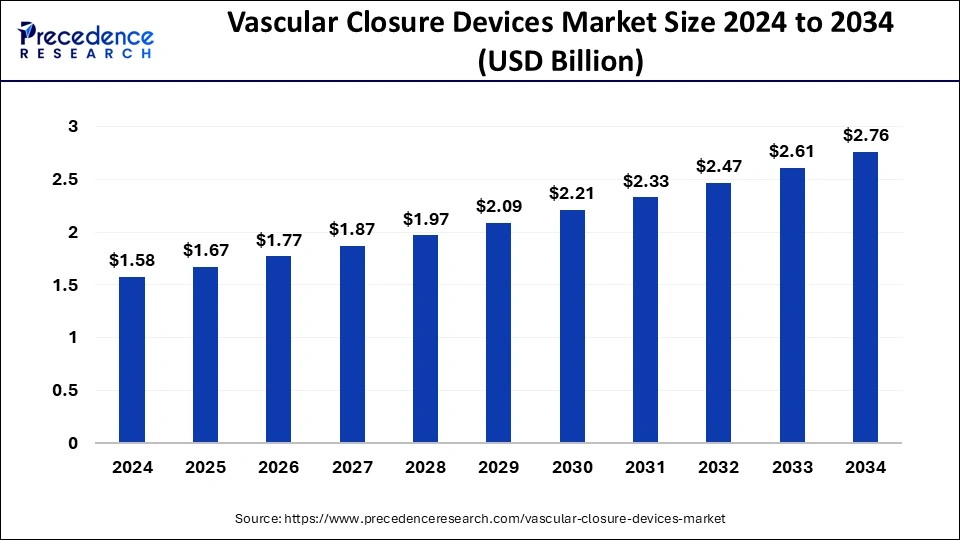

The global vascular closure devices market size accounted for USD 1.75 billion in 2023 and is predicted to grow around USD 3.30 billion by 2033, growing at a CAGR of 6.55% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 43% in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By type, the active vascular closure devices segment held the largest share of the market in 2023.

- By access, the femoral segment is expected to capture a prominent market share during the forecast period while sustaining dominance.

- By end-use, the ambulatory surgical centers segment dominated the market with the largest share of 61% in 2023.

The global vascular closure devices market is witnessing robust growth propelled by the increasing prevalence of cardiovascular diseases and the rising adoption of minimally invasive procedures. Vascular closure devices are medical devices used to achieve hemostasis after the puncture of a blood vessel during diagnostic or interventional procedures. These devices play a crucial role in reducing the time to achieve hemostasis, minimizing complications such as bleeding and vascular complications, and facilitating early ambulation of patients post-procedure.

Get a Sample: https://www.precedenceresearch.com/sample/3945

Growth Factors

Several factors are driving the growth of the vascular closure devices market. Firstly, the growing burden of cardiovascular diseases, including coronary artery disease and peripheral artery disease, is fueling the demand for vascular interventions. Additionally, advancements in vascular closure technologies, such as the development of next-generation devices with improved efficacy and safety profiles, are expanding the market. Moreover, the increasing preference for minimally invasive procedures among patients and healthcare providers is driving the adoption of vascular closure devices, as these devices enable quicker recovery, shorter hospital stays, and reduced procedural complications compared to traditional surgical approaches.

Vascular Closure Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.55% |

| Global Market Size in 2023 | USD 1.75 Billion |

| Global Market Size by 2033 | USD 3.30 Billion |

| U.S. Market Size in 2023 | USD 530 Million |

| U.S. Market Size by 2033 | USD 990 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Access, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vascular Closure Devices Market Dynamics

Drivers:

One of the primary drivers of the vascular closure devices market is the rising prevalence of cardiovascular diseases globally. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death worldwide, accounting for an estimated 17.9 million deaths annually. The growing aging population, sedentary lifestyles, unhealthy dietary habits, and the high prevalence of risk factors such as obesity, diabetes, and hypertension contribute to the increasing incidence of cardiovascular diseases, thereby driving the demand for vascular interventions and closure devices.

Restraints:

Despite the significant growth opportunities, the vascular closure devices market faces certain challenges that may hinder its growth trajectory. One of the key restraints is the high cost associated with vascular closure procedures and devices. The initial capital investment required for setting up catheterization laboratories equipped with advanced imaging and interventional technologies can be substantial, particularly in developing countries with limited healthcare infrastructure and resources. Moreover, the reimbursement landscape for vascular closure procedures varies across different regions, which may affect the adoption of these devices, especially in cost-sensitive markets.

Opportunities:

The vascular closure devices market presents several opportunities for growth and innovation. One such opportunity lies in the development of novel closure devices with enhanced performance characteristics, such as improved hemostatic efficacy, reduced vascular complications, and compatibility with various access sites and vessel sizes. Additionally, expanding indications for vascular closure devices beyond traditional applications in coronary and peripheral interventions to include emerging areas such as structural heart interventions and neurovascular procedures could further broaden the market potential. Furthermore, strategic collaborations and partnerships between medical device companies, research institutions, and healthcare providers can facilitate technology transfer, product development, and market expansion efforts.

Read Also: Tubeless Insulin Pump Market Size to Grow USD 11.93 Bn by 2033

Region Insights:

The vascular closure devices market exhibits regional variations in terms of market dynamics, adoption rates, regulatory frameworks, and competitive landscape. North America dominates the global market, driven by the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and early adoption of advanced medical technologies. The presence of key market players, supportive reimbursement policies, and increasing investments in research and development further contribute to the region’s market leadership. Europe is another significant market for vascular closure devices, characterized by a growing geriatric population, increasing healthcare expenditure, and favorable government initiatives to promote minimally invasive procedures. The Asia Pacific region is poised to witness rapid growth, fueled by improving healthcare infrastructure, rising healthcare spending, and expanding access to medical services in emerging economies such as China and India. However, market growth in this region may be tempered by challenges such as regulatory complexities, healthcare system fragmentation, and economic constraints in some countries.

Recent Developments

- In February 2023, the LockeT product was introduced to the market by Catheter Precision, Inc., a wholly-owned subsidiary of Ra Medical Systems, Inc. The first shipments of the product to its distributors will start right away. When a catheter is inserted through the skin into a blood artery and subsequently removed after an operation, LockeT can be utilized in combination with the closure of the percutaneous wound site. LockeT is used to keep the sutures in place after the doctor has sutured the vessel and the location. The lockeT can be utilized in place of or in addition to closing devices. These devices are Angioseal, marketed by Terumo, Vascade, marketed by Cardiva, a division of Haemonetics, and Perclose, marketed by Abbott.

Vascular Closure Devices Market Companies

- Medtronic

- Abbott Vascular

- Biotronik GMBH & CO. KG

- COOK

- Merit Medical Systems, Inc.

- C. R. Bard, Inc.

- Boston Scientific Corporation

- ESSENTIAL MEDICAL, Inc.

- Cardinal Health

- W L. Gore & Associates

Segments Covered in the Report

By Type

- Active Vascular Closure Device

- Passive Vascular Closure Device

By Access

- Radial

- Femoral

By End-use

- Ambulatory Surgical Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/