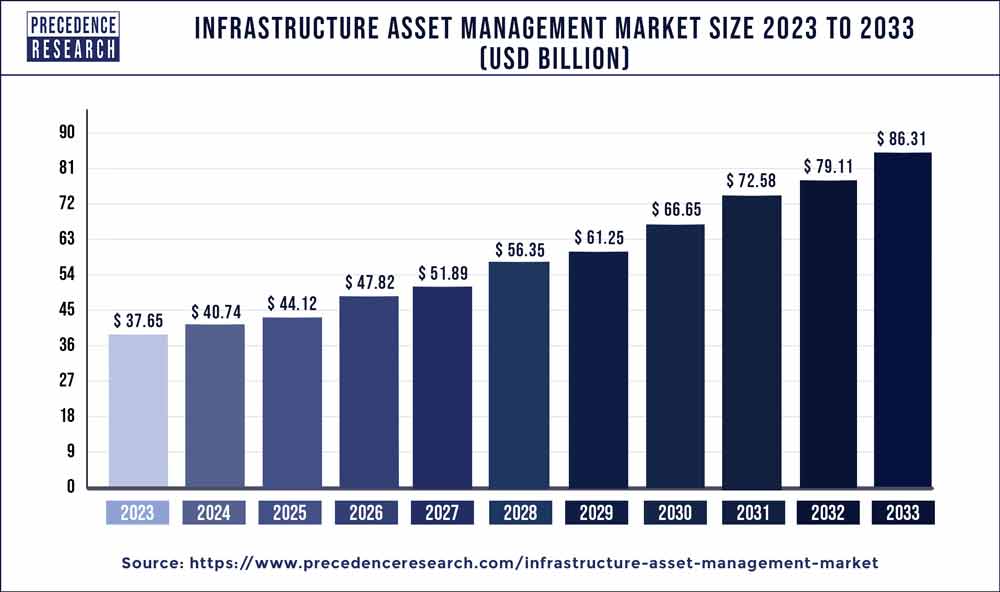

The global infrastructure asset management market size is projected to hit around USD 86.31 billion by 2033 from USD 37.65 billion in 2023, notable at a CAGR of 8.70% from 2024 to 2033.

Key Takeaways

- North America contributed 33% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By application, the transportation segment has held the largest market share of 32% in 2023.

- By application, the energy infrastructure segment is anticipated to grow at a remarkable CAGR of 11.4% between 2024 and 2033.

- By service, the operational asset management segment generated over 40% of the market share in 2023.

- By service, the strategic asset management segment is expected to expand at the fastest CAGR over the projected period.

- By component, the services segment generated over 66% of the market share in 2023.

- By component, the solution segment is expected to expand at the fastest CAGR over the projected period.

Introduction

The Infrastructure Asset Management market is witnessing a paradigm shift driven by the growing need for efficient and sustainable management of physical assets across various sectors. Infrastructure Asset Management involves the systematic planning, operation, maintenance, and optimization of infrastructure assets such as roads, bridges, utilities, and transportation systems. This market analysis delves into the key aspects influencing the Infrastructure Asset Management sector, including factors contributing to its growth, driving forces, potential constraints, emerging opportunities, and regional trends shaping the market landscape.

Get a Sample: https://www.precedenceresearch.com/sample/3719

Growth Factors

The Infrastructure Asset Management market is experiencing robust growth owing to several key factors. The increasing complexity and aging of infrastructure assets worldwide have heightened the demand for advanced management solutions. Governments and organizations are recognizing the importance of adopting proactive asset management strategies to extend the lifespan of assets, enhance operational efficiency, and ensure optimal resource allocation. Furthermore, the integration of technology, including IoT sensors, data analytics, and predictive maintenance tools, is significantly contributing to the growth of Infrastructure Asset Management solutions. This digital transformation allows for real-time monitoring, predictive modeling, and data-driven decision-making, improving overall asset performance and reducing downtime.

Infrastructure Asset Management Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.70% |

| Global Market Size in 2023 | USD 37.65 Billion |

| Global Market Size by 2033 | USD 86.31 Billion |

| U.S. Market Size in 2023 | USD 8.70 Billion |

| U.S. Market Size by 2033 | USD 19.94 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Service, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In June 2023, Macquarie Asset Management (MAM) successfully completed the recapitalization of Coastal Waste & Recycling, making MAM the primary owner. This strategic investment is anticipated to accelerate Coastal’s growth, solidifying its position as a leading privately owned integrated solid waste and recycling enterprise in the Southeast region.

- In April 2023, Siemens Digital Industries Software and IBM announced an extended partnership, focusing on creating a combined software solution. This collaboration integrates their expertise in systems engineering, service lifecycle management, and asset management, offering an innovative solution to address complex challenges in these domains.

- In September 2022, WSP acquired John Wood Group plc’s Environment & Infrastructure Business, combining their strengths to deliver a broader range of multidisciplinary services. This strategic move enhances their capacity to provide innovative solutions, ultimately delivering increased value to their clients.

Infrastructure Asset Management Market Dynamics

Drivers

Several drivers are propelling the adoption of Infrastructure Asset Management solutions globally. One of the primary drivers is the need for cost-effective and sustainable infrastructure maintenance. Asset managers are leveraging technology to optimize maintenance schedules, reduce unplanned downtime, and extend the life cycle of assets. Additionally, regulatory requirements and compliance standards are compelling organizations to implement robust asset management practices. The growing trend towards smart cities and the need for resilient infrastructure in the face of climate change are also driving investments in Infrastructure Asset Management solutions. Moreover, the rising awareness of the economic and social impact of well-maintained infrastructure is encouraging governments and private entities to invest in advanced asset management technologies.

Restraints

Despite the positive trajectory, the Infrastructure Asset Management market faces certain restraints. Limited awareness and understanding of the benefits of advanced asset management practices in some regions may hinder adoption. The initial investment required for the implementation of sophisticated Infrastructure Asset Management solutions can be a barrier for smaller organizations. Moreover, interoperability issues and the integration of new technologies with existing legacy systems pose challenges. Resistance to change within organizations and the lack of skilled personnel for managing advanced asset management technologies are additional hurdles that the market needs to address.

Opportunity

The Infrastructure Asset Management market presents significant opportunities for growth and innovation. As the demand for sustainable and resilient infrastructure continues to rise, there is a growing market for solutions that offer predictive analytics, condition monitoring, and risk assessment. Furthermore, the integration of Artificial Intelligence (AI) and machine learning in asset management is opening new avenues for improved decision-making and efficiency. The ongoing trend of public-private partnerships for infrastructure development and maintenance also creates opportunities for service providers in the Infrastructure Asset Management sector. Additionally, the global push towards renewable energy and the electrification of transportation infrastructure present untapped opportunities for asset management solutions catering to these emerging sectors.

Region Snapshot

The adoption of Infrastructure Asset Management solutions varies across regions, influenced by factors such as infrastructure development priorities, regulatory frameworks, and technological readiness. In developed regions like North America and Europe, stringent regulations, a focus on sustainability, and the need for infrastructure modernization are driving significant investments in advanced asset management technologies. Asia-Pacific, with its rapid urbanization and infrastructure expansion, presents a lucrative market for Infrastructure Asset Management solutions. Governments in countries like China and India are increasingly investing in smart city projects, creating a demand for intelligent asset management systems. In regions with established infrastructure networks, such as the Middle East, there is a growing emphasis on upgrading existing assets to meet modern standards, fueling the adoption of Infrastructure Asset Management solutions.

Read Also: Healthcare Digital Payment Market Size to Grow $81.36 Bn By 2033

Infrastructure Asset Management Market Companies

- IBM Corporation

- SAP SE

- Oracle Corporation

- Schneider Electric SE

- Bentley Systems, Incorporated

- ABB Ltd

- Siemens AG

- Infor Inc.

- eMaint (Fluke Corporation)

- IPS-Intelligent Process Solutions

- Dude Solutions, Inc.

- Cityworks (Trimble Inc.)

- Hexagon AB

- Yokogawa Electric Corporation

- Mott MacDonald Group Limited

Segments Covered in the Report

By Application

- Transportation infrastructure

- Energy infrastructure

- Water & waste infrastructure

- Critical infrastructure

- Mining

- Others

By Service

- Strategic asset management

- Operational asset management

- Tactical asset management

By Component

- Solution

- Services

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/