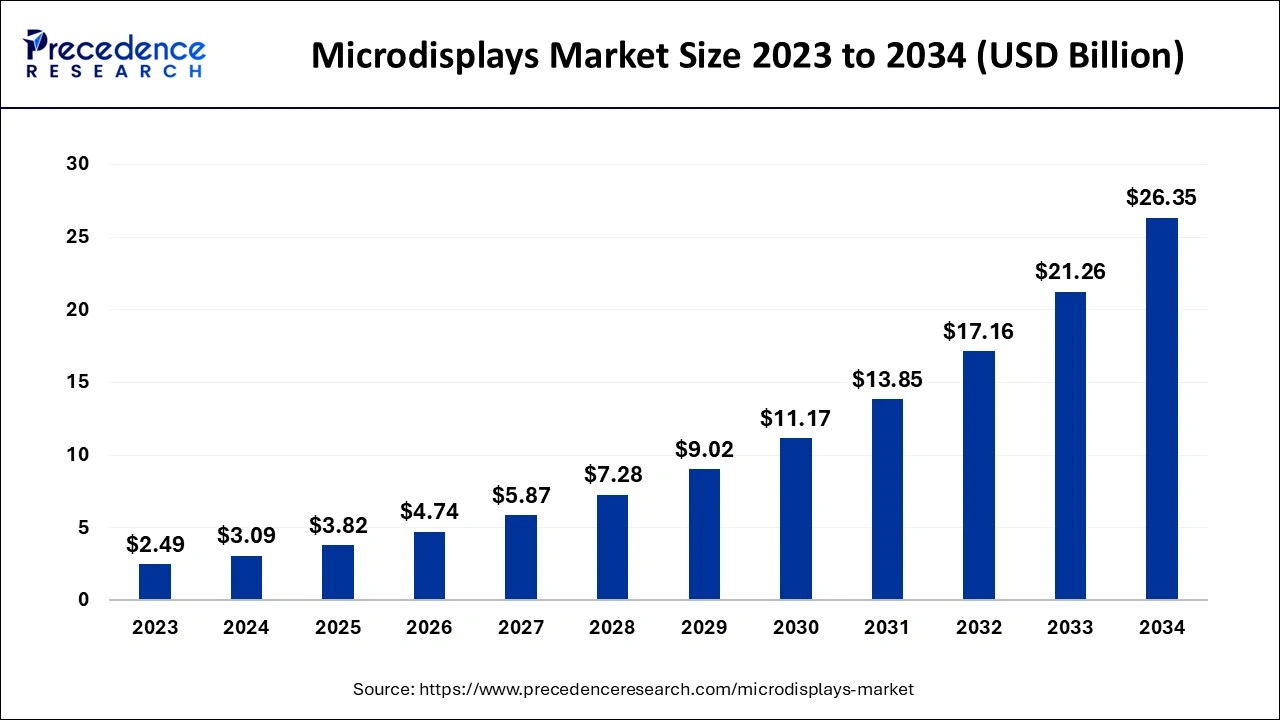

The global microdisplays market was valued at USD 3.09 billion in 2024 and is projected to exceed USD 26.35 billion by 2034, growing at a healthy CAGR of 23.92% during the forecast period.

Microdisplays Market Key Takeaways

-

In 2023, Asia Pacific led the global microdisplays market, capturing the highest market share of 36%.

-

North America is projected to witness the fastest growth rate throughout the forecast timeline.

-

Within North America, the U.S. dominated the regional microdisplays market with over 73% share in 2023.

-

The near-to-eye product segment held the leading position in the global market during 2023.

-

The projection product segment is expected to experience the fastest CAGR during the forecast period.

-

LCD technology accounted for the largest market share in 2023.

-

The LCoS technology segment is forecast to register a significant CAGR in the coming years.

-

Consumer electronics emerged as the top application segment in 2023.

-

The automotive application segment is anticipated to grow at the highest CAGR during the forecast duration.

Microdisplays Market Overview

A microdisplay is a small electronic display panel. These displays are less than two inches in length and diagonal size and can be viewed through an optical system. Microdisplays have been utilized in many applications, such as near-eye applications, rear-projection TVs, data projectors, head-mounted displays (HMDs), etc.

The microdisplays market offers super extended graphics array (SEGA) resolution for improved brightness. Some common types of microdisplays are OLED microdisplays and AMOLED microdisplays. The rapid integration of advanced display technologies across consumer electronics and the defense sector is contributing significantly to the market’s expansion.

Microdisplays Market Drivers

Key growth drivers for the microdisplays market include the surging adoption of augmented and virtual reality across industries, along with advancements in wearable technology. As user experiences become increasingly immersive, the need for lightweight, low-power, and high-resolution displays intensifies. Additionally, the defense sector’s rising demand for head-mounted and near-to-eye displays is further accelerating growth.

Microdisplays Market Opportunities

The market presents strong opportunities in the automotive industry, where heads-up displays (HUDs) are becoming standard in premium and electric vehicles. Furthermore, ongoing innovation in OLED and LCoS technologies is opening up new use cases in smart glasses and medical diagnostics. The rising popularity of metaverse applications and mixed-reality environments also creates fertile ground for future demand.

Microdisplays Market Challenges

Despite its promising outlook, the market faces challenges related to high production costs and technical limitations in resolution and brightness in compact formats. The complexity involved in integrating microdisplays into smaller devices without compromising performance or energy efficiency remains a critical obstacle for manufacturers.

Microdisplays Market Regional Insights

Asia Pacific dominated the global microdisplays market with a 36% share in 2023, driven by strong electronics manufacturing in China, Japan, and South Korea. North America is expected to grow at the fastest pace due to increased investments in defense technology and AR/VR startups. The U.S. held over 73% of the North American market, underlining its leadership in innovation and R&D in display technology.

Microdisplays Market Recent Developments

Recent developments in the market include major players focusing on miniaturization and power efficiency, with increased R&D investments in OLED and microLED displays. Strategic collaborations between tech companies and display manufacturers are accelerating the commercialization of AR/VR devices with integrated microdisplays. Furthermore, companies are exploring AI-driven image processing to enhance microdisplay performance across applications.

Microdisplays Market Companies

- LG DISPLAY CO., LTD.

- eMagin. (SAMSUNG DISPLAY)

- Sony Corporation

- KOPIN

- AUO Corporation

- Micron Technology, Inc.

- Himax Technologies, Inc.

- Syndicate

- UNIVERSAL DISPLAY

- MicroVision

Segments Covered in the Report

By Product

- Near-To-Eye

- Projection

- Others

By Technology

- Liquid Crystal Display (LCD)

- Organic Light-Emitting Diode (OLED)

- Digital Light Processing (DLP)

- Liquid Crystal On Silicon (Lcos)

By Application

- Consumer Electronics

- Military and Defense

- Medical Applications

- Industrial Systems

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!