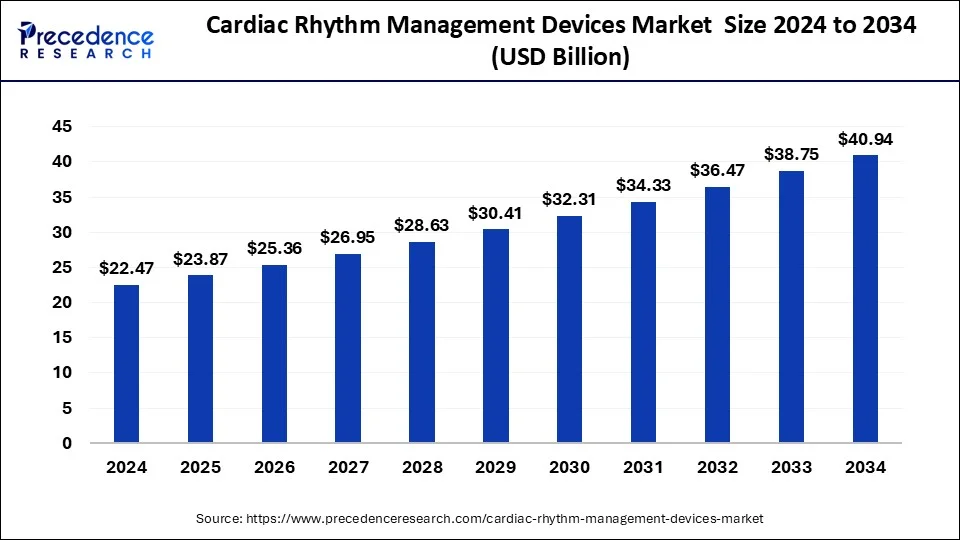

The global cardiac rhythm management devices market size accounted for USD 21.15 billion in 2023 and is predicted to reach around USD 38.75 billion by 2033, poised to grow at a CAGR of 6.24% from 2024 to 2033.

Key Points

- North America has accounted more than 40% of the market share in 2023.

- By product, the defibrillators segment held the largest share of the market in 2023.

- By application, the arrhythmias segment held the largest share of the market in 2023.

- By end-user, the hospitals segment led the market with the largest market share of 50% in 2023.

The Cardiac Rhythm Management (CRM) Devices Market encompasses a range of medical devices designed to monitor and regulate the heart’s rhythm, ensuring optimal cardiac function. These devices are crucial in treating various cardiac arrhythmias, including bradycardia, tachycardia, and atrial fibrillation. The market for CRM devices has witnessed substantial growth in recent years, driven by the increasing prevalence of cardiovascular diseases, advancements in technology, and growing awareness about early diagnosis and treatment of heart conditions. As the global population ages and lifestyle-related risk factors for heart disease continue to rise, the demand for CRM devices is expected to further escalate, presenting significant opportunities for manufacturers, healthcare providers, and investors.

Get a Sample: https://www.precedenceresearch.com/sample/3968

Growth Factors:

Several factors contribute to the growth of the Cardiac Rhythm Management Devices Market. Firstly, the rising prevalence of cardiovascular diseases, including atrial fibrillation, heart failure, and cardiac arrhythmias, has increased the demand for effective treatment options. CRM devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices play a vital role in managing these conditions, thereby driving market growth.

Moreover, technological advancements in CRM devices have led to the development of more sophisticated and reliable products with enhanced features and functionalities. Miniaturization of devices, improved battery life, wireless connectivity, and advanced sensing algorithms have improved device performance and patient outcomes, driving adoption rates and market expansion.

Additionally, favorable reimbursement policies and healthcare infrastructure development in both developed and developing regions have facilitated access to CRM devices for patients. Governments and private payers are increasingly recognizing the clinical benefits of these devices and are providing reimbursement for implantation procedures, which has further fueled market growth.

Furthermore, increasing patient awareness about the importance of early diagnosis and treatment of cardiac arrhythmias has led to greater demand for CRM devices. Educational initiatives, patient advocacy groups, and physician outreach programs have played a crucial role in raising awareness about cardiovascular health and the role of CRM devices in managing heart rhythm disorders.

Region Insights:

The Cardiac Rhythm Management Devices Market exhibits regional variations in terms of market size, adoption rates, and regulatory frameworks. In North America, the United States and Canada dominate the market, driven by high healthcare expenditure, advanced medical infrastructure, and a large patient population with cardiovascular diseases. The presence of key market players, robust reimbursement policies, and favorable government initiatives to promote cardiovascular health contribute to market growth in the region.

In Europe, countries like Germany, France, and the United Kingdom are significant contributors to the CRM devices market. The region benefits from a well-established healthcare system, high awareness about cardiovascular health, and supportive regulatory environments. However, market growth in Europe is somewhat restrained by cost containment measures and pricing pressures on medical devices.

The Asia Pacific region represents a rapidly growing market for CRM devices, fueled by increasing healthcare expenditure, improving healthcare infrastructure, and a growing burden of cardiovascular diseases. Countries such as China, India, and Japan are witnessing rapid adoption of CRM devices, driven by rising disposable incomes, urbanization, and an aging population. However, market growth in the region is subject to regulatory challenges, pricing pressures, and market access barriers.

Latin America and the Middle East & Africa are also witnessing growing demand for CRM devices, albeit at a slower pace compared to other regions. Economic development, increasing healthcare investments, and rising awareness about cardiovascular diseases are driving market growth in these regions. However, market expansion is hindered by limited access to healthcare services, reimbursement challenges, and regulatory complexities.

Cardiac Rhythm Management Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.24% |

| Global Market Size in 2023 | USD 21.15 Billion |

| Global Market Size by 2033 | USD 38.75 Billion |

| U.S. Market Size in 2023 | USD 6.35 Billion |

| U.S. Market Size by 2033 | USD 11.36 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cardiac Rhythm Management Devices Market Dynamics

Drivers:

Several drivers propel the growth of the Cardiac Rhythm Management Devices Market. Firstly, the increasing prevalence of cardiovascular diseases, particularly among the elderly population, is a significant driver of market demand. Age-related factors such as hypertension, diabetes, and obesity contribute to the risk of developing cardiac arrhythmias, necessitating the use of CRM devices for disease management.

Moreover, advancements in technology have led to the development of next-generation CRM devices with improved features and capabilities. Enhanced sensing algorithms, remote monitoring capabilities, and wireless connectivity enable better patient management and personalized therapy delivery, driving adoption rates and market growth.

Furthermore, the growing emphasis on preventive healthcare and early intervention strategies has led to greater awareness about cardiovascular health and the importance of timely diagnosis and treatment. Physicians and healthcare providers are increasingly recommending CRM devices for patients at risk of or diagnosed with cardiac arrhythmias, leading to increased device utilization and market expansion.

Additionally, favorable reimbursement policies and insurance coverage for CRM devices have made these treatments more accessible to patients, further driving market growth. Reimbursement support for implantation procedures and device upgrades encourages healthcare providers to prescribe CRM devices, thereby boosting market demand.

Moreover, the expanding indications for CRM devices, such as cardiac resynchronization therapy for heart failure patients and subcutaneous ICDs for patients at risk of sudden cardiac arrest, have widened the addressable patient population, driving market growth. Advances in device technology and clinical evidence supporting the efficacy of these therapies continue to fuel adoption rates and market expansion.

Opportunities:

The Cardiac Rhythm Management Devices Market presents numerous opportunities for stakeholders across the healthcare ecosystem. Firstly, the increasing adoption of remote monitoring and telemedicine technologies presents opportunities for CRM device manufacturers to develop innovative solutions for remote patient management and data analytics. Remote monitoring capabilities enable healthcare providers to remotely monitor patients’ cardiac status, optimize device settings, and intervene proactively in case of device malfunction or clinical deterioration.

Moreover, there is growing interest in personalized medicine and precision therapy approaches in the field of cardiology. Advancements in genetic testing, biomarker identification, and predictive analytics enable clinicians to tailor treatment strategies based on individual patient characteristics, thereby improving treatment outcomes and patient satisfaction. CRM device manufacturers can capitalize on these trends by developing personalized therapy delivery systems and integrating predictive analytics into device algorithms.

Furthermore, the expanding use of CRM devices in emerging markets presents opportunities for market expansion and revenue growth. Rising healthcare investments, improving healthcare infrastructure, and increasing awareness about cardiovascular diseases in countries such as China, India, and Brazil create a favorable market environment for CRM device manufacturers. By leveraging partnerships, distribution networks, and market entry strategies tailored to local needs, manufacturers can tap into these emerging markets and establish a strong foothold.

Additionally, there is growing interest in value-based healthcare models and cost-effective treatment strategies in the management of cardiovascular diseases. CRM device manufacturers can collaborate with healthcare providers and payers to develop bundled payment models, risk-sharing agreements, and outcomes-based reimbursement schemes that incentivize the adoption of cost-effective therapies and promote better patient outcomes.

Moreover, ongoing research and development efforts aimed at advancing CRM device technology present opportunities for innovation and product differentiation. Investments in novel materials, miniaturization techniques, energy-efficient battery technologies, and software algorithms can lead to the development of next-generation CRM devices with enhanced performance, durability, and patient comfort. By staying at the forefront of technological innovation, CRM device manufacturers can maintain a competitive edge in the market and drive continued growth.

Challenges:

Despite the promising growth prospects, the Cardiac Rhythm Management Devices Market faces several challenges that could potentially hinder market expansion. Firstly, regulatory hurdles and compliance requirements pose significant challenges for manufacturers seeking to obtain regulatory approvals and market access for their products. The lengthy and complex regulatory approval processes, varying requirements across different regions, and evolving regulatory landscapes create uncertainties and delays in product commercialization, which can impede market growth.

Moreover, pricing pressures and cost containment measures in healthcare systems worldwide pose challenges for CRM device manufacturers. Healthcare providers and payers are increasingly scrutinizing the cost-effectiveness of medical devices.

Read Also: Ammonium Chloride Market Size To Rise USD 2.24 Bn by 2033

Recent Developments

- In June 2023, Philips and BIOTRONIK formed a strategic alliance to expand care for out-of-hospital cardiology labs.

- In October 2023, MicroPort CRM launched the ULYS ICD and INVICTA Defibrillation Lead in Japan.

- In October 2023, Boston Scientific introduced the LUX-Dx II+ Insertable Cardiac Monitor System.

Cardiac Rhythm Management Devices Market Companies

- Physio-Control, Inc. (Stryker)

- BIOTRONIK

- Schiller

- Medtronic

- Abbott

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- Schiller

- Boston Scientific Corporation

- Progetti Srl

- LivaNova Plc

Segments Covered in the Report

By Product

- Pacemakers

- Implantable

- External

- Defibrillators

- Implantable Cardioverter Defibrillators (ICD)

- S-ICD

- T-ICD

- Implantable Cardioverter Defibrillators (ICD)

- External Defibrillator

- Manual External Defibrillator

- Automatic External Defibrillator

- Wearable Cardioverter Defibrillator

- Cardiac Resynchronization Therapy (CRT)

- CRT-Defibrillator

- CRT-Pacemakers

By Application

- Congestive Heart Failure

- Arrhythmias

- Bradycardia

- Tachycardia

- Others

By End-use

- Hospitals

- Cardiac care centers

- Ambulatory surgical centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/