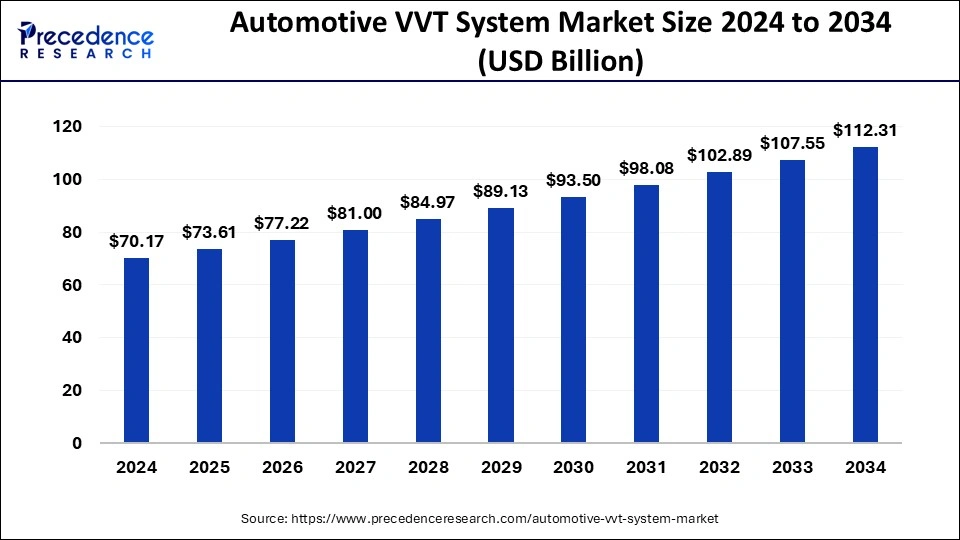

The automotive VVT system market is projected to grow from USD 70.17 billion in 2024 to USD 112.31 billion by 2034, at a CAGR of 4.82%

Automotive VVT System Market Key Takeaways

- In 2023, Asia Pacific held the largest share of the automotive VVT system market.

- The DOHC segment emerged as the top-performing category in the valve train segment.

- Passenger vehicles contributed more than 65% of the market’s total revenue in 2023

Market Overview

The automotive VVT system market is growing due to increasing demand for vehicles with improved fuel efficiency and performance. Variable Valve Timing (VVT) technology optimizes engine function by adjusting the timing of valve operations, enhancing power delivery and reducing fuel consumption. This technology plays a crucial role in meeting stringent emission norms worldwide. The market is also benefiting from the rising adoption of hybrid vehicles, where VVT systems help optimize engine performance alongside electric powertrains. Continuous advancements in engine technology and the integration of electronic control systems are further shaping the market landscape.

Drivers

The need for enhanced fuel efficiency and lower emissions is a major factor driving the automotive VVT system market. Governments worldwide are enforcing stricter emission standards, compelling automakers to implement advanced engine technologies. Rising consumer preference for high-performance vehicles with better drivability and fuel economy is another contributing factor. Additionally, technological advancements such as dual VVT and continuously variable valve timing (CVVT) systems are boosting demand, as they provide improved efficiency without compromising power output.

Opportunities

Expanding vehicle production in developing economies offers significant opportunities for the automotive VVT system market. Countries in Asia-Pacific, such as China and India, are witnessing rapid growth in automobile manufacturing, increasing the demand for efficient engine technologies. The growing hybrid vehicle segment also presents a lucrative opportunity, as VVT systems enhance fuel efficiency in hybrid powertrains. Moreover, research and development efforts focused on improving engine thermal efficiency and reducing mechanical losses are expected to lead to innovative VVT solutions.

Challenges

One of the key challenges for the automotive VVT system market is the rising cost of implementation. Advanced VVT systems require complex components and precise calibration, which can increase production costs. This poses a challenge, particularly for budget and entry-level vehicle segments. Additionally, the shift toward fully electric vehicles (EVs) presents a long-term threat, as EVs do not utilize VVT systems. The market is also susceptible to supply chain disruptions and fluctuations in raw material prices, affecting the availability and cost of key VVT components.

Regional Insights

Asia-Pacific is the leading region in the automotive VVT system market, driven by strong automotive manufacturing industries in China, Japan, and India. The presence of major car manufacturers and increasing vehicle production contribute to regional market growth. North America and Europe follow closely, with stringent fuel efficiency regulations and demand for high-performance vehicles driving market expansion. Meanwhile, emerging markets in Latin America, the Middle East, and Africa are expected to witness steady growth due to increasing automobile sales and technological advancements.

Recent News

The automotive VVT system market has seen notable developments, including the introduction of next-generation VVT technologies designed to enhance engine efficiency. Automakers are investing heavily in R&D to improve fuel economy and meet regulatory standards. The increasing focus on hybrid powertrains is also driving innovation, with manufacturers developing advanced VVT solutions that complement hybrid engine architectures. Additionally, collaborations between automotive component manufacturers and carmakers are fostering the development of cutting-edge VVT systems tailored for modern vehicles.

Automotive VVT System Market Companies

- Mikuni American Corporation

- Johnson Controls, Inc.

- Federal-Mogul LLC

- Camcraft, Inc.

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Eaton Corporation

- Mitsubishi Electric Corporation

- DENSO Corporation

- Robert Bosch GmbH

Segments Covered in the Report

By Fuel Type

- Diesel

- Gasoline

By Methods

- Cam Changing

- Cam Phasing

- Variable Valve

- Cam Phasing & Changing

By System

- Continuous

- Discrete

By Number of Valves

- More than 24

- Between 17 to 23

- 16

- Less Than 12

By Valve Train

- Over Head Valve(OHV)

- Double Overhead Cam(DOHC)

- Single Overhead Cam (SOHC)

By Technology

- Dual VVT-I

- VVT-I

- VVT-iW

- VVT-iE

By Vehicle Type

- Passenger Vehicles

- Electrical Vehicles

- Commercial Vehicles

By Actuation Type

- Type V

- Type IV

- Type III

- Type II

- Type I

By End-use

- Aftermarket

- OEMs

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World