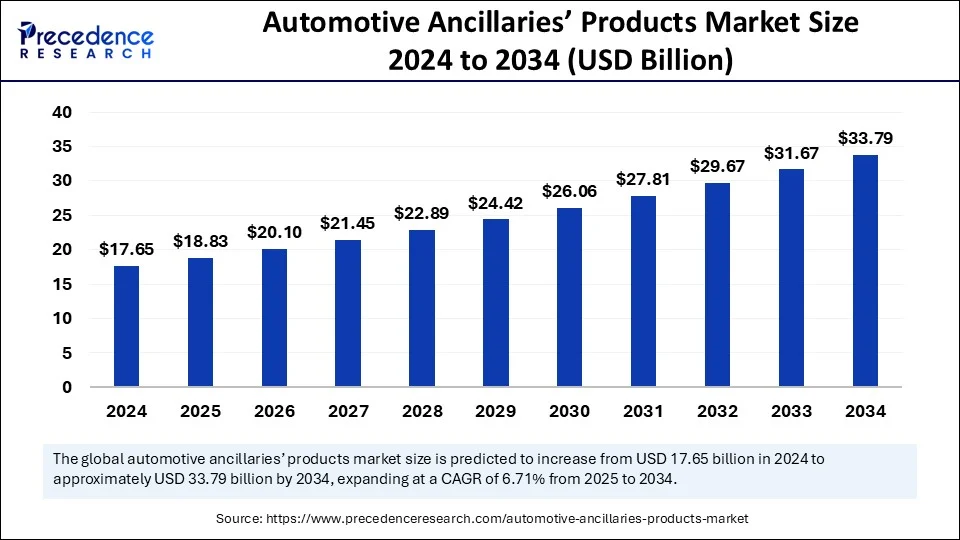

Automotive ancillaries’ products market to witness strong growth with a 6.71% CAGR, reaching USD 33.79 Bn by 2034 from USD 17.65 Bn in 2024. Learn more.

Automotive Ancillaries’ Products Market Key Takeaways

- Asia Pacific dominated the automotive ancillaries’ products market with the largest market share of 39% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecasted years.

- By component, the engine transmission and suspension components segment captured the biggest market share in 2024.

- By component, the electrical parts segment is expected to grow at the fastest rate during the forecast period.

- By application, the passenger vehicle segment held the major market share of 73% in 2024.

- By application, the commercial vehicle segment is anticipated to show considerable growth in the forecast period.

- By distribution channel, the aftermarket segment accounted for the kargest market share of 75% in 2024.

- By distribution channel, the OEM segment is anticipated to show considerable growth over the forecast period.

Market Overview

The automotive ancillaries’ products market is undergoing a significant transformation driven by the global shift toward electric and hybrid vehicles. The market now includes an expanded range of components, including thermal management systems, power electronics, battery cooling modules, lightweight materials, and energy-efficient systems. The convergence of electrification with intelligent vehicle systems is reshaping demand patterns and prompting ancillary manufacturers to reinvent their offerings to align with future mobility needs. The evolving regulatory environment and growing consumer awareness around sustainability further contribute to the dynamic nature of this market.

Drivers

Electrification stands as the primary driver of this market shift. Governments across the world are offering incentives and enforcing regulations aimed at reducing carbon emissions, which in turn encourage the adoption of electric and hybrid vehicles. This trend significantly alters the ancillary product demand, favoring components like electric drivetrains, regenerative braking systems, and advanced battery packs. Moreover, technological advancements in lightweight materials and composite structures are enhancing energy efficiency, further fueling market demand. The integration of digital technologies such as AI and IoT into vehicle systems also necessitates a new generation of electronic ancillaries.

Opportunities

The automotive ancillaries’ products market finds substantial opportunities in the innovation and development of electric mobility solutions. The surge in EV adoption requires a complete overhaul of traditional component design and functionality, offering ancillary manufacturers a chance to lead in innovation. Partnerships between tech companies and component suppliers are fostering the development of integrated, smart components that offer data-driven diagnostics and predictive maintenance. Additionally, the rising popularity of shared mobility services and autonomous vehicles opens the door to components focused on enhanced safety, comfort, and connectivity, driving ancillary market expansion.

Challenges

As the industry pivots toward electrification, ancillary suppliers face the challenge of adapting their legacy product lines to meet new demands. The capital-intensive nature of developing and manufacturing high-tech components may deter smaller firms from keeping pace with industry giants. There is also the issue of standardization in EV components, which remains a barrier to widespread scalability. Supply chain constraints, particularly related to rare earth materials and semiconductor chips, continue to impact production capabilities. Moreover, the fast-evolving regulatory landscape requires constant innovation and compliance efforts, which can strain resources.

Regional Insights

Europe has emerged as a frontrunner in the electric vehicle ecosystem, supported by aggressive emissions regulations and ambitious electrification targets. Germany, France, and the UK are leading contributors, with strong OEM and supplier networks. The Asia-Pacific region, particularly China, is a major driver of global EV production and consumption, with significant investment in battery technology and ancillary infrastructure. North America is steadily catching up, with a focus on EV production, especially in the U.S. and Canada. Other regions such as Latin America and the Middle East are at the early stages of EV adoption but show potential due to increasing urbanization and supportive policies.

Recent Developments

Recent innovations in the automotive ancillaries’ products market are centered around EV-specific components such as battery management systems, electric motors, and modular electronic control units. Several leading suppliers have announced large-scale investments in R&D and EV-specific production facilities. Mergers and acquisitions are becoming increasingly common, with companies aiming to consolidate their market presence and expand technological capabilities. There is also a marked shift toward sustainable and circular manufacturing practices, with an emphasis on recyclable materials and reduced energy consumption during production.

Automotive Ancillaries’ Products Market Companies

- Magna International Inc

- Robert Bosch GmbH

- Uno Minda

- Lear Corporation

- DENSO CORPORATION

- ZF Friedrichshafen AG

- AISIN CORPORATION

- Continental AG

- Duncan Engineering Ltd

- Nippon

Segments Covered in the Report

By Component

- Engine Transmission and Suspension Components

- Electrical Parts

- Sheet Metal Parts and Body and Chassis

- Cleaning, Maintenance, and Repair of Products

- Others

By Application

- Commercial Vehicle

- Passenger Vehicle

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/