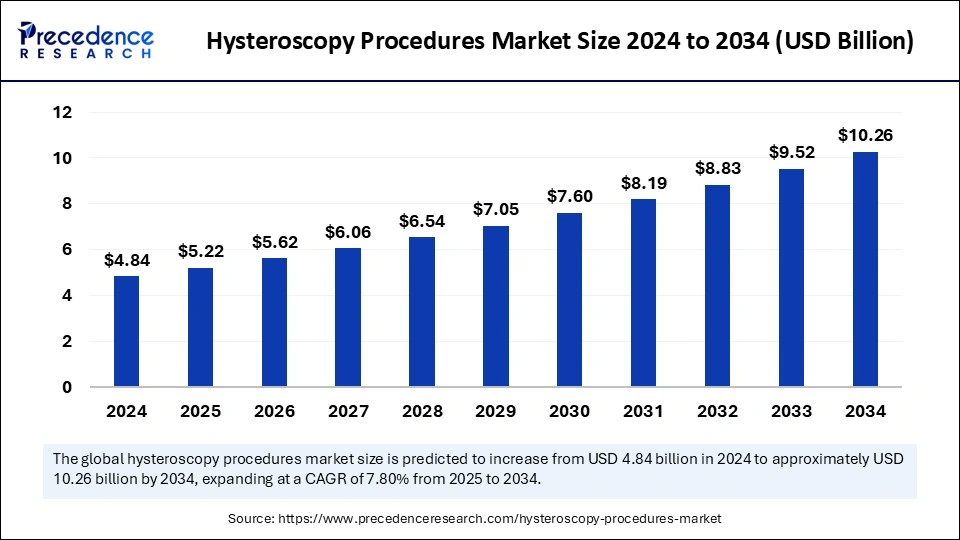

Hysteroscopy procedures market size to rise from USD 4.84 billion in 2024 to around USD 10.26 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

-

North America dominated the hysteroscopy procedures market with 39% share in 2024.

-

Asia Pacific is forecasted to grow at a CAGR of 8.5% over the projected period.

-

The 58558 CPT code segment held the highest market share of 36% in 2024.

-

The 58562 CPT code segment is anticipated to grow significantly.

-

Hospitals contributed the largest share of 53% in the hysteroscopy market in 2024.

-

Ambulatory surgery centers are expected to witness notable growth.

Hysteroscopy Procedures Market Overview

The global hysteroscopy procedures market is growing at a notable pace due to the increasing prevalence of gynecological conditions, rising adoption of minimally invasive procedures, and technological advancements in hysteroscopy devices. Hysteroscopy is a diagnostic and therapeutic procedure used to visualize the interior of the uterus and treat abnormalities such as fibroids, polyps, and adhesions.

The growing demand for minimally invasive gynecological treatments, which offer faster recovery, reduced pain, and fewer complications, is driving the adoption of hysteroscopy procedures. With the increasing burden of uterine disorders and a growing emphasis on women’s health, the need for accurate and efficient diagnostic and treatment procedures is rising. Moreover, the integration of high-definition imaging systems and advanced hysteroscopic instruments is further enhancing the precision and safety of these procedures.

As healthcare systems worldwide focus on improving access to quality care and promoting early diagnosis, the hysteroscopy procedures market is expected to witness sustained growth. The expansion of healthcare services in developing regions and the growing adoption of office-based hysteroscopy procedures are further contributing to market growth.

Market Drivers

-

Rising Incidence of Uterine Abnormalities: The increasing prevalence of conditions such as fibroids, polyps, and abnormal uterine bleeding is driving the demand for hysteroscopy procedures. Early diagnosis and minimally invasive treatment options are becoming the standard of care.

-

Increasing Preference for Minimally Invasive Treatments: Minimally invasive procedures such as hysteroscopy offer advantages such as faster recovery, reduced pain, and lower risk of complications, making them an attractive option for patients and healthcare providers.

-

Technological Innovations in Hysteroscopic Instruments: Advancements in hysteroscopy technologies, including the development of flexible hysteroscopes, miniaturized instruments, and improved imaging systems, are enhancing the safety and effectiveness of procedures.

-

Rising Focus on Fertility Treatments and Reproductive Health: Hysteroscopy is widely used in the diagnosis and treatment of infertility-related conditions, contributing to the increasing demand for these procedures.

-

Government Initiatives Promoting Women’s Health: Several government and healthcare organizations are implementing programs and initiatives to promote early diagnosis and treatment of gynecological conditions, boosting the adoption of hysteroscopy procedures.

Market Opportunities

-

Expansion of Office-Based Hysteroscopy Services: The growing adoption of office-based hysteroscopy procedures presents an opportunity for healthcare providers to offer cost-effective and convenient solutions for patients.

-

Development of AI-Assisted Hysteroscopy Systems: The integration of artificial intelligence in hysteroscopy systems can enhance procedural accuracy, improve diagnosis, and reduce human error, creating growth opportunities for market players.

-

Penetration in Emerging Markets: Emerging economies with improving healthcare infrastructure and increasing awareness about minimally invasive procedures present untapped growth potential for hysteroscopy procedures.

-

Introduction of Miniaturized and Disposable Hysteroscopic Instruments: The development of cost-effective and disposable hysteroscopic instruments is expected to reduce procedural costs and increase accessibility.

-

Collaborations and Partnerships for Technological Advancements: Strategic collaborations between healthcare providers and medical device companies can accelerate the development and adoption of advanced hysteroscopic solutions.

Market Challenges

-

High Cost of Advanced Hysteroscopic Devices: The cost of advanced hysteroscopy systems and instruments limits their adoption, particularly in developing regions with budget constraints.

-

Shortage of Skilled Healthcare Professionals: The successful performance of hysteroscopy procedures requires specialized training and expertise, and the shortage of skilled professionals in some regions hampers market growth.

-

Risk of Procedural Complications: Despite being minimally invasive, hysteroscopy procedures carry the risk of complications such as bleeding, infections, and uterine perforation, which may discourage patient adoption.

-

Regulatory Compliance and Approval Delays: Stringent regulatory requirements and lengthy approval processes can delay the introduction of new hysteroscopic devices and limit market growth.

-

Limited Access to Advanced Healthcare Facilities in Developing Regions: Inadequate healthcare infrastructure and limited access to advanced medical technologies in low-income regions pose challenges to market penetration.

Regional Insights

-

North America: North America leads the hysteroscopy procedures market due to the presence of advanced healthcare systems, high awareness levels, and strong adoption of minimally invasive procedures.

-

Europe: Europe is a prominent market driven by favorable government initiatives, technological advancements, and increasing incidence of gynecological disorders. Countries such as Germany, France, and the UK contribute significantly to market growth.

-

Asia-Pacific: Asia-Pacific is witnessing rapid growth in the hysteroscopy procedures market due to rising healthcare investments, increasing awareness about women’s health, and improving access to healthcare services.

-

Latin America: Latin America is gradually adopting hysteroscopy procedures, with increasing focus on improving healthcare infrastructure and promoting early diagnosis and treatment.

-

Middle East and Africa: The Middle East and Africa region is experiencing moderate growth due to rising investments in healthcare infrastructure and growing awareness about minimally invasive procedures.

Recent Developments

-

January 2025: A leading healthcare technology company launched a new AI-assisted hysteroscopy system aimed at enhancing procedural accuracy and improving patient outcomes.

-

December 2024: A major medical device manufacturer introduced a line of disposable hysteroscopic instruments designed to reduce procedural costs and enhance patient safety.

Hysteroscopy Procedures Market Companies

- Medtronic

- Stryker Corp.

- Hologic, Inc.

- KARL STORZ SE and Co. KG

- Medical Devices Business Services, Inc. (Ethicon, Inc.)

- Olympus Corp.

- Delmont Imaging

- B. Braun Melsungen AG

- Richard Wolf GmbH

- CooperCompanies

- Maxer Endoscopy GmbH

- Boston Scientific Corp.

- MedGyn Products, Inc.

- Lina Medical APS

- Luminelle

Segments Covered in the Report

By CPT Codes

- 58555

- 58558

- 58562

- 58340

- 58563

- 58565

- 58353

- 58561,74740

- Others

By End Use

- Hospitals

- Clinics

- Ambulatory Surgery Centers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!