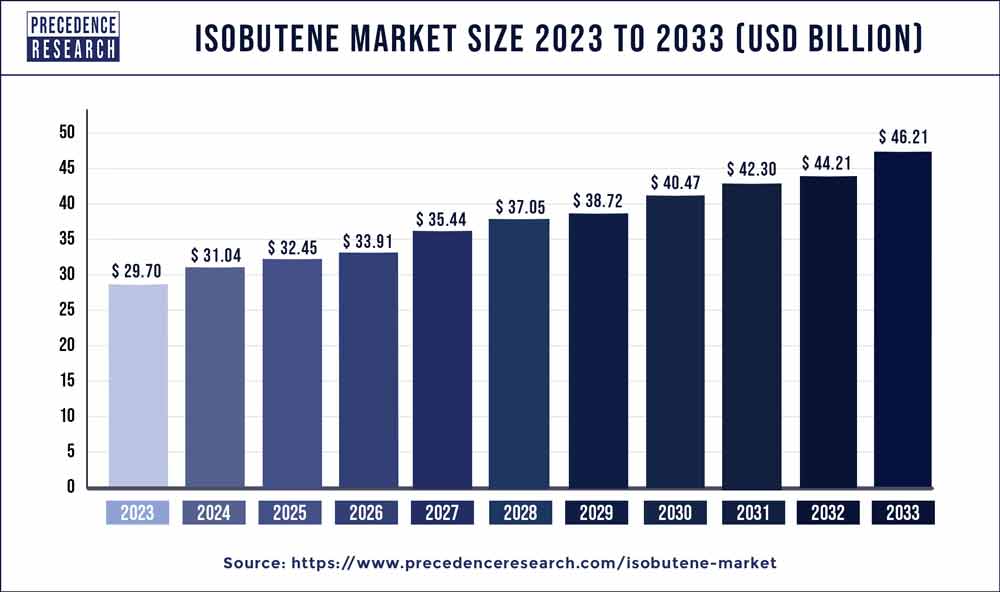

The global isobutene market size was valued at USD 29.70 billion in 2023 and is projected to reach around USD 46.21 billion by 2033 with a CAGR of 4.52% from 2024 to 2033.

Key Points

- North America dominated the market with the largest share of 43% in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 5.29% during the forecast period.

- By product, the Methyl tert-butyl ether (MTBE) segment held the largest segment of 80% in 2023.

- By application, the automotive segment held the biggest market share of 34% in 2023.

- By application, the aerospace segment is expected to grow at a notable CAGR of 4.71% between 2023 and 2033.

The Isobutene market is witnessing significant growth globally, driven by the expanding demand for isobutene in various industries such as chemicals, plastics, and automotive. Isobutene, also known as 2-methylpropene, is a colorless and odorless gas with numerous applications, including the production of methyl tert-butyl ether (MTBE), polyisobutylene (PIB), and butyl rubber. The market’s growth is fueled by factors such as increasing industrialization, rising demand for high-quality polymers, and the growing automotive sector.

Get a Sample: https://www.precedenceresearch.com/sample/3824

Table of Contents

ToggleGrowth Factors

Several factors contribute to the growth of the Isobutene market. One of the primary drivers is the rising demand for isobutene-derived products, particularly in the automotive industry for manufacturing high-performance tires and automotive parts. Additionally, the increasing consumption of MTBE as a fuel additive to enhance octane levels in gasoline is bolstering the demand for isobutene. Furthermore, technological advancements in isobutene production processes, such as catalytic dehydrogenation of isobutane, are improving efficiency and driving market growth.

Recent Developments

- In April 2023, Global Bioenergies (Evry, France) launched its Isonaturane 16, 2nd cosmetic ingredient. It is a natural version of isododecane, a twelve-carbon molecule attained by assembling 3 naturally sourced isobutene.

- In March 2021, BASF SE announced it has successfully collaborated with OMV AG have to start-up of isobutene plant using novel direct-production technology for high-purity isobutene at the Burghausen site.

- In January 2021, Global Bioenergies, French biotech company, announced that they have launched their 1st batch of cosmetic-grade renewable plant-based isododecane.

Opportunities

The Isobutene market presents promising opportunities for expansion and diversification. With the growing emphasis on sustainable and eco-friendly solutions, there is a rising demand for bio-based isobutene derived from renewable sources such as biomass or bioethanol. Moreover, the development of novel applications for isobutene in sectors such as healthcare, adhesives, and lubricants opens up new avenues for market players to explore. Additionally, the increasing investment in research and development for enhancing the properties of isobutene-derived products presents lucrative opportunities for innovation and differentiation.

Challenges

Despite the promising growth prospects, the Isobutene market faces several challenges. Fluctuations in raw material prices, particularly for feedstocks like butane and ethanol, can impact production costs and profit margins for manufacturers. Regulatory challenges related to environmental regulations and safety standards also pose hurdles for market players, necessitating compliance with stringent norms. Furthermore, market saturation and intense competition from alternative products may hinder the market’s growth trajectory.

Read Also: Polysilicon Market Size to Attain USD 37.84 Billion by 2033

Competitive Landscape:

The Isobutene market exhibits a competitive landscape characterized by the presence of several key players striving to strengthen their market positions through strategic initiatives such as mergers and acquisitions, product innovations, and geographic expansions. Leading companies in the market include ExxonMobil Corporation, BASF SE, LyondellBasell Industries Holdings B.V., TPC Group, and Sinopec Group, among others. These players focus on enhancing their production capacities, improving product quality, and expanding their distribution networks to gain a competitive edge in the global Isobutene market. Additionally, collaborations with research institutions and partnerships with end-user industries are adopted to foster innovation and address evolving customer needs.

Isobutene Market Companies

- BASF

- Evonik

- ExxonMobil

- ABI Chemicals

- Global Bioenergies

- Praxair

- Syngip BV

- LanzaTech

- Honeywell International

- LyondellBasell Industries

Segments Covered in the Report

By Product

- Methyl tert-butyl ether (MTBE)

- Ethyl tert-butyl ether (ETBE)

By Application

- Automotive

- Aerospace

- Antioxidants

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/