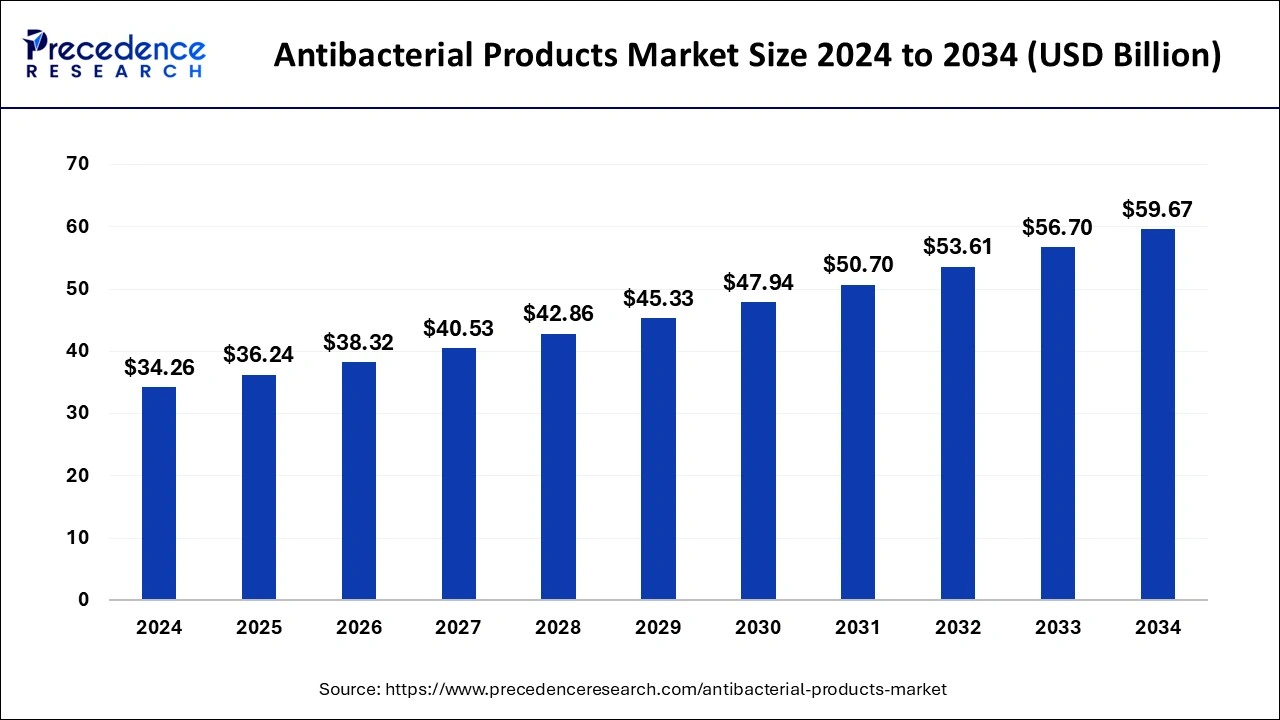

The global antibacterial products market size accounted for USD 32.40 billion in 2023 and is predicted to rake around USD 56.70 billion by 2033, growing at a CAGR of 5.75% from 2024 to 2033.

Key Points

- Asia Pacific dominated the global antibacterial products market in 2023 with a revenue share of 48%.

- By Product, the hand soap segment dominated the global antibacterial products market with the largest share of around 38% in 2023.

- By Product, the hand sanitizers segment held the second position while showing a notable rate of growth during the forecast period.

- By Distribution channel, the hypermarkets and supermarkets segment dominated the market with a revenue share of 47.5% in 2023.

- By distribution channel, the online platforms segment has held a 24% revenue share in 2023.

The antibacterial products market encompasses a wide range of goods designed to combat bacteria and prevent the spread of infections. These products play a crucial role in maintaining public health by reducing the transmission of harmful pathogens in various settings, including households, healthcare facilities, and commercial establishments. With increasing awareness about hygiene and infection control, the demand for antibacterial products has witnessed significant growth in recent years.

Get a Sample: https://www.precedenceresearch.com/sample/4064

Growth Factors:

Several factors contribute to the growth of the antibacterial products market. One of the primary drivers is the rising prevalence of infectious diseases and healthcare-associated infections (HAIs). As the global population grows and ages, the incidence of infections increases, driving demand for antibacterial products for both prevention and treatment.

Moreover, growing awareness about the importance of hygiene and infection control, particularly in light of recent pandemics such as COVID-19, has heightened consumer demand for antibacterial products. Hand sanitizers, disinfectant wipes, and antibacterial soaps have become essential items in households, workplaces, and public spaces, driving market growth.

Additionally, advancements in biotechnology and antimicrobial research have led to the development of innovative antibacterial formulations with enhanced efficacy and safety profiles. These advancements have expanded the range of available antibacterial products, offering consumers more options for infection prevention and control.

Region Insights:

The antibacterial products market exhibits variations across different regions, influenced by factors such as healthcare infrastructure, regulatory frameworks, consumer preferences, and cultural norms.

In North America and Europe, stringent regulations governing hygiene and infection control in healthcare settings drive demand for antibacterial products. Moreover, high consumer awareness about health and hygiene practices, coupled with robust healthcare systems, sustains market growth in these regions.

In Asia-Pacific and Latin America, rapid urbanization, increasing disposable incomes, and growing awareness about hygiene contribute to the expansion of the antibacterial products market. However, differences in regulatory environments, cultural practices, and economic development levels across countries in these regions can impact market dynamics.

Antibacterial Products Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.75% |

| Global Market Size in 2023 | USD 32.40 Billion |

| Global Market Size in 2024 | USD 34.26 Billion |

| Global Market Size by 2033 | USD 56.70 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Antibacterial Products Market Dynamics

Drivers:

Several drivers propel the growth of the antibacterial products market. Consumer awareness about the importance of hand hygiene and infection prevention has surged, especially in the wake of global health crises such as the COVID-19 pandemic. This heightened awareness has led to increased adoption of antibacterial products in households, healthcare facilities, and public spaces.

Moreover, the healthcare sector plays a significant role in driving demand for antibacterial products, particularly in the context of infection control and prevention. Healthcare-associated infections pose a significant burden on healthcare systems worldwide, leading to increased investments in infection control measures and antimicrobial products.

Furthermore, technological advancements in antibacterial formulations, such as the development of long-lasting surface disinfectants and alcohol-free hand sanitizers, drive innovation and differentiation in the market. Manufacturers are investing in research and development to create products that are both effective against bacteria and safe for long-term use.

Opportunities:

The antibacterial products market presents various opportunities for growth and innovation. One such opportunity lies in the development of environmentally friendly antibacterial formulations that minimize the environmental impact of chemical disinfectants. Bio-based antimicrobial agents, eco-friendly packaging materials, and sustainable production practices can appeal to environmentally conscious consumers and drive market expansion.

Furthermore, expanding market penetration in emerging economies presents significant growth opportunities for antibacterial product manufacturers. Rising healthcare expenditure, improving healthcare infrastructure, and growing awareness about infection control measures create a conducive environment for market growth in these regions.

Moreover, diversification of product offerings beyond traditional antibacterial soaps and disinfectants presents avenues for market expansion. Antimicrobial textiles, coatings, and medical devices represent emerging segments within the antibacterial products market, offering novel solutions for infection prevention and control.

Challenges:

Despite the growth prospects, the antibacterial products market faces several challenges. One of the primary challenges is the emergence of antimicrobial resistance (AMR), which threatens the efficacy of existing antibacterial agents. Overuse and misuse of antibiotics and antibacterial products contribute to the development of resistant strains of bacteria, posing a significant public health threat.

Moreover, regulatory scrutiny and increasing consumer awareness about the potential risks associated with certain antibacterial ingredients, such as triclosan and triclocarban, pose challenges for manufacturers. Regulatory agencies are imposing restrictions on the use of these ingredients in consumer products, leading to reformulations and product recalls in some cases.

Furthermore, market saturation and intense competition among manufacturers pose challenges for new entrants and smaller players in the antibacterial products market. Established brands with strong brand recognition and distribution networks dominate the market, making it challenging for smaller companies to gain market share.

Read Also: Protein A Resins Market Size to Reach USD 2.60 Billion By 2033

Recent Developments

- In 2022, a Russia-based pharmaceutical manufacturing group acquired a medicine brand to increase the production of medicines related to antibacterial products.

- In 2021, NSG Group launched antibacterial glass to maintain hygiene when people touch the glass. The innovation covers a large portion of users and it provides glass cover for smartphones and other electronic devices.

- In 2021, Medimix launched their antibacterial hand sanitizer gels for convenient use. The product includes glycerin, aloe vera gel and other basil products.

- In 2021, ITC an India-based manufacturing company launched a Savlon moisturizing sanitizer. The product contains five ingredients which help to kill germs without the use of any soap or water.

Antibacterial Products Market Companies

- Reckitt Benckiser Group Plc

- Unilever

- Johnson & Johnson

- Farouk Systems

- Guardpack

- Nice-pak Products Inc

- GOJO Industries, Inc

- The Himalaya Drug Company

- Rockline Industries

- Sebapharma GmbG& Co. KG

- Bielenda

- fco Lp

- Colgate- Palmolive Company

- Henkel Corporation

Segments Covered in the Report

By Product

- Body Moisturizer

- Hand Cream and Lotion

- Facial Cleansers

- Hand Soap

- Hand Sanitizer

- Body Wash

By Distribution Channel

- Hypermarkets and supermarkets

- Pharmacy and Drug Stores

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/