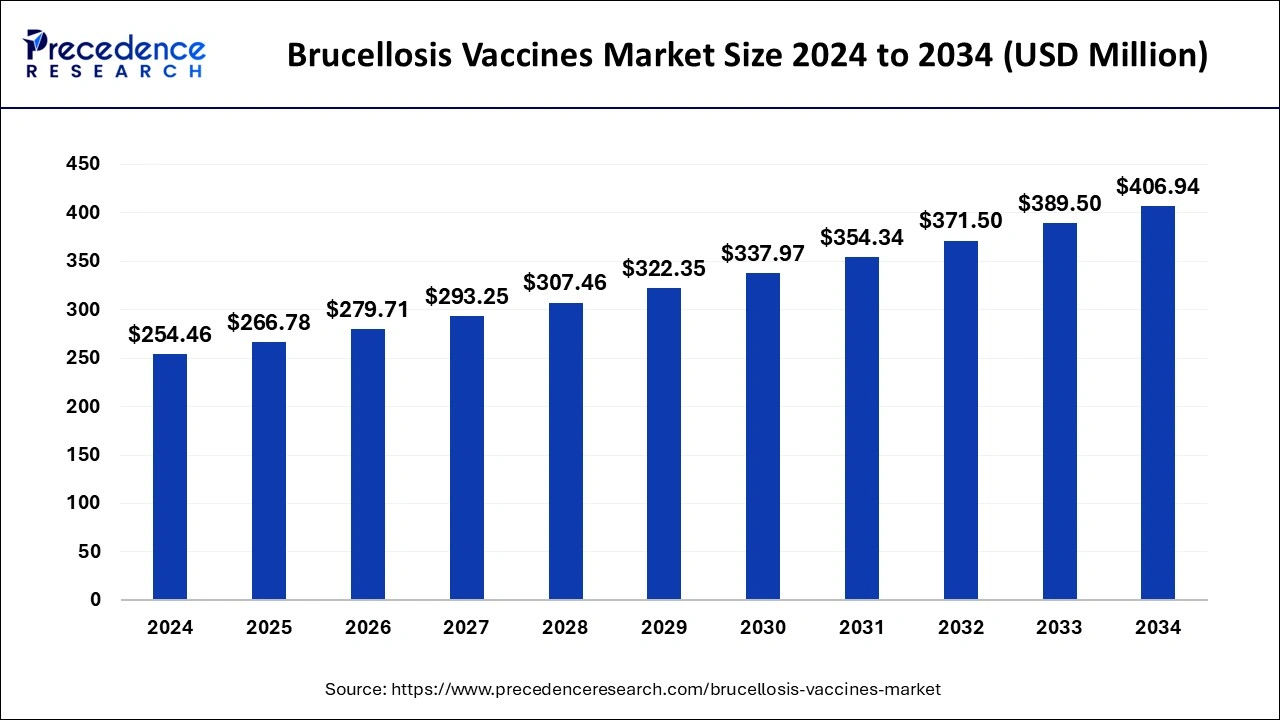

The global brucellosis vaccines market size accounted for USD 242.70 million in 2023 and is anticipated to grow around USD 389.50 million by 2033 growing at a CAGR of 4.84% from 2024 to 2033.

Key Points

- The North America brucellosis vaccines market size reached USD 104.36 million in 2023 and is expected to surpass around USD 167.49 million by 2033.

- North America has dominated the market with revenue share of 43% in 2023.

- By application, in 2023, the cattle segment has accounted 57% revenue share in 2023.

- By type, the RB51 vaccine segment dominated the market with revenue share of 43% in 2023.

- By Vaccine Type, the DNA Vaccines segment has captured 32.5% revenue share in 2023.

- By distribution channel, the public segment had the largest market share in 2023.

The Brucellosis Vaccines market encompasses the development, production, and distribution of vaccines designed to prevent brucellosis in livestock and, in some cases, humans. Brucellosis is a zoonotic disease caused by bacteria of the genus Brucella, which can lead to severe health issues in animals and humans. Vaccination is an essential tool for controlling the spread of the disease, which can affect various livestock such as cattle, sheep, and goats. The market is driven by the need to protect livestock health and food safety, as well as public health in regions where brucellosis is prevalent.

Get a Sample: https://www.precedenceresearch.com/sample/4113

Growth Factors:

The Brucellosis Vaccines market is expected to grow due to several factors. The increasing awareness of the economic impact of brucellosis on livestock industries and the associated public health risks is driving demand for vaccines. Government initiatives and regulations to control the spread of brucellosis through vaccination programs are also contributing to market growth. Additionally, advancements in vaccine technology, such as the development of more effective and safer vaccines, are expected to support market expansion.

Region Insights:

The market’s regional dynamics vary depending on the prevalence of brucellosis in different parts of the world. Regions such as the Middle East, Africa, and parts of Asia experience higher incidences of brucellosis, leading to increased demand for vaccines. In contrast, regions like North America and Europe have relatively lower incidence rates due to established control measures, including widespread vaccination programs. Nonetheless, there remains a steady demand for brucellosis vaccines in these areas to maintain disease control.

Brucellosis Vaccines Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 242.70 Million |

| Global Market Size in 2024 | USD 254.46 Million |

| Global Market Size by 2033 | USD 389.50 Million |

| Growth Rate from 2024 to 2033 | CAGR of 4.84% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Vaccine, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Brucellosis Vaccines Market Dynamics

Drivers:

Key drivers of the Brucellosis Vaccines market include the rising prevalence of brucellosis in certain regions, the growing need to protect livestock and ensure food safety, and increasing government support for vaccination programs. Additionally, the development of innovative and efficient vaccines is propelling market growth.

Opportunities:

There are several opportunities in the Brucellosis Vaccines market. These include the potential for the development of novel vaccines that offer better protection with fewer side effects and the expansion of vaccination programs in underpenetrated regions. The growing trend toward one health approach, integrating animal and human health, offers further potential for vaccine development and distribution.

Challenges:

The Brucellosis Vaccines market faces challenges such as the complexity of producing effective vaccines, regulatory hurdles, and the need for sustained public funding and support for vaccination programs. Additionally, the market may experience resistance from livestock owners due to cost concerns or lack of awareness about the benefits of vaccination. Overcoming these challenges requires coordinated efforts from stakeholders across the public and private sectors.

Read Also: Dental Caries Treatment Market Size to Grow USD 11.60 Bn by 2033

Brucellosis Vaccines Market Recent Developments

- In March 2024, Boehringer Ingelheim, a renowned player in the animal health sector, collaborated with Square Pharmaceuticals to launch Aftovaxpur in Bangladesh. This advanced foot-and-mouth disease (FMD) vaccine is specifically formulated for ruminants, including cattle and sheep, aiming to enhance livestock health in the region.

- In October 2023, Zoetis, a leading animal health company based in the US, made headlines by acquiring Semex, a Canadian company specializing in bovine genetics and reproductive technology. This strategic move aims to bolster Zoetis’ standing in the cattle health market, particularly by enhancing its brucellosis vaccine offerings. The acquisition brings valuable expertise and a robust distribution network from Semex, strengthening Zoetis’ position in cattle breeding management.

- In April 2023, Cornell University College of Veterinary Medicine (CVM) scientists researched and developed a novel diagnostic test to identify Brucella canis. This test helps in the early diagnosis of this zoonotic disease, which can spread to humans through contact with infected dogs. This will boost vaccination over time.

- In July 2023, A notable development came from Hester Biosciences, an animal health company in India, with the launch of a new oral brucellosis vaccine for cattle. This innovative vaccine, based on the Brucella Abortus B19 strain, offers a more convenient and potentially cost-effective alternative to traditional injection-based vaccines. The introduction of this oral vaccine could open up new market segments, particularly in regions with limited resources, such as India.

Brucellosis Vaccines Market Companies

- Merck & Co.

- CZ Vaccines

- Colorado Serum Company

- Indian Immunologicals

- Hester Biosciences

- Veterinary Technologies Corporation

- Laboratorios Tornel

- Five Animal Health

- VETAL Animal Health Products Inc.

Segments Covered in the Report

By Type

- Rbs1 Vaccine

- S19 Vaccine

- Others

By Vaccine

- DNA Vaccine

- Subunit Vaccine

- Vector Vaccine

- Recombinant Vaccine

By Application

- Cattle

- Sheep & Goat

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Channels

- Public

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/