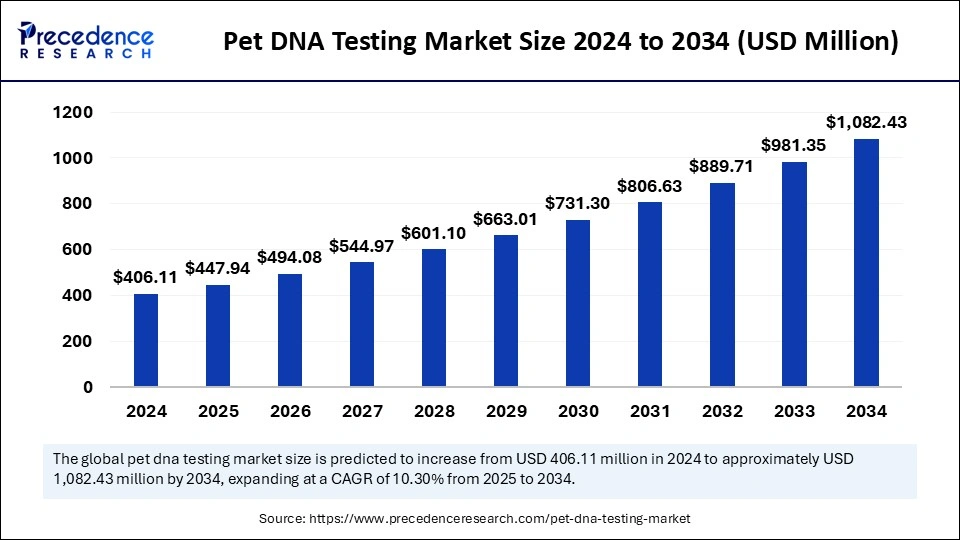

The global pet DNA testing market was valued at USD 406.11 million in 2024 and is projected to reach USD 1,082.43 million by 2034, growing at a CAGR of 10.30% from 2025 to 2034.

Pet DNA Testing Market Key Takeaways

-

North America led the market in 2024 with the largest share of 42%.

-

Asia Pacific is projected to grow at the fastest CAGR of 12.2% throughout the forecast period.

-

The dogs segment held the highest market share by animal type, accounting for 53% in 2024.

-

The cat segment is anticipated to grow at a significant CAGR of 10.9% during the forecast timeframe.

-

Saliva samples contributed the highest market share of 55% by sample type in 2024.

-

Blood samples are growing at a notable CAGR of 10.72% during the forecast period.

-

The breed profile segment captured the largest market share of 39% by test type in 2024.

-

Health and wellness tests are forecasted to grow at a CAGR of 10.52% in 2024.

-

The breeder’s segment accounted for the highest end-use market share of 42% in 2024.

-

The pet owner’s segment is expanding at a notable CAGR of 10.6% during the forecast period.

Pet DNA Testing Market Overview

The pet DNA testing market has experienced substantial growth in recent years as pet ownership trends shift toward more personalized and health-conscious care. With increased humanization of pets, especially dogs and cats, pet owners are turning to genetic testing services to gain insights into breed identification, health risks, ancestry, and behavioral traits.

The market’s expansion is supported by advancements in genomics and biotechnology, making DNA testing more accessible and affordable for everyday consumers. Pet DNA testing is quickly becoming a standard wellness tool among tech-savvy and health-focused pet owners globally.

Pet DNA Testing Market Drivers

A primary driver for the pet DNA testing market is the growing awareness among pet owners about hereditary diseases and preventive health management. Consumers are increasingly motivated to understand their pets’ genetic predispositions to tailor diet, exercise, and medical care. The rapid rise in pet adoptions, particularly during the COVID-19 pandemic, also contributed to higher demand for DNA testing services. Moreover, the integration of digital platforms and mobile applications has made it easier for users to order tests, register kits, and receive detailed genetic reports.

Pet DNA Testing Market Opportunities

Significant opportunities exist for expanding the pet DNA testing market into untapped regions and developing countries where pet care industries are still evolving. Companies that invest in educating consumers about the benefits of genetic testing are likely to capture a loyal customer base.

Expansion into testing for exotic pets and offering subscription-based wellness tracking services could also unlock new revenue streams. Collaborations with veterinary clinics and pet insurance providers offer strategic pathways for scaling market reach.

Pet DNA Testing Market Challenges

The pet DNA testing market faces challenges related to accuracy, standardization, and regulation. Since this is a relatively new sector, there is limited oversight regarding testing protocols and data interpretation. Variability in test results across different companies has raised concerns about consistency and reliability. Additionally, data privacy and ethical questions about how pet genetic information is stored and used remain key concerns that could hinder broader adoption.

Pet DNA Testing Market Regional Insights

North America dominates the pet DNA testing market due to high pet ownership rates, strong disposable income, and early adoption of pet wellness technologies. Europe follows closely, driven by rising trends in personalized pet care and growing veterinary infrastructure.

The Asia-Pacific region is emerging as a high-potential market, particularly in urban areas where a rising middle class is spending more on pet products and services. Countries like China, Japan, and Australia are beginning to witness increased awareness and adoption of pet DNA services.

Pet DNA Testing Market Recent Developments

Recent developments in the market include partnerships between DNA testing companies and veterinary networks to expand service availability. Several startups have emerged offering niche services such as feline-only testing or behavioral gene analysis.

Technological innovation is also driving progress, with AI and machine learning being integrated to provide predictive health analytics. Additionally, there is a growing focus on building user-friendly platforms that consolidate genetic data with long-term pet health monitoring.

Pet DNA Testing Market Companies

- Zoetis Inc. (Basepaws Inc.)

- Mars Petcare (Wisdom Panel)

- Orivet Genetic Pet Care Limited

- Embark Veterinary, Inc.

- Dognomics (public: Clinomics)

- DNA MY DOG (Canadian Dog Group Ltd.)

- Neogen Corporation

- EasyDNA (Genetic Technologies)

- CirclePaw (Prenetics Global Limited)

- Macrogen, Inc.

Segments Covered in the Report

By Animal Type

- Dogs

- Cats

- Other Animals

By Sample Type

- Blood

- Saliva

- Fecal

- Others

By Test Type

- Breed Profile

- Genetic Diseases

- Health and Wellness

By End-use

- Pet Owners

- Breeders

- Veterinarians

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/