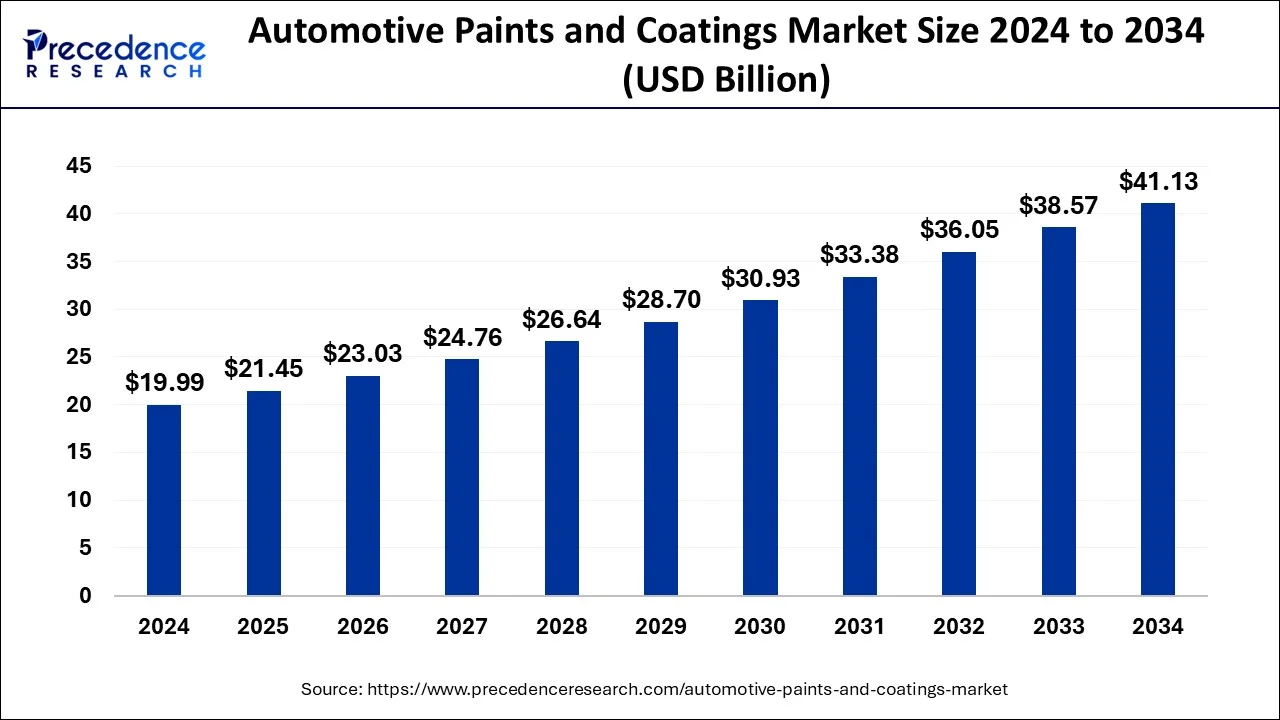

Automotive paints and coatings market size is set to reach USD 41.13 billion by 2034, expanding at a CAGR of 7.48% from USD 19.99 billion in 2024

Automotive Paints and Coatings Market Key Takeaways

- North America remained the dominant regional market for automotive paints and coatings in 2024, supported by strong demand for high-performance coatings.

- Electrocoats gained significant traction, securing a notable market share in 2024 due to their extensive use in primer applications for enhanced vehicle protection.

- Waterborne coating technology led the market, holding the largest share in 2024, as automakers increasingly adopt low-VOC and sustainable coating solutions.

Market Overview

The automotive paints and coatings market plays a vital role in the automotive industry by providing protective, aesthetic, and performance-enhancing coatings. With the growing demand for corrosion-resistant and durable finishes, automakers are investing in advanced coating solutions that enhance vehicle lifespan and aesthetics. The industry is shifting toward sustainable coatings to comply with stringent environmental policies while meeting consumer preferences for high-gloss, matte, and specialty finishes. The rise in electric and hybrid vehicles is also fueling the need for coatings that enhance battery efficiency, thermal management, and lightweight components.

Market Drivers

The market is primarily driven by the rise in global vehicle production and increasing consumer demand for high-performance coatings. Additionally, automotive manufacturers are adopting waterborne and powder coatings to meet regulatory requirements for lower VOC emissions. Other key drivers include:

- Advancements in coating technology, such as ceramic, self-healing, and nano-coatings.

- Growing automotive aftermarket demand for repair and refinishing coatings.

- Increased R&D investments in smart coatings that provide self-cleaning, anti-microbial, and weather-resistant properties.

Growth Opportunities

The rising trend of vehicle customization is driving demand for specialty coatings, such as pearlescent, metallic, and textured finishes. Additionally, self-healing coatings that repair scratches and extend paint longevity are gaining popularity. Another major opportunity is the growth of electric vehicles (EVs), which require specialized coatings for battery components, lightweight structures, and heat-resistant surfaces. Digital and smart coatings that change color or provide enhanced protection against environmental factors are also an emerging market trend.

Challenges Impacting the Market

- Regulatory challenges: Strict VOC emission laws require manufacturers to invest in environmentally friendly coatings, which may increase production costs.

- High raw material costs: Prices of resins, pigments, and additives are fluctuating, impacting profit margins.

- Fluctuations in automotive production: Economic downturns, supply chain disruptions, and changing mobility trends (e.g., ride-sharing) may affect long-term demand for automotive coatings.

Regional Analysis

- North America: A leading market for eco-friendly coatings, with major players investing in sustainable solutions.

- Europe: Home to premium and luxury vehicle manufacturers, focusing on high-quality, low-emission coatings.

- Asia-Pacific: The fastest-growing region, driven by booming automotive production, rising consumer spending, and increasing EV adoption.

- Latin America & Middle East & Africa: Market expansion is fueled by infrastructure development and increasing automotive sales.

Industry Developments

The market is witnessing continuous innovation, with leading companies focusing on:

- New sustainable coatings, including low-VOC and bio-based solutions.

- Collaborations between automakers and paint manufacturers to enhance performance, durability, and eco-friendliness.

- Advancements in smart coatings, offering color-changing and temperature-resistant properties for modern vehicles.

Automotive Paints and Coatings Market Companies

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Cabot Corp

- Clariant AG

- Covestro

- Donglai Coating Technology

- Dupont

- Eastman

Segments Covered in the Report

By Vehicle Type

- Passenger Cars

- Heavy Commercial Vehicles

- Light Commercial Vehicles

By Coating Type

- Basecoat

- Primer

- Electrocoat

- Clearcoat

By Technology Type

- Solvent borne

- Waterborne

- UV Curved

- Powder

By Texture

- Metallic

- Solid

- Matte

By Distribution Channel

- Aftermarket

- OEM

By Raw Material

- Epoxy

- Acrylic

- Polyurethane

- Other Resins

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/