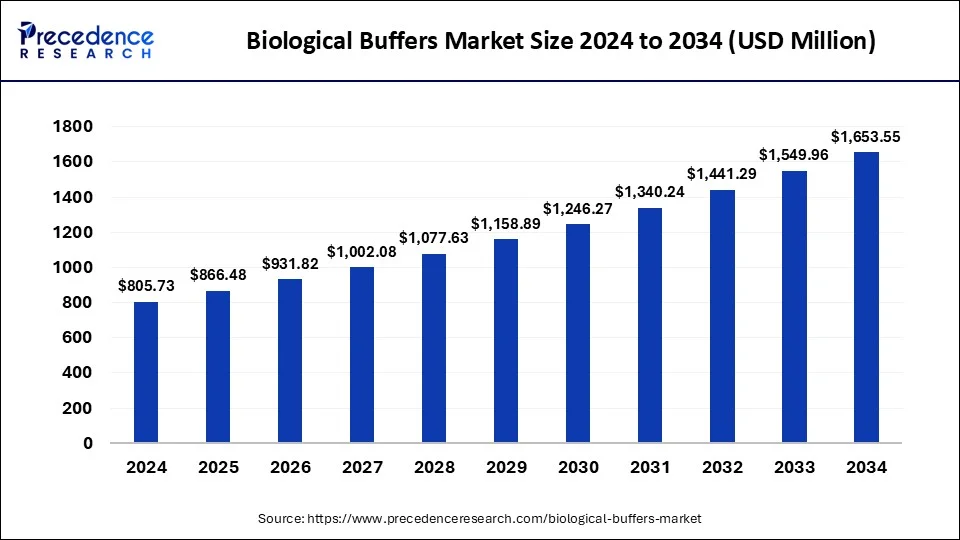

The global biological buffers market size was exhibited at USD 749.24 million in 2023 and is predicted to rake around USD 1,549.96 million by 2033, expanding at a CAGR of 7.54% from 2024 to 2033.

Biological Buffers Market Key Points

- Europe led the global biological buffers market in 2023.

- Asia Pacific is expected to show significant growth in the market during the forecast period.

- By type, the phosphate type segment dominated the market in 2023 and is anticipated to experience rapid growth during the forecast period.

- By application, in 2023, the research institution segment dominated the market and is expected to experience the fastest growth during the projected period.

The biological buffers market is an essential segment of the biopharmaceutical and biotechnology industries, playing a critical role in maintaining pH stability and ensuring the integrity of biological samples and reactions. These buffers are widely used in various applications, including cell culture, protein purification, molecular biology, and diagnostic assays. The market has seen significant growth in recent years due to the increasing demand for biopharmaceuticals, advancements in biotechnology, and the expanding scope of life sciences research. Additionally, the rise in research and development activities, coupled with the growing need for effective and reliable buffer systems in laboratory and industrial processes, is propelling market expansion.

Get a Sample: https://www.precedenceresearch.com/sample/4660

Region Insights

The biological buffers market exhibits varied growth patterns across different regions. North America holds a significant share of the market, driven by the presence of major biopharmaceutical companies, advanced research facilities, and substantial investments in biotechnology. The United States, in particular, is a key contributor due to its robust healthcare infrastructure and extensive R&D activities. Europe follows closely, with countries like Germany, the United Kingdom, and France leading the market due to their well-established biotechnology sectors and supportive government policies. The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, driven by increasing investments in biotechnology, rising healthcare expenditure, and the expanding pharmaceutical industry in countries like China, India, and Japan. Additionally, emerging markets in Latin America and the Middle East & Africa are gradually gaining traction due to improving healthcare infrastructure and growing awareness of advanced biological research techniques.

Trends

Several notable trends are shaping the biological buffers market. One of the key trends is the increasing adoption of automated and high-throughput techniques in research and diagnostics, which necessitates the use of specialized buffers. Moreover, there is a growing focus on developing customized buffer solutions tailored to specific applications and experimental conditions. The trend towards personalized medicine and targeted therapies is also influencing the market, as these approaches require precise and reliable buffer systems. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning in buffer formulation and quality control processes is gaining momentum, enhancing the efficiency and effectiveness of buffer solutions.

Biological Buffers Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,549.96 Million |

| Market Size in 2023 | USD 749.24 Million |

| Market Size in 2024 | USD 805.73 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.54% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biological Buffers Market Dynamics

Drivers

The biological buffers market is primarily driven by the rising demand for biopharmaceuticals and biotechnology products. The increasing prevalence of chronic diseases and the growing focus on personalized medicine are fueling the need for advanced biotechnological solutions, thereby boosting the demand for biological buffers. Additionally, the expanding scope of life sciences research, coupled with the continuous advancements in molecular biology techniques, is driving market growth. The increasing adoption of biologics and biosimilars, along with the rising number of clinical trials and research studies, further propels the market. Furthermore, the growing emphasis on maintaining the stability and integrity of biological samples in various research and industrial processes is a significant driver for the market.

Opportunities

The biological buffers market presents several growth opportunities, particularly in emerging economies. The expanding biotechnology and pharmaceutical industries in countries like China, India, and Brazil offer significant growth potential for market players. Additionally, the increasing focus on precision medicine and targeted therapies presents opportunities for developing specialized buffer solutions. The growing trend of outsourcing research and manufacturing activities to contract research organizations (CROs) and contract manufacturing organizations (CMOs) also provides lucrative opportunities for market expansion. Moreover, advancements in buffer formulation technologies and the development of novel buffer systems tailored to specific applications offer potential for market growth.

Challenges

Despite the positive growth prospects, the biological buffers market faces certain challenges. One of the major challenges is the stringent regulatory requirements associated with the use of biological buffers in pharmaceutical and biotechnological applications. Compliance with these regulations necessitates significant investment in quality control and validation processes, posing a challenge for market players. Additionally, the high cost of advanced buffer systems and the availability of alternative solutions may hinder market growth. The complexity of buffer formulation and the need for precise pH control and stability also present challenges. Furthermore, the limited awareness and adoption of advanced buffer solutions in certain regions may impede market expansion.

Read Also: Neurology Clinical Trials Market Size to Rake USD 9.64 Bn by 2033

Recent Developments

- In October 2023, Nijhuis Saur Industries (NSI) found the finishing touch of the acquisition of Pall Aria containerized devices, which constitutes a subset of Pall Water’s cell water commercial enterprise in Europe.

- In February 2023, WuXi AppTec launched a new biological safety testing facility in Suzhou, China. This facility is equipped with the latest technology and will provide a wide range of biological safety testing services to clients in the Asia-Pacific region.

- In January 2023, Charles River Laboratories announced the acquisition of Eurofins Scientific’s biological safety testing business. This acquisition will expand Charles River’s capabilities in biological safety testing and help the company meet the growing demand for these services.

- In June 2023, CellTech Innovations unveiled “LysoBoost Plus,” an enhanced cell lysis reagent with improved efficiency and compatibility across a wide range of cell types. The product incorporates a unique enzyme blend and optimized formulation to achieve higher yields of intracellular components, benefiting applications such as proteomics, genomics, and drug discovery.

- In January 2023, BioLysis Inc. introduced a breakthrough cell lysis technology, “CytoBreaker,” which allows for faster and more efficient cell disruption. The technology utilizes advanced nanoparticle-based reagents for targeted cell lysis in various sample types.

Biological Buffers Market Companies

- Merck KGaA

- Thermo Fisher Scientific Inc

- Avantor

- GE Healthcare

- Santa Cruz Biotechnology, Inc.

- Lonza Group Ltd.

- Bio-Rad Laboratories, Inc

- F. Hoffmann-La Roche Ltd.

- Hamilton Company

- BASF SE

Segments covered in the report

By Type

- Phosphate Type

- Acetate Type

- TRIS Type

- Other Types

By End-User

- Research Institution

- Pharmaceutical Industry

- Other End-Users

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/