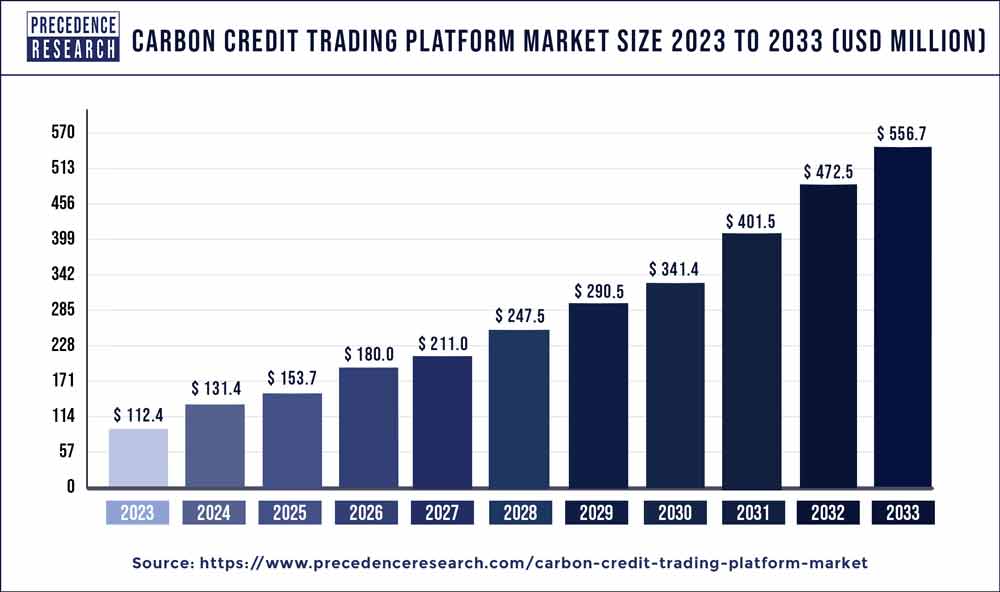

The global carbon credit trading platform market size reached USD 112.4 million in 2023 and is expected to hit around USD 556.7 million by 2033, notable at a CAGR of 17.40% from 2024 to 2033.

Key Takeaways

- Europe contributed 40% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the voluntary segment has held the largest market share of 55% in 2023.

- By type, the compliance segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By system type, the cap trade segment generated over 57% of market share in 2023.

- By system type, the baseline and credit segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the utilities segment generated over 26% of market share in 2023.

- By end-use, the aviation segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The Carbon Credit Trading Platform market is at the forefront of global efforts to combat climate change by creating a marketplace for the exchange of carbon credits. As countries and businesses strive to meet sustainability goals and reduce their carbon footprints, the demand for effective carbon credit trading platforms has surged. These platforms play a crucial role in facilitating the buying and selling of carbon credits, enabling participants to offset their emissions and contribute to environmental conservation.

Get a Sample: https://www.precedenceresearch.com/sample/3733

Growth Factors

Several factors contribute to the growth of the Carbon Credit Trading Platform market. Increasing awareness of environmental issues, coupled with the commitment of businesses and governments to achieve carbon neutrality, has led to a rising demand for carbon credits. The implementation of stringent environmental regulations and the adoption of sustainable practices further drive the market growth. Additionally, technological advancements in blockchain and smart contract technologies enhance transparency and efficiency in carbon credit transactions, fostering market expansion.

Carbon Credit Trading Platform Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.40% |

| Global Market Size in 2023 | USD 112.4 Million |

| Global Market Size by 2033 | USD 556.7 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By System Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In July 2022, Aircarbon Exchange (ACX) formalized a collaborative agreement with the Nairobi International Financial Center (NIFC) and the Nairobi Securities Exchange (NSE) during the official launch of NIFC. This partnership aims to establish a carbon ecosystem in Kenya that will be seamlessly integrated with ACX’s international client order book. This connectivity will enable both international and domestic buyers and sellers to engage in transparent and efficient carbon transactions.

- In March 2022, CarbonX, a carbon asset developer, entered into a memorandum of understanding (MOU) with AirCarbon Exchange (ACX) to jointly create a carbon marketplace in Indonesia. Through this collaboration, Indonesian carbon project developers will gain access to a domestic carbon market connected to ACX’s international client order book. The envisioned carbon marketplace in Indonesia is expected to contribute to the rapid expansion of the country’s growing carbon market.

- In September 2021, CTX and IBAC joined forces in a partnership geared towards supporting Business Aviation Voluntary Commitments on Climate Change. The International Business Aviation Council (IBAC), representing over 18,000 operators globally, is actively engaged in initiatives aimed at reducing aviation emissions.

Carbon Credit Trading Platform Market Dynamics

Drivers:

The drivers propelling the Carbon Credit Trading Platform market are multifaceted. Governments worldwide are implementing policies to limit carbon emissions, encouraging organizations to participate in carbon credit trading as a compliance mechanism. Moreover, the growing emphasis on corporate social responsibility (CSR) compels businesses to actively engage in carbon offset initiatives, boosting the demand for trading platforms. The integration of digital solutions for monitoring and reporting emissions enhances the ease of participation, attracting a broader spectrum of industries to the carbon credit market.

Restraints:

Despite the positive momentum, the Carbon Credit Trading Platform market faces certain restraints. Challenges related to standardization and harmonization of carbon credit methodologies create complexities in trading processes. Additionally, concerns about the reliability and accuracy of carbon offset projects may deter potential participants. Market fragmentation and the lack of a unified global regulatory framework pose hurdles to the seamless functioning of the carbon credit trading ecosystem.

Opportunity:

The Carbon Credit Trading Platform market presents a significant opportunity for innovation and collaboration. Advancements in satellite technology, artificial intelligence, and remote sensing can contribute to more accurate carbon monitoring and verification. Collaboration between governments, businesses, and environmental organizations can foster the development of standardized protocols, addressing current market challenges. Furthermore, the expansion of carbon credit trading platforms into emerging markets presents a vast opportunity for global participation and the development of new environmental initiatives.

Read Also: Automotive Glass Market Size to Rake USD 50.25 Billion by 2033

Carbon Credit Trading Platform Market Companies

- AirCarbon Exchange (ACX)

- CarbonX

- CTX (Climate Trade)

- CBL Markets

- Markit (now IHS Markit)

- APX, Inc.

- Climex

- Carbon Trade Exchange (CTX)

- Karbone

- Redshaw Advisors

- EEX Group

- ClearBlue Markets

- ClimateCare

- South Pole

- Bluesource

Segments Covered in the Report

By Type

- Voluntary

- Compliance

By System Type

- Cap and Trade

- Baseline and Credit

By End-use

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/