Plant Asset Management Market Key Takeaways

- North America dominated the global plant asset management market with the largest market share of 37% in 2023.

- The U.S. is projected to expand at a double-digit CAGR of 14.72% during the forecast period.

- The Asia Pacific is anticipated to grow at a notable CAGR of 16.44% during the forecast period.

- By component, the solution segment accounted for the biggest market share of 64% in 2023.

- By component, the services segment is representing a solid CAGR of 15.93 during the forecast period.

- By deployment, the cloud segment stood the dominant in the global market in 2023.

- By deployment, the on-premise segment is anticipated to at the fastest CAGR of 14.82% during the forecast period.

- By asset type, the production assets segment contributed more than 55% of market share in 2023.

- By asset type, the automation assets segment is anticipated to grow at the highest CAGR of 15.82% during the forecast period.

- By end-user, the energy and power segment held the largest market share of 24% in 2023.

- By end-user, the manufacturing segment is expected to grow at a remarkable CAGR of 16.72% during the forecast period.

Market Overview

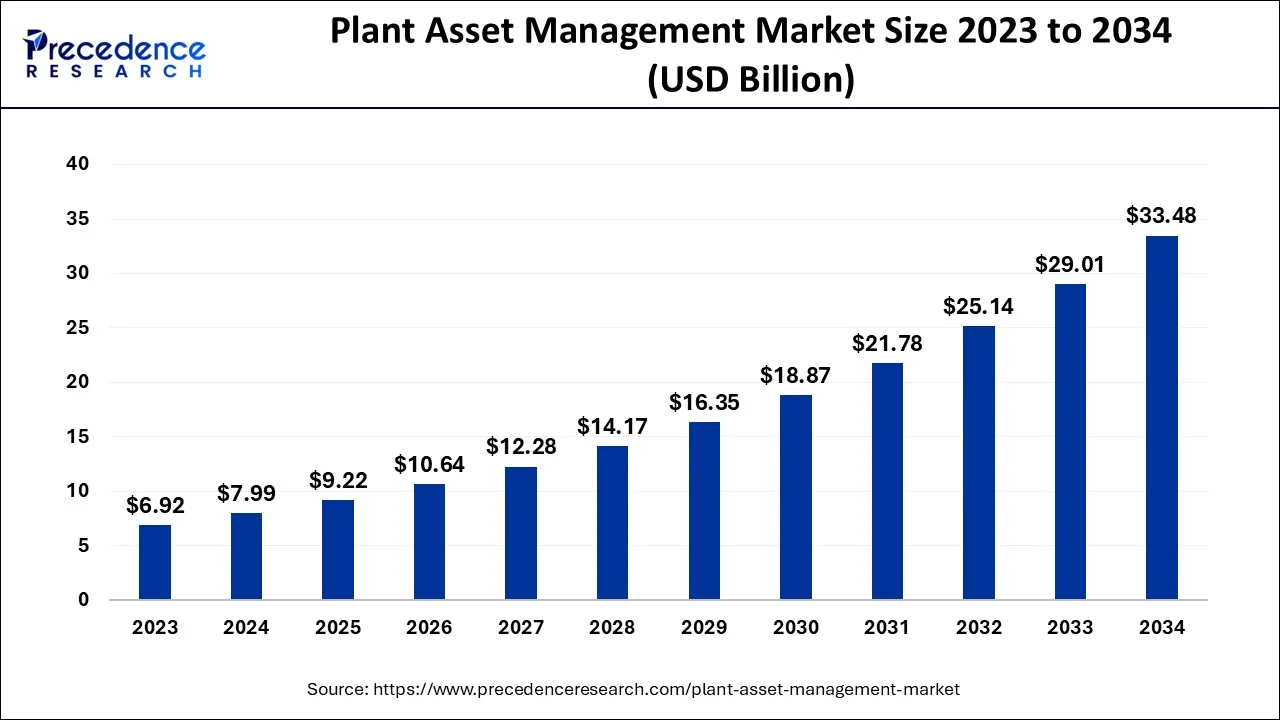

The Plant Asset Management (PAM) market is undergoing a transformative phase, with industries increasingly recognizing the importance of predictive maintenance and sustainability. PAM encompasses the strategic planning, monitoring, and optimization of physical assets within industrial settings. The market is projected to grow significantly, driven by the need to minimize unplanned downtime, extend asset lifecycles, and achieve environmental goals. The integration of advanced technologies and the shift towards data-driven decision-making are central to this evolution.

Drivers

Several factors are driving the growth of the PAM market. The increasing complexity of industrial operations necessitates efficient asset management to ensure reliability and compliance. The adoption of predictive maintenance strategies, enabled by AI and IoT technologies, allows for early detection of potential failures, reducing downtime and maintenance costs. Additionally, the growing emphasis on sustainability and energy efficiency compels industries to optimize asset performance and reduce environmental impact, further fueling the demand for PAM solutions.

Opportunities

The PAM market offers substantial opportunities, particularly in the development and deployment of advanced analytics and machine learning algorithms. These technologies enhance the ability to predict equipment failures and optimize maintenance schedules. The expansion of cloud-based PAM solutions provides scalability and accessibility, making them suitable for organizations of varying sizes. Furthermore, the increasing focus on regulatory compliance and safety standards presents opportunities for PAM providers to offer solutions that ensure adherence to industry regulations and enhance operational safety.

Challenges

Despite the favorable market conditions, challenges persist. The high cost of implementing advanced PAM systems can be a barrier for small and medium-sized enterprises. Additionally, the integration of new technologies with existing legacy systems requires careful planning and execution. Data security and privacy concerns associated with cloud-based solutions may also impede adoption. Addressing these challenges necessitates strategic investments, robust cybersecurity measures, and comprehensive training programs to equip personnel with the necessary skills.

Regional Insights

North America leads the PAM market, attributed to its advanced industrial infrastructure and early adoption of digital technologies. The region’s focus on sustainability and regulatory compliance further drives the demand for PAM solutions. The Asia-Pacific region is anticipated to experience the highest growth rate, propelled by rapid industrialization, increasing investments in manufacturing, and the adoption of smart technologies in countries such as China, India, and Southeast Asian nations. Europe maintains steady growth, supported by stringent environmental regulations and a strong emphasis on operational efficiency.

Recent Developments

The PAM market has witnessed notable developments aimed at enhancing predictive maintenance capabilities and promoting sustainability. Companies are increasingly investing in AI-driven solutions to monitor asset health and predict failures. The integration of cloud-based platforms facilitates real-time data analysis and remote monitoring, enabling proactive maintenance strategies. Additionally, collaborations between technology providers and industry players are fostering the development of innovative PAM solutions tailored to specific industrial needs, further advancing the market.

Plant Asset Management Market Companies

- Siemens AG, ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- General Electric (GE)

- IBM Corporation

- Bentley Systems, Inc.

- Yokogawa Electric Corporation

Segments Covered in the Report

By Component

- Solution

- Asset Lifecycle Management

- Predictive Maintenance

- Work Order Management

- Inventory Management

- Services

- Professional Service

- Managed Service

By Deployment

- Cloud

- On-Premises

By Asset Type

- Production Assets

- Automation Assets

By End-user

- Energy and Power

- Oil and Gas

- Manufacturing

- Mining and Metal

- Aerospace and Defense

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!