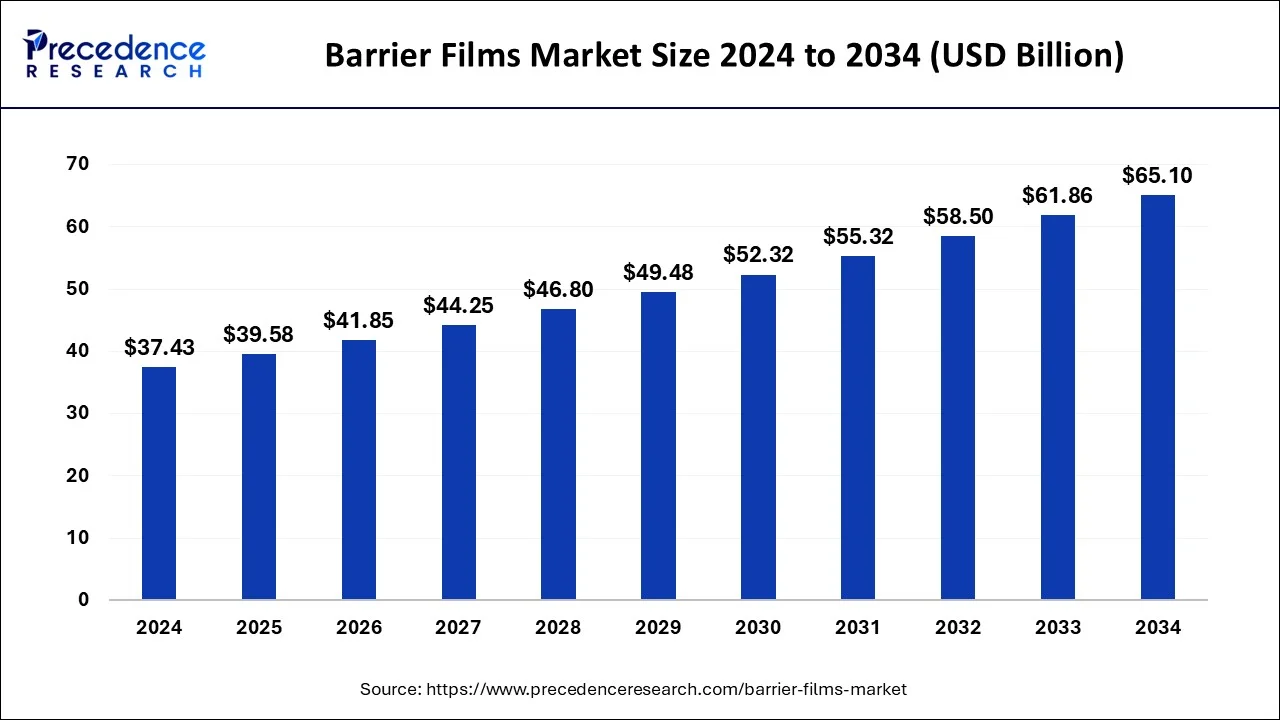

The global barrier films market size accounted for USD 35.40 billion in 2023 and is anticipated to grow around USD 61.86 billion by 2033, growing at a CAGR of 5.74% from 2024 to 2033.

Key Points

- Asia Pacific held the largest share of the barrier films market and is expected to hold the largest share during the forecast period.

- By region, North America is expected to show notable growth during the forecast period.

- By material, the organic coating segment held the largest share of the market.

- By packaging type, the pouches segment had the largest market share in 2023.

- By end use, the agriculture segment held the largest share of the market.

The barrier films market has witnessed significant growth in recent years, driven by the increasing demand for packaging solutions across various industries such as food and beverage, pharmaceuticals, and electronics. Barrier films are specialized packaging materials designed to provide protection against external factors such as moisture, oxygen, light, and gases, thereby extending the shelf life of packaged products and maintaining their quality. These films offer superior barrier properties compared to conventional packaging materials like polyethylene and polypropylene, making them ideal for preserving the freshness and integrity of perishable goods.

The global barrier films market is expected to continue its upward trajectory, fueled by the rising consumer awareness regarding food safety and sustainability, coupled with stringent regulations mandating the use of high-quality packaging materials. Additionally, advancements in manufacturing technologies have led to the development of innovative barrier film solutions with enhanced properties, further driving market growth.

Get a Sample: https://www.precedenceresearch.com/sample/4015

Growth Factors:

Several factors contribute to the growth of the barrier films market. Firstly, the increasing consumption of packaged food and beverages, driven by changing consumer lifestyles and preferences, has spurred the demand for high-performance packaging materials capable of preserving product freshness and flavor. Moreover, the growing popularity of convenience foods and on-the-go snacking has necessitated the use of packaging solutions that offer convenience, portability, and extended shelf life, thereby boosting the adoption of barrier films.

Furthermore, the expanding pharmaceutical and healthcare sectors, particularly in emerging economies, have created opportunities for barrier film manufacturers. With the rising demand for pharmaceutical products, there is a growing need for packaging materials that ensure the integrity and safety of medications, medical devices, and diagnostic kits. Barrier films play a crucial role in protecting pharmaceutical products from moisture, oxygen, and other environmental factors, thereby maintaining their efficacy and prolonging their shelf life.

Additionally, the increasing emphasis on sustainable packaging solutions has driven the development of eco-friendly barrier films made from renewable materials such as bioplastics and bio-based polymers. As consumers become more environmentally conscious, there is a growing demand for packaging materials that minimize the environmental impact while still offering superior barrier properties. This shift towards sustainable packaging solutions is expected to fuel the growth of the barrier films market in the coming years.

Region Insights:

The barrier films market exhibits significant regional variation, with key growth opportunities emerging in both developed and developing regions. In North America, the market is driven by the robust demand for barrier films in the food and beverage industry, particularly in the United States. The region benefits from a well-established packaging industry, stringent regulatory standards, and a strong emphasis on product innovation and sustainability.

In Europe, the barrier films market is characterized by a high level of technological advancement and a strong focus on environmental sustainability. Countries such as Germany, France, and the United Kingdom are key contributors to market growth, driven by the presence of leading packaging manufacturers and increasing investments in research and development activities aimed at enhancing barrier film properties.

Asia Pacific is poised to emerge as the fastest-growing region in the barrier films market, fueled by rapid industrialization, urbanization, and changing consumer lifestyles. Countries such as China, India, and Japan are witnessing robust demand for barrier films across various end-use industries, including food and beverage, pharmaceuticals, and electronics. The region’s growing population, rising disposable incomes, and expanding retail sector are driving the demand for packaged goods, thereby stimulating market growth.

Barrier Films Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.74% |

| Global Market Size in 2023 | USD 35.40 Billion |

| Global Market Size by 2033 | USD 61.86 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Packaging Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Barrier Films Market Dynamics

Drivers:

Several key drivers are shaping the growth trajectory of the barrier films market. Firstly, the increasing focus on product safety and quality assurance is driving the adoption of barrier films in the food and beverage industry. With consumers becoming more discerning about the quality and freshness of packaged products, manufacturers are increasingly turning to advanced packaging solutions that offer superior protection against contamination, spoilage, and tampering.

Moreover, the growing prevalence of foodborne illnesses and contamination incidents has prompted regulatory authorities to enforce stringent food safety regulations, mandating the use of high-quality packaging materials. Barrier films play a critical role in preventing microbial growth, extending the shelf life of perishable foods, and ensuring compliance with regulatory standards, thereby driving their adoption in the food packaging sector.

In addition to food safety concerns, the rising demand for sustainable packaging solutions is fueling the growth of the barrier films market. With increasing awareness about environmental issues such as plastic pollution and climate change, there is a growing emphasis on reducing the environmental footprint of packaging materials. Barrier films made from renewable resources, recyclable materials, and bio-based polymers are gaining traction as eco-friendly alternatives to conventional plastics, driving their adoption across various industries.

Furthermore, technological advancements in barrier film manufacturing processes are enhancing their performance and versatility, further driving market growth. Innovations such as nano-coatings, plasma treatments, and multi-layer extrusion techniques are enabling manufacturers to develop barrier films with enhanced barrier properties, improved mechanical strength, and greater flexibility, thereby expanding their applicability across a wide range of packaging applications.

Opportunities:

The barrier films market presents numerous opportunities for growth and innovation, driven by evolving consumer preferences, technological advancements, and regulatory developments. One of the key opportunities lies in the development of high-performance barrier films tailored to specific end-use applications. Customized barrier solutions that offer tailored barrier properties, such as moisture resistance, oxygen barrier, and UV protection, can cater to the unique requirements of different industries and packaging formats, thereby opening up new market opportunities.

Moreover, the growing demand for sustainable packaging solutions presents a significant opportunity for manufacturers to develop eco-friendly barrier films using renewable materials and environmentally friendly manufacturing processes. As consumers become more conscious of the environmental impact of packaging materials, there is a growing demand for sustainable alternatives that minimize waste, reduce carbon emissions, and promote circularity.

Furthermore, the expanding e-commerce sector presents a lucrative opportunity for barrier film manufacturers. With the rise of online shopping and home delivery services, there is a growing demand for durable and protective packaging materials that can withstand the rigors of shipping and handling while ensuring product integrity and freshness. Barrier films with enhanced puncture resistance, tear strength, and tamper-evident features are well-suited for e-commerce packaging applications, offering opportunities for market expansion.

Additionally, the growing adoption of advanced packaging technologies such as active and intelligent packaging presents new avenues for innovation in the barrier films market. Active packaging systems incorporating oxygen scavengers, antimicrobial agents, and moisture absorbers can help extend the shelf life of perishable products and enhance food safety. Similarly, intelligent packaging solutions equipped with sensors, indicators, and tracking devices can provide real-time information about product freshness, temperature exposure, and tampering, thereby enhancing consumer confidence and brand loyalty.

Challenges:

Despite the promising growth prospects, the barrier films market faces several challenges that could impede its growth trajectory. One of the primary challenges is the increasing competition from alternative packaging materials and technologies. With the growing emphasis on sustainability and environmental stewardship, there is a rising demand for biodegradable, compostable, and recyclable packaging solutions that offer comparable or superior barrier properties to traditional plastics. Barrier films made from bio-based polymers, compostable materials, and recyclable plastics are increasingly being adopted as alternatives to conventional barrier films, posing a challenge to market incumbents.

Moreover, the volatility of raw material prices and supply chain disruptions pose significant challenges for barrier film manufacturers. The barrier films industry relies heavily on petrochemical-based resins such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), whose prices are subject to fluctuations in crude oil prices and supply-demand dynamics. Any disruption in the supply of raw materials or fluctuations in prices can impact the cost competitiveness and profitability of barrier film manufacturers,

Read Also: Neurotech Devices Market Size to Rise USD 55.14 Bn by 2033

Recent Developments

- In March 2024, At the CFIA exhibition in Rennes, France, specialty film producer Jindal Films introduced new mono-material barrier film solutions, BICOR 25 and 30 MBH568 films. The solutions for polypropylene (PP) and polyethylene (PE) nanomaterials are intended to assist packaging companies in complying with the impending European mechanical recycling regulations.

- In October 2023, Madura Tea, an Australian company, used Koehler NexPlus Seal Pure MOB 72 gsm flexible paper packaging. German suppliers Gundlach Packaging Group and Koehler Paper provided test materials after promising results.

Barrier Films Market Companies

- Berry Global Inc.

- Amcor Plc

- Sealed Air

- Toppan Printing Co.

- Cosmo Films Ltd.

- Jindal Poly Films Ltd.

Segment Covered in the Report

By Material

- Polyethylene

- Polypropylene

- Polyester

- Polyamide

- Organic Coating

- Inorganic Oxide Coating

By Packaging Type

- Pouches

- Bags

- Blister Packs

By End-use

- Food & Beverage

- Pharmaceutical & Medical

- Electronics

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/