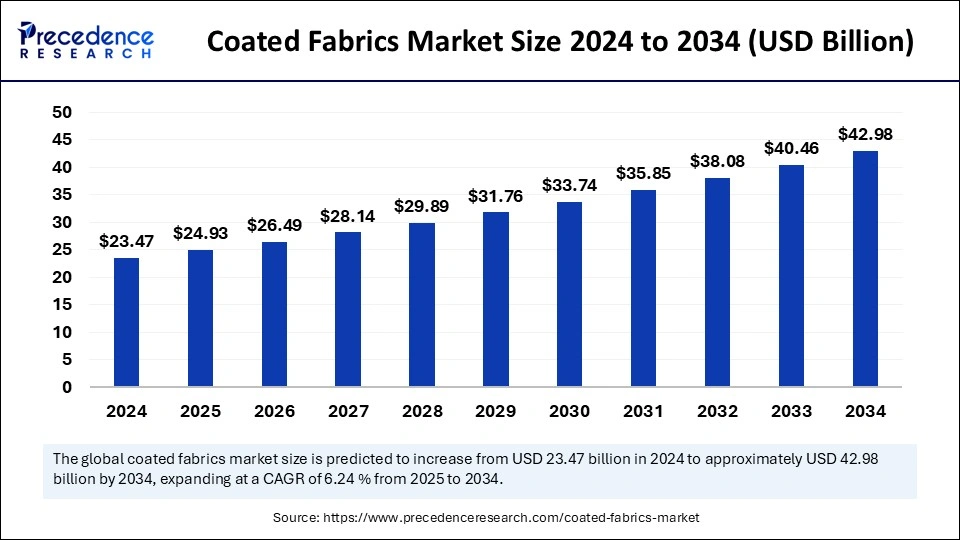

The global coated fabrics market, valued at USD 23.47 billion in 2024 and projected to reach USD 42.98 billion by 2034, growing at a CAGR of 6.24% from 2025 to 2034.

Coated Fabrics Market Key Takeaways

- Asia Pacific dominated the global market with the highest share around 40% in 2024

- North America is estimated to expand at the fastest CAGR in the market between 2025 and 2034

- By product type, vinyl-coated fabrics segment accounted for the biggest market share in 2024

- By product type, polymer-coated fabrics segment is anticipated to witness fastest growth over the forecast period

- By application, the transportation segment contributed the largest share in 2024

- By application, the protective clothing segment is expected to grow at the fastest rate during the forecast period

Market Overview

Coated fabrics are textiles treated with coating materials forming a one or multiple layers on the fabric for enhancing their functionality and performance like water resistance, durability, antimicrobial protection or flame retardancy. Usually, a resin or polymer material is applied for coating.

The most commonly used coating materials are acrylic, plastic resins, polyurethane, rubber, silicone and vinyl. Coating process for manufacturing coated fabrics includes techniques like direct application, roll coating, dip coating, spray coating, flame lamination among others.

The coated fabrics is expected to grow significantly in the upcoming years due to rising investments in manufacturing sectors, rapid industrialization and urbanization, expansion of the automotive industry with increased production rates and growing use of coated fabrics in automotive interiors like trims and upholstery, focus of manufacturers on extending product portfolios by introducing new products, use of sustainable and recycled materials as well as advancements in textile technology.

Drivers

Several key factors are contributing to the growth of the coated fabrics market. One of the primary drivers is the increasing use of coated fabrics in the automotive industry. These materials are extensively utilized in vehicle interiors such as seats, door panels, and airbags due to their aesthetic appeal, durability, and resistance to environmental damage. As global vehicle production rises, particularly in emerging economies, the demand for coated fabrics continues to grow proportionately. The safety requirements in vehicles have also led to an increased adoption of coated fabrics in safety gear and airbag systems, thus further stimulating the coated fabrics market.

Another significant driver is the robust growth in the construction and infrastructure sectors worldwide. Coated fabrics are commonly used in architectural structures, tents, canopies, and awnings due to their weather resistance and flexibility. As urbanization progresses, especially in Asia-Pacific and the Middle East, the construction of commercial and residential buildings has surged, driving up demand in the coated fabrics market. Additionally, the rising awareness of worker safety and protection is leading to the increased use of protective clothing made from coated fabrics in various hazardous work environments.

Technological advancements in coating techniques and material sciences are also propelling the coated fabrics market forward. Modern coatings now offer multifunctional capabilities including antibacterial properties, flame retardancy, and thermal insulation, making them highly sought-after in healthcare and defense applications. As industries seek materials that are not only strong but also smart and responsive, the coated fabrics market continues to expand its application landscape.

Opportunities

The coated fabrics market presents numerous growth opportunities, particularly in the realm of sustainable and eco-friendly products. With increasing environmental consciousness and strict governmental regulations regarding volatile organic compounds (VOCs), manufacturers are shifting toward water-based and solvent-free coatings. This trend is opening new avenues for product development and market expansion. Companies that invest in eco-innovation and sustainable practices stand to gain a competitive edge in the evolving coated fabrics market.

Another promising opportunity lies in the rapidly expanding electric vehicle (EV) segment. As EV manufacturers look for lightweight, durable, and fire-retardant materials for interiors and battery enclosures, the demand for high-performance coated fabrics is expected to rise. The integration of smart fabrics and conductive textiles within vehicle cabins also offers untapped potential in the coated fabrics market. With the automotive sector undergoing a massive transformation, suppliers of coated fabrics have the chance to align their offerings with these new requirements.

The healthcare industry is also emerging as a key opportunity area for the coated fabrics market. The COVID-19 pandemic brought to light the urgent need for high-quality, protective medical textiles. Coated fabrics used in surgical gowns, drapes, and mattress covers must meet strict hygiene and performance standards. As health and hygiene continue to remain a top priority globally, the demand for specialized medical coated fabrics is anticipated to grow, unlocking new growth dimensions within the coated fabrics market.

Challenges

Despite its potential, the coated fabrics market faces several challenges that can hinder its growth trajectory. One of the most pressing concerns is the environmental impact associated with traditional coatings. Many coated fabrics are manufactured using PVC and solvent-based coatings, which release harmful VOCs during production and disposal. Regulatory bodies in regions such as Europe and North America are imposing stricter emission norms, compelling manufacturers to adopt greener alternatives or risk losing market access.

Another challenge is the volatility in raw material prices, especially those derived from petrochemicals. These fluctuations affect the cost structure and profitability of coated fabric manufacturers, creating uncertainty in the supply chain. The global nature of the coated fabrics market means that any disruption—be it geopolitical tension, trade barriers, or natural disasters—can significantly impact production and distribution.

Intense competition within the coated fabrics market also presents a significant challenge. Numerous players offer similar products, making differentiation increasingly difficult. Companies must continuously innovate and invest in R&D to maintain relevance and market share. Furthermore, counterfeit products and substandard coatings that enter the supply chain can damage brand reputation and erode consumer trust, presenting a long-term challenge for quality-focused manufacturers in the coated fabrics market.

Regional Insights

The coated fabrics market exhibits varied growth dynamics across different geographical regions. Asia-Pacific remains the dominant regional market, driven by rapid industrialization, urban development, and strong automotive and construction sectors in countries such as China, India, and South Korea. China, in particular, is a major production hub for coated fabrics, supported by its extensive manufacturing capabilities and relatively lower labor costs.

North America represents another significant region within the coated fabrics market, largely due to its advanced technological infrastructure and established automotive and aerospace industries. The U.S. leads the market in terms of innovation and the adoption of high-performance coated fabrics for both commercial and defense applications. Environmental regulations in North America are also encouraging the use of sustainable and low-emission coated products, influencing market trends positively.

Europe, with its stringent environmental norms and strong industrial base, continues to make significant strides in the coated fabrics market. Countries such as Germany, France, and Italy are investing heavily in R&D and sustainable manufacturing practices. The demand for eco-friendly coatings and the push toward circular economy initiatives are shaping the future of the market in this region. Meanwhile, the Middle East and Africa, though still emerging, show promise with infrastructure growth and increasing demand for weather-resistant textiles for construction and marine applications. Latin America, too, is gradually becoming a part of the global coated fabrics market ecosystem as regional industries modernize and expand.

Recent Developments

Recent developments in the coated fabrics market reflect the industry’s growing emphasis on innovation and sustainability. Leading players are heavily investing in the development of bio-based coatings and recycled fabric substrates to reduce environmental impact. Companies such as Trelleborg, Saint-Gobain, and Seaman Corporation have launched new product lines that emphasize performance as well as eco-friendliness. These developments aim to meet the rising consumer demand for sustainable solutions and to comply with evolving global regulations.

Collaborations and mergers have also been on the rise in the coated fabrics market. Strategic partnerships between coating technology firms and textile manufacturers are leading to the creation of advanced composite materials with superior mechanical and functional properties. These alliances are expected to enhance production efficiency, reduce costs, and expand product portfolios.

Digitization and automation are being increasingly integrated into manufacturing processes within the coated fabrics market. From digital textile printing to AI-driven quality control systems, companies are leveraging technology to streamline operations and enhance product quality. This tech-driven approach not only improves productivity but also supports customized solutions, which are gaining traction among end-users.

Coated Fabrics Market Companies

- BASF SE

- Berry Plastics Group, Inc.

- Bo-Tex Sales Co.

- Omnova Solutions

- Saint-Gobain S.A.

- Spradling International Inc.

- Takata Corporation

- Trelleborg AB

- Mauritzon Inc.

- ContiTech AG

- Isotex S.p.A

- Kuraray Co., Ltd.

- Graniteville Specialty Fabrics

- The Dow Chemical Company

- The RKW Group

- Serge Ferrari Group

Segments Covered in the Report

By Product Type

- Polymer-coated Fabrics

- Vinyl-coated Fabrics

- PU-coated Fabrics

- PE-coated Fabrics

- Rubber-coated Fabrics

- Fabric-backed Wall Coverings

By Application

- Transportation

- Protective Clothings

- Industrial

- Roofing, Awnings and Canopies

- Furniture & Seatings

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/