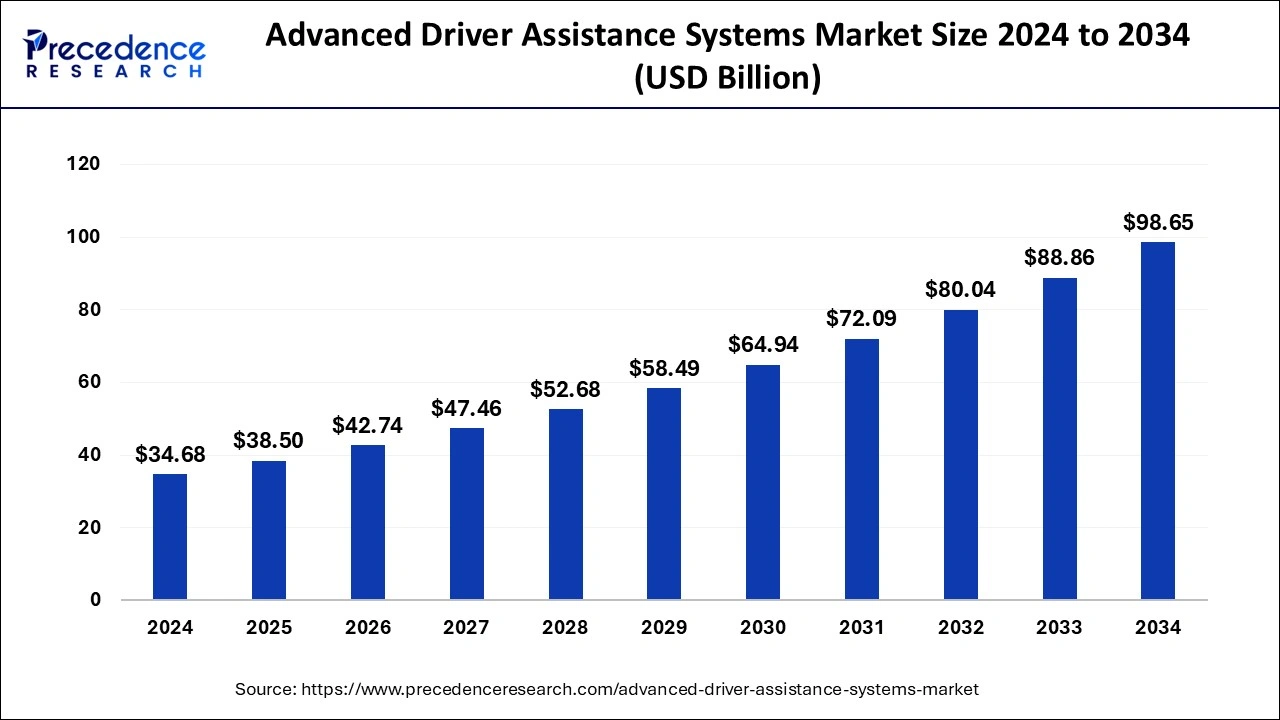

The Advanced Driver Assistance Systems market is projected to grow from USD 34.68 billion to USD 98.65 billion by 2034, at a CAGR of 11.02%.

Advanced Driver Assistance Systems Market Key Takeaways

- n 2024, the LiDAR sensors segment held a significant share of the market by component type.

- The software segment is experiencing notable growth with a strong CAGR from 2025 to 2034.

- The commercial car segment is expanding at a CAGR of 17.3% by vehicle type.

- The tire pressure monitoring system segment accounted for over 20.7% of the market share in 2024 by solution type.

- The autonomous emergency braking segment is set to grow at a CAGR of 21.5% during the forecast period.

Advanced Driver Assistance Systems (ADAS) Market Overview

Advanced Driver Assistance Systems (ADAS) are revolutionizing the automotive industry by enhancing vehicle safety, improving driving efficiency, and reducing road accidents. These systems use sensors, cameras, radar, and artificial intelligence to assist drivers in various functions such as lane departure warnings, adaptive cruise control, blind-spot detection, and automatic emergency braking. The increasing focus on road safety, government regulations promoting vehicle safety standards, and the rise of autonomous driving technology are driving the rapid adoption of ADAS. As automotive manufacturers integrate these technologies into vehicles, the ADAS market is expected to experience significant growth in the coming years.

Market Drivers

The ADAS market is primarily driven by rising concerns over road safety and the growing number of traffic accidents worldwide. Governments and regulatory bodies are enforcing stricter safety mandates, requiring vehicles to be equipped with advanced safety features. Consumer demand for enhanced driving experiences and comfort is also fueling market expansion. Additionally, advancements in sensor technology, artificial intelligence, and vehicle-to-everything (V2X) communication are making ADAS more reliable and efficient. The increasing adoption of electric and connected vehicles further supports the integration of ADAS features in modern automobiles.

Opportunities in the Market

There are several opportunities in the ADAS market, particularly in emerging technologies and expanding automotive markets. The development of Level 3 and Level 4 autonomous driving capabilities presents a significant opportunity for ADAS providers. As electric vehicles gain popularity, integrating ADAS into these cars enhances their appeal and safety. The growth of ride-sharing and autonomous vehicle fleets also offers potential for advanced driver assistance features. Furthermore, developing cost-effective ADAS solutions for budget-friendly vehicles can open up new market segments, especially in developing economies where affordability is a key factor.

Challenges Facing the Market

Despite its rapid expansion, the ADAS market faces multiple challenges. The high cost of ADAS components, including LiDAR, radar, and advanced cameras, increases the overall vehicle price, making it less accessible to cost-conscious consumers. Additionally, integrating ADAS into vehicles requires significant software and hardware compatibility, posing engineering challenges for automakers. Concerns over cybersecurity and data privacy also pose risks, as connected vehicles become more vulnerable to hacking and data breaches. Moreover, the varying regulatory standards across different regions make it difficult for manufacturers to standardize ADAS solutions globally.

Regional Insights

The ADAS market is growing at different rates across regions. North America and Europe lead in adoption due to stringent safety regulations, high consumer awareness, and the presence of major automotive manufacturers investing in advanced technology. Asia-Pacific is emerging as the fastest-growing market, driven by increasing vehicle production, rising disposable incomes, and government initiatives promoting vehicle safety. Countries like China, Japan, and South Korea are at the forefront of ADAS development, with strong investments in autonomous driving technologies. Meanwhile, Latin America, the Middle East, and Africa are gradually adopting ADAS, with opportunities for market expansion as infrastructure and automotive industries develop further.

Recent Developments

Recent innovations in ADAS technology have focused on improving sensor accuracy, AI-driven automation, and seamless vehicle integration. Several automakers are launching new models with enhanced ADAS features, such as advanced lane-keeping assistance and real-time traffic monitoring. There is also growing research on integrating ADAS with smart city infrastructure to enhance urban mobility and reduce congestion. Additionally, collaborations between technology firms and automakers are driving the development of fully autonomous driving solutions, setting the stage for the next generation of intelligent vehicles.

Advanced Driver Assistance Systems (ADAS)Companies

- Denso

- Aptiv

- Robert Bosch GmbH

- Continental AG

- Magna International

- Veoneer

- Hyundai Mobis

- ZF Friedrichshafen

Segments Covered in the Report

By System Type

- Intelligent Park Assist (IPA)

- Lane Departure Warning (LDW)

- Road Sign Recognition (RSR)

- Tire Pressure Monitoring System (TPMS)

- Night Vision System (NVS)

- Automatic Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Adaptive Front Light (AFL)

- Blind Spot Detection (BSD)

- Cross Traffic Alert (CTA)

- Driver Monitoring System (DMS)

- Forward Collision Warning (FCW)

- Others

By Sensor Type

- Image Sensors

- Ultrasonic Sensors

- LiDAR

- Radar Sensors

- Infrared (IR) Sensors

- Laser Sensors

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

By Level of Autonomy

- L1

- L2

- L3

- L4

- L5

By Electric Vehicle

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/