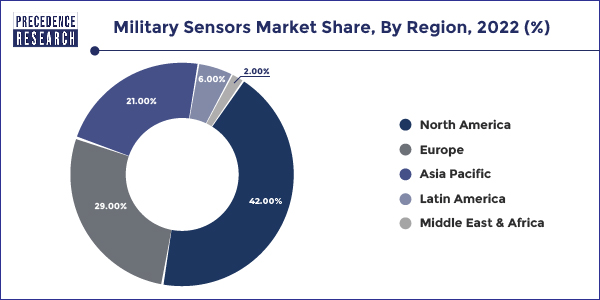

- North America contributed more than 42% of revenue share in 2022.

- Asia Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- The land segment held the largest market share of 40% in 2022.

- The airborne segment is anticipated to grow at a remarkable CAGR of 8.2% between 2023 and 2032.

- The software segment generated over 59% of revenue share in 2022.

- The hardware segment is expected to expand at the fastest CAGR over the projected period.

- The communication and navigation segment had the largest market share of 42% in 2022.

- The combat operations segment is expected to expand at the fastest CAGR over the projected period.

The military sensors market plays a pivotal role in modern defense systems, encompassing a diverse range of technologies designed to enhance situational awareness, threat detection, and overall mission effectiveness. These sensors are integral components of military platforms, including land, air, and sea-based systems, providing critical data for decision-making and ensuring the success of military operations. The market for military sensors has witnessed significant growth in recent years, driven by advancements in sensor technologies, evolving security threats, and the increasing integration of sensors into defense platforms.

Get a Sample: https://www.precedenceresearch.com/sample/3472

Growth Factors

Several factors contribute to the continuous growth of the military sensors market. Technological advancements, particularly in the fields of artificial intelligence, machine learning, and miniaturization, have led to the development of highly sophisticated and efficient sensors. These advancements enhance the capabilities of military sensors, enabling them to provide real-time data, improve accuracy, and operate in diverse and challenging environments.

The evolving nature of modern warfare and the increasing need for precision in military operations are driving the demand for advanced sensors. Integrated sensor networks, including radar systems, infrared sensors, acoustic sensors, and more, enable comprehensive surveillance and threat detection capabilities, addressing the dynamic and multifaceted challenges faced by armed forces globally.

Additionally, the rise in asymmetric threats, cyber warfare, and unmanned systems has further propelled the demand for military sensors. Governments and defense organizations recognize the importance of investing in sensor technologies to maintain a strategic advantage and ensure the safety and effectiveness of their armed forces. As defense budgets continue to allocate resources for modernization, the military sensors market is expected to experience sustained growth, fostering innovation and the development of cutting-edge sensor solutions.

Military Sensors Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 6.4% |

| Market Size in 2023 | USD 9.74 Billion |

| Market Size by 2032 | USD 17.03 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Platform, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Food Antioxidants Market Size To Increase USD 3.70 Billion By 2032

In 2022, North America dominated with the highest revenue share of 42%. The region, led by the U.S. Department of Defense’s modernization efforts, has been at the forefront of embracing advanced military sensors. The integration of artificial intelligence and machine learning into military sensor systems has been a focal point, enhancing real-time data processing and threat detection capabilities. Notably, the U.S. Department of Defense’s investments in cutting-edge sensor technologies, such as radar, EO/IR, and CBRN sensors, underscore the region’s commitment to maintaining military superiority. Collaborations with private defense companies for research and development further foster innovation.

Platforms

The military sensors market exhibits a comprehensive segmentation based on platforms, components, and applications. In terms of platforms, these sensors are strategically deployed across various domains, including land, air, and sea. Land-based platforms encompass ground vehicles, where sensors play a crucial role in enhancing situational awareness and threat detection. Airborne platforms, such as unmanned aerial vehicles (UAVs) and military aircraft, leverage sensors for surveillance, reconnaissance, and target tracking. Naval platforms, including ships and submarines, rely on sensors for maritime domain awareness, anti-submarine warfare, and navigation.

Components

In the realm of components, the Military Sensors Market comprises a diverse range of technological elements. Sensor components include but are not limited to radar systems, infrared sensors, acoustic sensors, and chemical, biological, radiological, and nuclear (CBRN) sensors. Each component serves a unique purpose, contributing to the overall efficacy of military sensor systems. Radar systems, for instance, facilitate long-range detection and tracking, while infrared sensors excel in capturing thermal signatures, enhancing target identification in varying environmental conditions.

Applications

Regarding applications, military sensors find extensive use across a spectrum of critical functions. Surveillance and reconnaissance applications involve the use of sensors to gather intelligence, monitor activities, and identify potential threats. Target tracking applications leverage sensors for precise and real-time monitoring of enemy movements, enhancing the accuracy of military operations. Additionally, sensors play a pivotal role in navigation, guiding military platforms through complex terrains or ensuring precise positioning in maritime environments.

Recent Developments

- In December 2022, the Air Force Research Laboratory partnered with Nano Bio-materials Consortium and Case western Reserve University to build wearable sensors that measure biomarkers in Airmen.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Military Sensors Market Players

- Lockheed Martin Corporation

- BAE Systems plc

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Thales Group

- Safran S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Rheinmetall AG

- FLIR Systems, Inc.

- Textron Inc.

- Honeywell International Inc.

- Elbit Systems Ltd.

- Terma A/S

Segments Covered in the Report

By Platform

- Land

- Naval

- Airborne

By Component

- Software

- Hardware

By Application

- Combat Operations

- Target Recognition

- Electronic Warfare

- Communication and Navigation

- Command and Control

- Surveillance and Monitoring

- Intelligence and Reconnaissance

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Military Sensors Market

5.1. COVID-19 Landscape: Military Sensors Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Military Sensors Market, By Platform

8.1. Military Sensors Market Revenue and Volume, by Platform, 2023-2032

8.1.1 Land

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Naval

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

8.1.3. Airborne

8.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Military Sensors Market, By Component

9.1. Military Sensors Market Revenue and Volume, by Component, 2023-2032

9.1.1. Software

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Hardware

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Military Sensors Market, By Application

10.1. Military Sensors Market Revenue and Volume, by Application, 2023-2032

10.1.1. Combat Operations

10.1.1.1. Market Revenue and Volume Forecast (2020-2032)

10.1.2. Target Recognition

10.1.2.1. Market Revenue and Volume Forecast (2020-2032)

10.1.3. Electronic Warfare

10.1.3.1. Market Revenue and Volume Forecast (2020-2032)

10.1.4. Communication and Navigation

10.1.4.1. Market Revenue and Volume Forecast (2020-2032)

10.1.5. Command and Control

10.1.5.1. Market Revenue and Volume Forecast (2020-2032)

10.1.6. Surveillance and Monitoring

10.1.6.1. Market Revenue and Volume Forecast (2020-2032)

10.1.7. Intelligence and Reconnaissance

10.1.7.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 11. Global Military Sensors Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.1.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.1.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.1.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.1.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.1.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.1.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.2.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.2.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.2.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.2.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.2.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.2.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.2.6.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.2.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.2.7.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.2.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.3.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.3.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.3.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.3.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.3.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.3.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.3.6.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.3.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.3.7.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.3.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.4.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.4.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.4.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.4.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.4.6.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.4.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.4.7.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.4.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.5.4.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.5.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Volume Forecast, by Platform (2020-2032)

11.5.5.2. Market Revenue and Volume Forecast, by Component (2020-2032)

11.5.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Lockheed Martin Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BAE Systems plc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Northrop Grumman Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Raytheon Technologies Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. General Dynamics Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thales Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Safran S.A.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. L3Harris Technologies, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Leonardo S.p.A.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Rheinmetall AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/