U.S. Dental Software Market Key Takeaways

U.S. Dental Software Market Key Takeaways- By type, the practice management software segment dominated the market with the highest market share in 2024.

- By type, the patient communication software segment is expected to witness significant growth in its market share during the predicted timeframe.

- By deployment, the web-based segment dominated the U.S. dental software market with the largest share in 2024.

- By deployment, the cloud-based segment is expected to grow at the fastest CAGR in the market.

- By end user, the hospital segment dominated the market with the largest share.

- By end user, the dental clinics segment is expected to grow fastest in the U.S. dental software market.

Market Overview

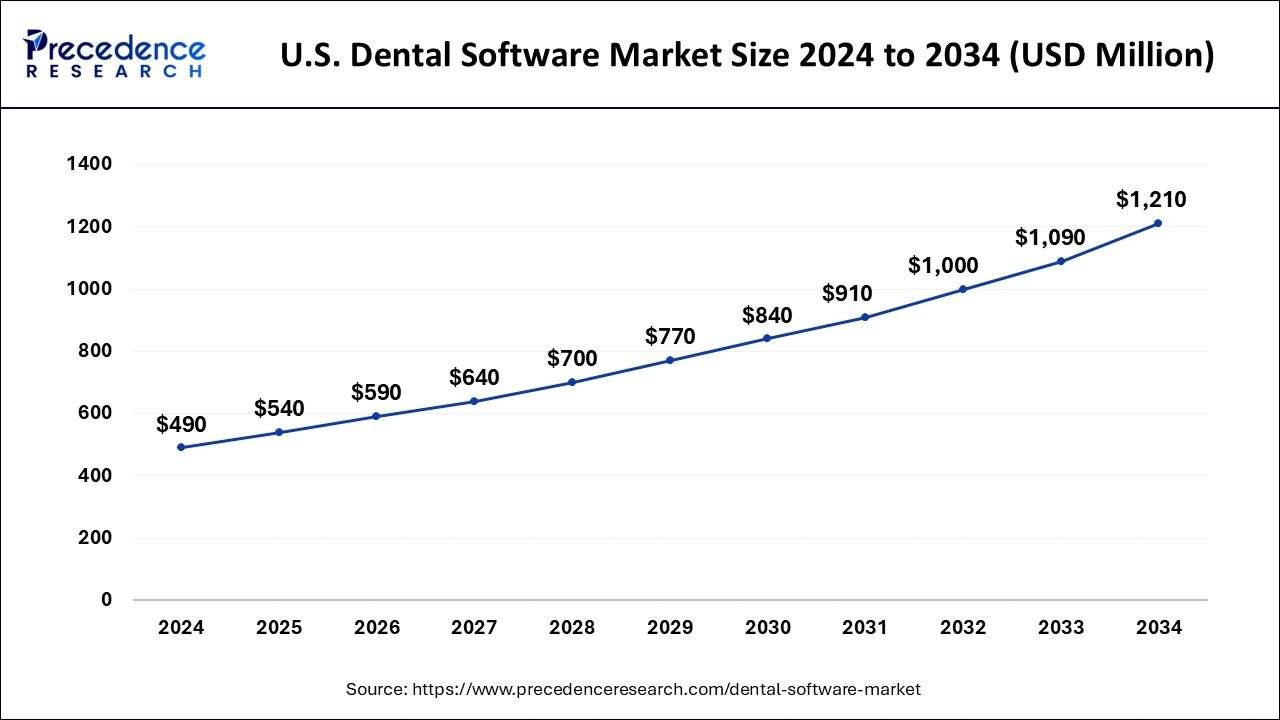

The U.S. dental software market has experienced remarkable growth due to the increasing adoption of digital technologies in dental practices across the country. Dental software solutions encompass a wide range of applications, from practice management systems to imaging software and patient engagement tools.

As dental practitioners and clinics continue to embrace digital transformation, the U.S. dental software market is expected to maintain a positive trajectory. The market’s expansion is fueled by advancements in artificial intelligence, cloud-based software, and the growing demand for efficient patient care management systems.

Drivers

Several factors are driving the growth of the U.S. dental software market. The ongoing shift towards digitalization in healthcare, including the integration of electronic health records (EHR) and electronic medical records (EMR) in dental practices, has created a need for sophisticated software solutions.

Furthermore, the increasing focus on improving patient care and streamlining administrative tasks has prompted dental professionals to adopt software systems that enhance practice management and operational efficiency. Rising healthcare expenditures, an aging population requiring more dental care, and the demand for improved diagnostic tools also play a role in fueling the market.

Opportunities

The U.S. dental software market presents significant opportunities, particularly in cloud-based dental solutions. Cloud technology offers scalability, cost-efficiency, and the ability to access patient data from multiple devices, which has made it an attractive option for dental practices, especially small and medium-sized ones.

Another opportunity lies in the integration of advanced technologies such as artificial intelligence and machine learning for enhanced diagnostics, predictive analytics, and personalized treatment plans. Additionally, the growing trend of teledentistry opens up new avenues for dental software providers to develop platforms that facilitate remote consultations and monitoring.

Challenges

Despite the positive growth prospects, the U.S. dental software market faces several challenges. One of the primary hurdles is the high cost of implementing comprehensive dental software systems, especially for smaller dental practices. The complexity of integrating new software with existing systems can also be a barrier, as practices may face disruptions during the transition period.

Data security concerns, particularly regarding patient privacy and compliance with regulations such as HIPAA, continue to be a significant challenge. Moreover, the pace of technological advancements means that software solutions must be continuously updated, creating additional costs and operational challenges.

Recent Developments

The U.S. dental software market has seen notable advancements in recent years, with companies focusing on enhancing user-friendly interfaces and improving software interoperability. Many vendors have embraced cloud-based solutions, offering scalable and accessible platforms to dental practitioners.

In addition, there is a growing trend toward the integration of artificial intelligence for diagnostic imaging and patient management. Some dental software providers have launched AI-powered tools to assist with treatment planning, patient monitoring, and even improving patient communication through automated reminders and appointment scheduling systems.

U.S. Dental Software Market Companies

- Carestream Dental LLC

- Allscripts Healthcare Solutions

- Dovetail Dental Software

- DentiMax LLC

- Epic Systems Corporation

- Patterson Companies Inc.

- Datacon Dental Systems

- Curve Dental Inc.

- Quality Systems Inc.

- Henry Schein

Segments Covered in the Report

By Type

- Practice Management Software

- Patient Communication Software

- Planning Software

- Patient Education Software

- Dental Imaging Software

By Deployment

- Web-based

- On-premise

- Cloud-based

By End User

- Dental Clinics

- Hospitals