Cloud Access Security Broker Market Key Takeaways

Cloud Access Security Broker Market Key Takeaways- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is projected to witness the fastest growth during the forecast period.

- By solution, the data security segment led the market in 2024.

- By solution, the threat protection segment is expected to grow rapidly in the coming years.

- By deployment mode, the SaaS segment held the largest market share in 2024.

- By deployment mode, the PaaS segment is projected to expand at the fastest CAGR between 2025 and 2034.

- By enterprise size, the large enterprises segment dominated the market in 2024.

- By enterprise size, the small & medium size enterprises (SMEs) segment is expected to show the quickest growth in the coming years.

- By end-use, the BFSI segment held the dominant share of the market in 2024.

- By end-use, the manufacturing segment is likely to grow at a significant rate during the projection period.

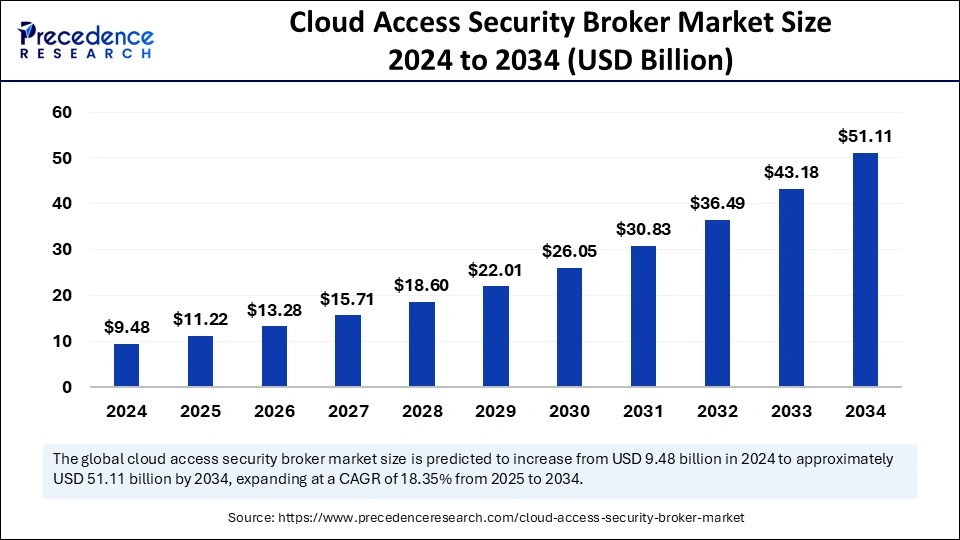

Market Overview

The cloud access security broker market is witnessing significant expansion as organizations accelerate cloud adoption and seek robust mechanisms to secure their cloud-based assets. Cloud access security brokers (CASBs) act as critical enforcement points between cloud service users and providers, enabling organizations to maintain visibility, control, and compliance across multi-cloud environments. With the increasing reliance on software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS), the demand for CASBs continues to rise, positioning the cloud access security broker market as a key segment in the broader cybersecurity landscape.

Drivers

One of the primary drivers of the cloud access security broker market is the rapid shift toward remote work and hybrid environments, which has led to an explosion in cloud usage and increased security vulnerabilities. Organizations need centralized tools to monitor and secure data across various cloud platforms without hindering user productivity. Regulatory requirements such as GDPR, HIPAA, and CCPA are also compelling enterprises to implement comprehensive data governance policies, further driving CASB adoption. Moreover, the increasing frequency of data breaches and insider threats is prompting both large enterprises and SMEs to invest in cloud security solutions that include CASBs as a core component.

Opportunities

The cloud access security broker market offers strong growth potential through integration with emerging technologies like artificial intelligence and machine learning. These integrations can enhance threat detection capabilities and automate policy enforcement, reducing the burden on IT teams. As more businesses transition to multi-cloud and hybrid cloud models, opportunities for CASBs to provide unified visibility and control across diverse environments will expand. Additionally, there is a rising opportunity in vertical-specific CASB solutions tailored for industries like healthcare, finance, and education, where data sensitivity and compliance are particularly critical.

Challenges

Despite its growth, the cloud access security broker market faces certain challenges. One major obstacle is the complexity involved in deploying and managing CASB solutions in large, distributed IT environments. Integration issues with existing security infrastructures, such as identity and access management (IAM) and endpoint protection systems, can hinder adoption. Furthermore, there is a learning curve associated with understanding the full scope of CASB functionalities, especially for smaller organizations with limited cybersecurity expertise. Concerns over performance overhead and data latency also pose challenges to seamless CASB deployment.

Regional Insights

North America currently dominates the cloud access security broker market due to early cloud adoption, a mature cybersecurity ecosystem, and stringent regulatory requirements. The United States remains a hotspot for innovation, with major vendors headquartered in the region. Europe follows closely, with increased demand driven by GDPR compliance and a growing emphasis on secure digital transformation. In the Asia-Pacific region, rapid cloud adoption across enterprises in India, China, and Southeast Asia is creating new opportunities for CASB vendors. Meanwhile, Latin America and the Middle East are gradually entering the market as they enhance their cybersecurity frameworks in response to rising cyber threats.

Recent Developments

Recent advancements in the cloud access security broker market include the development of API-based CASB solutions that offer deeper integration and more granular control within cloud-native applications. Vendors are increasingly incorporating behavior analytics to improve the identification of anomalous activity and insider threats. Several leading providers have launched next-generation CASB offerings that seamlessly integrate with zero trust architectures. Strategic mergers and acquisitions are also shaping the competitive landscape, as larger cybersecurity firms acquire CASB vendors to broaden their cloud security portfolios. Moreover, real-time monitoring and policy enforcement capabilities are becoming standard features in newer CASB models.

Cloud Access Security Broker Market Companies

- Broadcom Corporation

- Censornet

- Forcepoint

- iboss

- Lookout, Inc.

- McAfee, LLC

- Microsoft

- Netskope

- Proofpoint, Inc.

- Zscaler, Inc.

Segments Covered in the Report

By Solution

- Control and Monitoring Cloud Services

- Risk and Compliance Management

- Data Security

- Threat Protection

- Others

By Deployment Mode

- IaaS

- PaaS

- SaaS

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-Use

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Education

- Manufacturing

- Government

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa