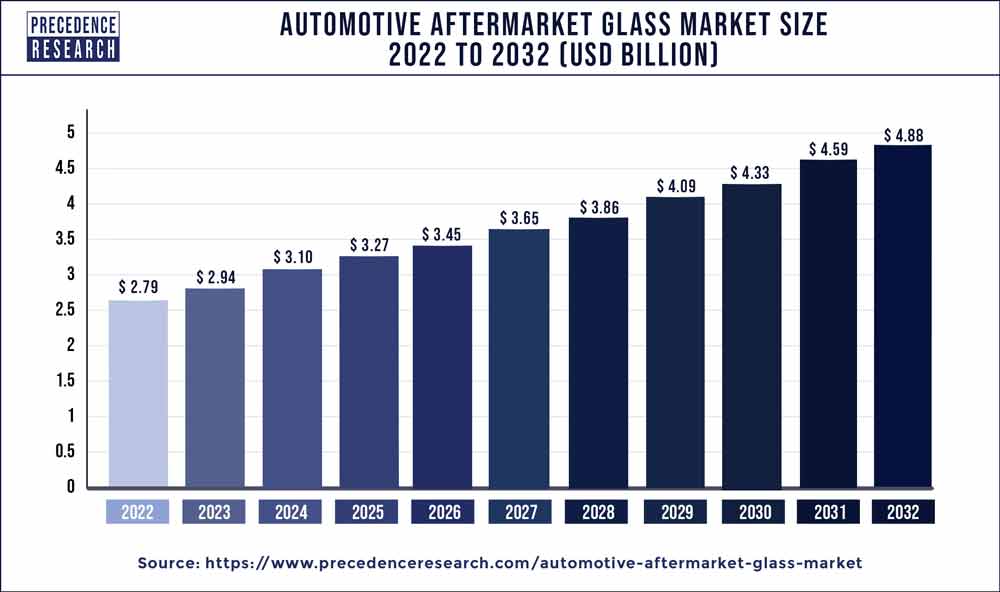

The global automotive aftermarket glass market size was valued at USD 2.94 billion in 2023 and is projected to be worth around USD 4.88 billion by 2032, growing at a CAGR of 5.80% during the forecast period from 2023 to 2032.

Key Takeaways

- Asia-Pacific contributed more than 54% of market share in 2022.

- North America is estimated to expand at the fastest CAGR between 2023 and 2032.

- By product, the tempered glass segment has held the largest market share of 51% in 2022.

- By product, the laminated glass segment is anticipated to grow at a remarkable CAGR of 6.2% between 2023 and 2032.

- By vehicle type, the passenger cars segment generated over 66% of market share in 2022.

- By vehicle type, the light commercial vehicles (LCV) segment is expected to expand at the fastest CAGR over the projected period.

- By application, the sidelite segment generated over 33% of the market share in 2022.

- By application, the backlite segment is expected to expand at the fastest CAGR over the projected period.

The automotive aftermarket glass market refers to the secondary market where replacement and repair glass products are available for vehicles. As vehicles age or encounter damage, there is a growing demand for aftermarket glass solutions. This market encompasses a wide range of products, including windshields, side windows, and rear windows, providing consumers with options for restoring their vehicles to optimal condition.

Get a Sample: https://www.precedenceresearch.com/sample/3652

Growth Factors:

The automotive aftermarket glass market is experiencing significant growth due to several key factors. A rise in the global vehicle fleet, increased awareness of vehicle safety, and a surge in road accidents are driving the demand for replacement glass. Additionally, advancements in glass technologies, such as enhanced durability and safety features, contribute to the market’s expansion as consumers seek upgraded and more resilient glass options.

Region Snapshot

Asia-Pacific captured more than 54% of market share in 2022. The automotive aftermarket glass market is distributed across various regions, with each displaying distinct characteristics. North America and Europe are prominent markets, driven by a large number of vehicles on the road and stringent safety regulations. Emerging economies in Asia-Pacific are witnessing substantial growth due to an expanding middle class, rising disposable income, and a surge in automotive sales.

Automotive Aftermarket Glass Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.80% |

| Market Size in 2023 | USD 2.94 Billion |

| Market Size by 2032 | USD 4.88 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product, By Vehicle Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Paper Diagnostics Market Size To Reach USD 26.55 Billion By 2032

Automotive Aftermarket Glass Market Dynamics

Drivers:

Key drivers of the automotive aftermarket glass market include the increasing average age of vehicles on the road, rising awareness about the importance of regular maintenance, and a growing consumer preference for high-quality, technologically advanced glass products. Stringent safety standards and regulations mandating the use of certified glass materials also propel market growth.

Opportunities:

Opportunities in the automotive aftermarket glass market are abundant, especially with the growing trend toward electric and autonomous vehicles. The need for specialized glass solutions to meet the unique requirements of these advanced vehicles presents a lucrative opportunity for market players. Additionally, expanding distribution channels, such as online platforms, offer a new avenue for growth.

Challenges:

Despite the positive trajectory, the automotive aftermarket glass market faces challenges. Price volatility in raw materials, intense competition among market players, and the complex installation process for certain advanced glass technologies pose hurdles. Moreover, fluctuations in automotive production levels and economic downturns can impact consumer spending on aftermarket products.

Recent Developments

- In May 2022, NSG Group announced plans to integrate its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd., a leading Chinese automotive glass manufacturer. This strategic move is aimed at bolstering NSG Group’s capacity to meet the growing demands of Chinese automobile manufacturers, reinforcing its position in the market.

- In March 2022, LKQ Corporation finalized an agreement with One Equity Partners to sell PGW Auto Glass, a prominent distributor of aftermarket glass in North America. With an extensive network of over 100 distribution branches and a customer base exceeding 27,000 in the U.S. and Canada, PGW Auto Glass utilizes a fleet of 500 vehicles to efficiently deliver a range of automotive products, including windshields and tempered glass, to over 9,000 installation customers.

- In March 2019, North American automotive-glass manufacturer Vitro committed a significant investment of USD 60 million to advance cutting-edge technologies. This strategic investment, focused on the North American market, aimed to reinforce Vitro’s position as a premier supplier to original equipment manufacturers (OEMs) and aftermarket customers, showcasing the company’s commitment to innovation and market leadership.

Competitive Landscape:

The competitive landscape of the automotive aftermarket glass market is characterized by the presence of several key players, including both global and regional manufacturers. Companies focus on product innovation, strategic collaborations, and mergers and acquisitions to gain a competitive edge. Quality assurance, adherence to safety standards, and efficient distribution networks are crucial factors for success in this dynamic market. Prominent players constantly strive to expand their product portfolios and enhance their market share through a customer-centric approach and technological advancements.

Automotive Aftermarket Glass Market Companies

- Saint-Gobain

- AGC Inc.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Fuyao Glass Industry Group Co., Ltd.

- Magna International Inc.

- Xinyi Glass Holdings Limited

- Guardian Industries

- Corning Incorporated

- Vitro, S.A.B. de C.V.

- PPG Industries, Inc.

- Shenzhen Benson Automobile Glass Co., Ltd.

- Asahi Glass Co., Ltd.

- Central Glass Co., Ltd.

- Webasto SE

- Carlex Glass America LLC

Segments Covered in the Report

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- Windscreen

- Backlite

- Sidelite

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Aftermarket Glass Market

5.1. COVID-19 Landscape: Automotive Aftermarket Glass Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Aftermarket Glass Market, By Product

8.1. Automotive Aftermarket Glass Market Revenue and Volume, by Product, 2023-2032

8.1.1 Tempered Glass

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Laminated Glass

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Automotive Aftermarket Glass Market, By Vehicle Type

9.1. Automotive Aftermarket Glass Market Revenue and Volume, by Vehicle Type, 2023-2032

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Light Commercial Vehicles

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Heavy Commercial Vehicles

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Automotive Aftermarket Glass Market, By Application

10.1. Automotive Aftermarket Glass Market Revenue and Volume, by Application, 2023-2032

10.1.1. Windscreen

10.1.1.1. Market Revenue and Volume Forecast (2020-2032)

10.1.2. Backlite

10.1.2.1. Market Revenue and Volume Forecast (2020-2032)

10.1.3. Sidelite

10.1.3.1. Market Revenue and Volume Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 11. Global Automotive Aftermarket Glass Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.1.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.1.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.1.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.2.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.2.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.2.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.2.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.2.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.3.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.3.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.3.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.3.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.3.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.4.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.4.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.4.6.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.4.7.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.5.4.3. Market Revenue and Volume Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2020-2032)

11.5.5.3. Market Revenue and Volume Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Saint-Gobain

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. AGC Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Nippon Sheet Glass Co., Ltd. (NSG Group)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Fuyao Glass Industry Group Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Magna International Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Xinyi Glass Holdings Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Guardian Industries

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Corning Incorporated

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Vitro, S.A.B. de C.V.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. PPG Industries, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/