Aerospace 3D Printing Materials Market Key Takeaways

-

North America led the global market with a 53% share in 2024.

-

Asia Pacific is expected to grow at the highest CAGR through 2034.

-

Plastic was the top material type in 2024; metal is set for fastest growth.

-

Fused Deposition Modeling (FDM) held a major share in 2024, while DMLS will see the fastest growth.

-

Aircraft platform dominated in 2024; spacecraft segment is gaining momentum.

-

Prototyping led applications in 2024; functional parts will grow rapidly.

-

Structural components were the top end products in 2024; engine components expected to expand swiftly.

Aerospace 3D Printing Materials Market Overview

Aerospace 3D printing materials market has seen rapid evolution in recent years, driven by the increasing adoption of additive manufacturing technologies across the aerospace and defense sectors. This market revolves around the supply and usage of materials—metals, plastics, ceramics, and composites—that are specifically formulated for 3D printing components such as aircraft parts, structural assemblies, and engine components.

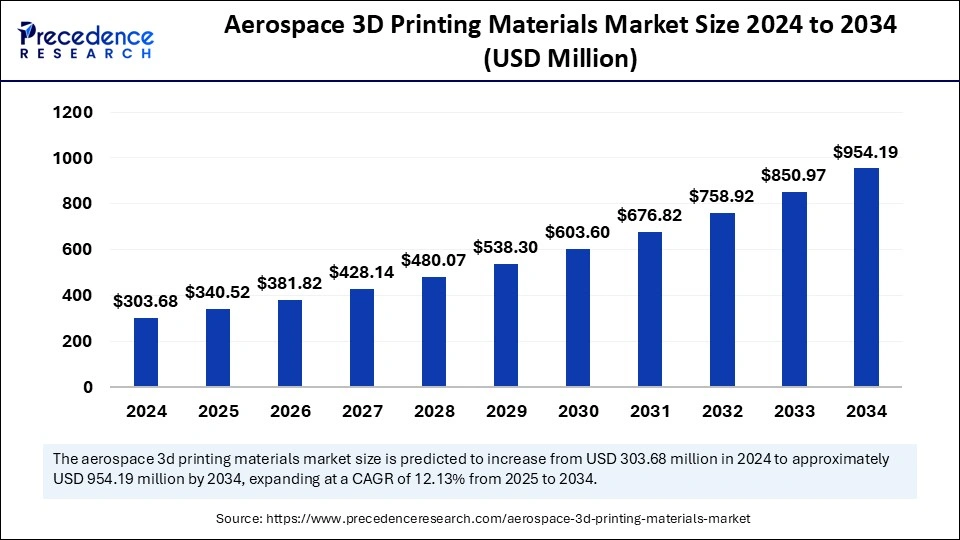

Aerospace manufacturers push for lighter, stronger, and more complex designs to enhance performance and reduce fuel consumption, 3D printing materials have become critical. In 2024, the market reached a significant valuation, and projections estimate strong double-digit CAGR growth through 2034.

Drivers

One of the primary drivers of this market is the demand for lightweight yet durable components in aircraft and spacecraft manufacturing. The aviation industry is constantly under pressure to improve fuel efficiency, which is directly tied to aircraft weight. Additive manufacturing enables the creation of intricate geometries that are impossible or cost-prohibitive with traditional techniques, reducing weight without compromising structural integrity.

Another major driver is the surge in demand for customization and on-demand production, especially for low-volume or critical components in defense applications. Additionally, as space exploration initiatives and satellite launches increase globally, the need for cost-effective, lightweight structures is further amplifying demand for aerospace-grade 3D printing materials.

Opportunities

The market offers significant opportunities in material innovation. The development of new metal alloys and high-performance polymers that can withstand extreme temperatures and stresses opens new frontiers for additive manufacturing in aerospace. Companies that can deliver materials with enhanced thermal resistance, strength-to-weight ratio, and fatigue resistance are likely to gain competitive advantages.

Another opportunity lies in the integration of smart materials or composites with embedded sensors, which could revolutionize the functionality and maintenance of aerospace components. Furthermore, as more airlines and defense agencies invest in in-house 3D printing capabilities, the demand for consumable materials will grow substantially.

Challenges

Despite its growth potential, the aerospace 3D printing materials market faces several hurdles. Regulatory compliance and certification remain significant challenges. Every material used in aerospace applications must meet stringent safety and performance standards, which often lengthens the development and approval cycle. High material costs are another challenge, particularly for metal powders like titanium and Inconel, which require sophisticated manufacturing processes.

Additionally, the lack of standardization in material properties, print quality, and testing methods continues to slow down broader adoption across various aerospace applications.

Regional Insights

North America currently dominates the aerospace 3D printing materials market, accounting for over half of global market share in 2024. The presence of major aerospace companies, such as Boeing, Lockheed Martin, and SpaceX, along with cutting-edge R&D institutions, fuels the demand for advanced materials.

Europe follows closely, driven by robust investments in space missions and strong aerospace hubs in Germany, France, and the UK. Asia Pacific, while still developing, is poised for the fastest growth due to increasing domestic aircraft production, government-led aerospace programs, and expanding defense budgets in China, India, and Japan.

Recent Developments

The market has witnessed significant developments recently. Companies like GE Additive and Stratasys have introduced new material lines specifically tailored for aerospace applications, including advanced metal powders and flame-retardant polymers.

Strategic collaborations between aerospace giants and 3D printing firms have also emerged, aimed at co-developing materials and accelerating adoption. Additionally, many governments are funding initiatives to support additive manufacturing research, further propelling material innovations.

Aerospace 3D Printing Materials Market Top Companies

- Stratasys Ltd

- Norsk

- Materialise

- Höganäs AB

- GE

- ExOne

- EOS

- 3D Systems, Inc

Segments Covered in the Report

By Material Type

- Metal

- Plastic

- Others

By Printing Technology

- Continuous Liquid Interface Production (CLIP)

- Direct Metal Laser Sintering (DMLS)

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

By Platform

- Aircraft

- Spacecraft

- UAVs

By Application

- Functional Parts

- Prototyping

- Tooling

By End Product

- Structural Components

- Engine Components

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!