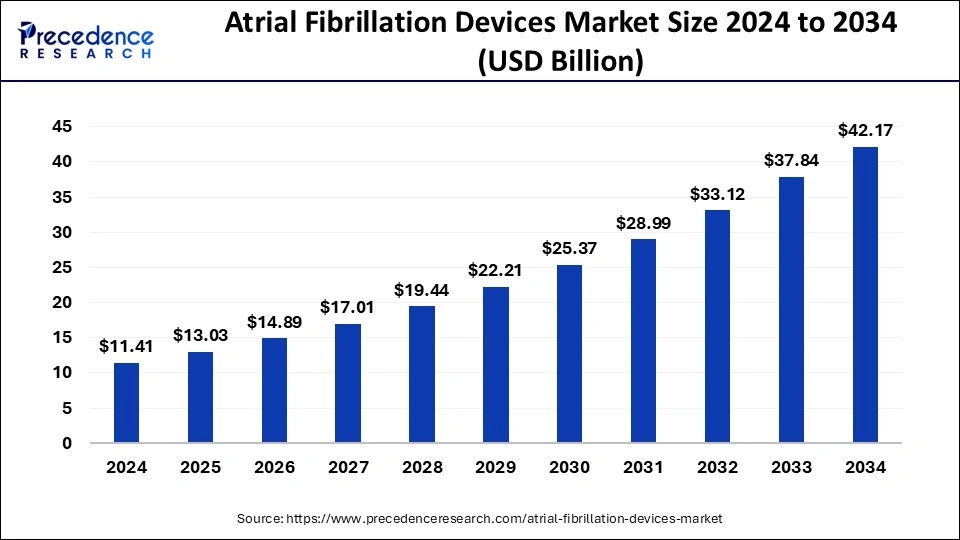

The global atrial fibrillation devices market size accounted for USD 9.99 billion in 2023 and is estimated to rake around USD 37.84 billion by 2033, growing at a CAGR of 14.25% from 2024 to 2033.

Key Points

- North America dominated the market share of 40% in 2023.

- By product, the EP ablation catheters segment dominated the atrial fibrillation devices market in 2023.

- By end-use, the hospitals segment dominated the market in 2023.

The atrial fibrillation (AF) devices market is witnessing significant growth due to the rising prevalence of atrial fibrillation globally. Atrial fibrillation is the most common type of irregular heartbeat, characterized by rapid and irregular beating of the heart’s upper chambers. It can lead to various complications, including stroke, heart failure, and other heart-related complications. As a result, there is a growing demand for devices aimed at diagnosing, monitoring, and treating atrial fibrillation. The AF devices market encompasses a range of products, including implantable devices, monitoring devices, and surgical instruments, designed to manage this condition effectively.

Get a Sample: https://www.precedenceresearch.com/sample/3950

Growth Factors:

Several factors contribute to the growth of the atrial fibrillation devices market. One of the primary drivers is the increasing prevalence of atrial fibrillation, driven by aging populations, sedentary lifestyles, and the rising incidence of comorbidities such as hypertension, diabetes, and obesity. Additionally, advancements in technology have led to the development of innovative devices with improved efficacy and safety profiles. The growing awareness among patients and healthcare professionals about the importance of early detection and management of atrial fibrillation is also fueling market growth. Moreover, favorable reimbursement policies for AF devices in many regions are further boosting market expansion.

Region Insights:

The atrial fibrillation devices market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market owing to the high prevalence of atrial fibrillation in the region, coupled with well-established healthcare infrastructure and favorable reimbursement policies. Europe follows closely behind, driven by increasing healthcare expenditure and a growing geriatric population. The Asia Pacific region is expected to witness significant growth attributed to rising awareness, improving healthcare infrastructure, and the increasing adoption of advanced medical technologies. Latin America and the Middle East and Africa regions are also anticipated to experience growth due to improving access to healthcare services and increasing investments in healthcare infrastructure.

Atrial Fibrillation Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.25% |

| Global Market Size in 2023 | USD 9.99 Billion |

| Global Market Size by 2033 | USD 37.84 Billion |

| U.S. Market Size in 2023 | USD 3 Billion |

| U.S. Market Size by 2033 | USD 11.35 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atrial Fibrillation Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the atrial fibrillation devices market. Technological advancements, such as the development of minimally invasive surgical techniques and the introduction of advanced catheter ablation systems, are expanding treatment options for patients with atrial fibrillation. Moreover, the growing prevalence of risk factors such as obesity, hypertension, and diabetes is contributing to the rising incidence of atrial fibrillation, thereby driving the demand for AF devices. Additionally, the increasing adoption of wearable devices for continuous monitoring of heart rhythm and the integration of artificial intelligence and machine learning algorithms for data analysis are enhancing diagnostic accuracy and improving patient outcomes.

Opportunities:

The atrial fibrillation devices market presents several opportunities for manufacturers and healthcare providers. Expansion into emerging markets with high unmet medical needs presents a significant growth opportunity for companies operating in this space. Moreover, the development of innovative technologies, such as implantable cardiac monitors with remote monitoring capabilities and catheter ablation systems with real-time navigation and visualization features, can further enhance the efficacy and safety of AF treatments. Furthermore, strategic collaborations and partnerships between industry players and healthcare organizations can facilitate knowledge sharing and technology transfer, leading to the development of advanced AF devices and therapies.

Challenges:

Despite the promising growth prospects, the atrial fibrillation devices market faces several challenges. One of the primary challenges is the high cost associated with AF devices and procedures, which may limit their adoption, particularly in developing regions with limited healthcare budgets. Additionally, the complexity of atrial fibrillation diagnosis and treatment, coupled with the lack of skilled healthcare professionals trained in AF management, poses a significant challenge. Moreover, regulatory hurdles and reimbursement constraints in some regions may hinder market growth. Furthermore, the risk of complications associated with AF devices, such as device-related infections and thromboembolic events, underscores the importance of ongoing research and development efforts to improve device safety and efficacy.

Read Also: Cardiac Arrhythmia Monitoring Devices Market Size, Report 2033

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/