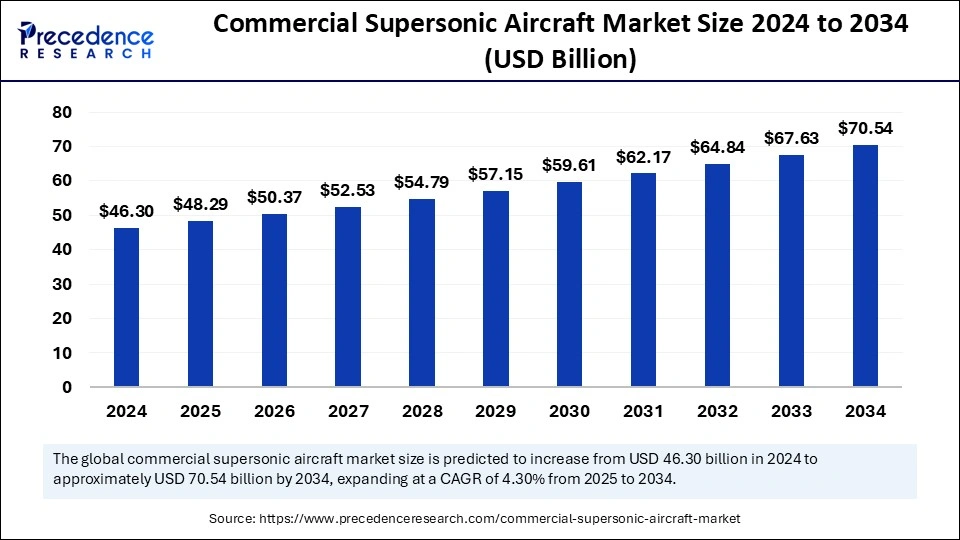

Commercial supersonic aircraft market size expected to rise from USD 46.30 billion in 2024 to USD 70.54 billion by 2034, growing at 4.30% CAGR.

Commercial Supersonic Aircraft Market Key Takeaways

-

North America dominated the commercial supersonic aircraft market with a 54% share in 2024, while Asia Pacific is set to grow at a CAGR of 3.9% through 2034.

-

The commercial supersonic aircraft segment led the market by aircraft type with a 57% share in 2024, while the business jet supersonic aircraft segment is expected to expand at a 4.6% CAGR.

-

The turbofan engines segment contributed the highest market share of 67% by engine type in 2024, while the turbojet engines segment is projected to grow at 3.91% CAGR from 2025 to 2034.

-

The commercial airline agencies segment held 48% of the market share by end-use industry in 2024, with the private aerospace companies segment projected to witness 4.5% CAGR growth.

Commercial Supersonic Aircraft Market Overview

The commercial supersonic aircraft market is experiencing renewed interest and rapid growth due to advancements in aviation technology and increasing demand for faster air travel. Supersonic aircraft are designed to fly at speeds greater than Mach 1, significantly reducing travel time between destinations. While commercial supersonic flights have been absent since the retirement of the Concorde in 2003, recent technological developments and increasing investments in supersonic aviation are driving the re-emergence of this market.

Commercial supersonic aircraft are expected to revolutionize long-haul travel by reducing flight times by 50% or more. For example, a typical transatlantic flight that takes around seven hours on a conventional aircraft can be reduced to three hours using a supersonic jet. The growing demand for luxury and premium air travel, along with advancements in aerodynamics, noise reduction technologies, and sustainable fuel alternatives, is propelling the development of next-generation supersonic aircraft. Several aerospace companies are actively working on designing and developing commercial supersonic jets that comply with modern environmental regulations while ensuring passenger safety and comfort.

Drivers of the Commercial Supersonic Aircraft Market

-

Increasing Demand for Faster Air Travel:

The growing need for faster and more efficient travel is a key driver of the commercial supersonic aircraft market. Business travelers, high-net-worth individuals, and government officials are seeking faster travel solutions, making supersonic air travel a lucrative option. -

Technological Advancements in Aerodynamics and Propulsion:

Recent advancements in aerodynamic designs, lightweight materials, and innovative propulsion technologies are making supersonic flight more feasible and efficient. Improved fuel efficiency and reduced noise levels are encouraging the development of next-generation supersonic jets. -

Rising Interest from Aerospace Giants and Startups:

Established aerospace companies and startups are investing heavily in the development of commercial supersonic aircraft. Companies such as Boom Supersonic, Aerion, and Spike Aerospace are leading the charge by designing aircraft capable of supersonic speeds while addressing concerns related to noise pollution and fuel efficiency. -

Increased Government Support and Regulatory Flexibility:

Governments and regulatory authorities are increasingly supporting the development of commercial supersonic aircraft by creating frameworks to regulate noise pollution and environmental impact. The relaxation of noise regulations for supersonic flights over land is expected to accelerate market growth.

Opportunities in the Commercial Supersonic Aircraft Market

-

Development of Sustainable Aviation Fuels (SAF):

The growing emphasis on reducing carbon emissions in the aviation sector is driving the adoption of sustainable aviation fuels (SAF). Supersonic aircraft manufacturers are exploring the use of SAF to minimize the environmental impact of high-speed air travel, opening new opportunities for sustainable growth. -

Emergence of Hypersonic Travel:

The development of hypersonic travel, which involves speeds exceeding Mach 5, presents a future opportunity for the commercial supersonic aircraft market. Innovations in propulsion systems and materials are expected to pave the way for even faster air travel in the coming decades. -

Growing Demand for Premium Air Travel:

The rising demand for luxury and premium air travel is creating a niche market for supersonic aircraft. High-net-worth individuals and business executives are willing to pay a premium for faster travel times, creating lucrative opportunities for supersonic jet manufacturers.

Challenges Facing the Commercial Supersonic Aircraft Market

-

Environmental Concerns and Carbon Emissions:

Supersonic aircraft consume more fuel than conventional jets, leading to higher carbon emissions. Addressing environmental concerns and developing eco-friendly propulsion systems are critical challenges for the market. -

Noise Pollution and Sonic Boom Regulations:

One of the most significant challenges facing the commercial supersonic aircraft market is noise pollution caused by sonic booms. Regulatory restrictions on supersonic flights over land due to sonic boom concerns limit the operational range and viability of these aircraft. -

High Development and Operational Costs:

The development and operation of supersonic aircraft require substantial investment, which can limit the entry of new players into the market. High manufacturing and maintenance costs pose challenges to achieving widespread adoption and commercial viability.

Regional Analysis of the Commercial Supersonic Aircraft Market

North America:

North America dominates the commercial supersonic aircraft market, driven by significant investments from aerospace companies and favorable regulatory frameworks. The United States is home to leading players such as Boom Supersonic and Aerion Supersonic, which are developing next-generation supersonic jets. The Federal Aviation Administration (FAA) is also actively working on regulations to facilitate the return of commercial supersonic flights.

Europe:

Europe is witnessing increasing interest in commercial supersonic aviation, with countries such as the United Kingdom and France focusing on research and development initiatives. The European Union is supporting projects aimed at reducing noise pollution and carbon emissions associated with supersonic flights.

Asia Pacific:

Asia Pacific is expected to experience significant growth in the commercial supersonic aircraft market due to the increasing demand for premium air travel and growing investments in aviation technology. Countries such as Japan and China are exploring supersonic flight technologies to cater to the growing demand for faster air travel.

Middle East and Africa:

The Middle East and Africa region is emerging as a potential market for commercial supersonic aircraft, driven by the presence of high-net-worth individuals and growing demand for luxury air travel. The region’s strategic geographic location as a global transit hub further enhances its potential as a key market for supersonic aviation.

Recent News in the Commercial Supersonic Aircraft Market

-

In March 2025, Boom Supersonic announced successful test flights of its XB-1 demonstrator aircraft, marking a significant milestone in the development of commercial supersonic aviation.

-

In January 2025, Aerion Supersonic secured additional funding to accelerate the production of its AS2 supersonic business jet, which is expected to enter commercial service by 2027.

-

In February 2025, NASA announced the completion of its Low-Boom Flight Demonstration project, aimed at developing technologies to minimize sonic booms and pave the way for supersonic flights over land.

Commercial Supersonic Aircraft Market Companies

- BAE Systems

- Airbus S.A.S.

- The Boeing Company

- Dassault Aviation SA

- Lockheed Martin Corporation

- Saab AB

- Hindustan Aeronautics Limited

- Spike Aerospace, Inc.

- Aieron

- Boom Technology, Inc.

- United Aircraft Corporation

- Aviation Industry Corporation of China

Segments Covered in the Report

By Aircraft Type

- Commercial Supersonic Aircraft

- Business Jet Supersonic Aircraft

By Engine Type

- Turbojet Engines

- Turbofan Engines

By End-use Industry

- Commercial Airline Agencies

- Private Aerospace Companies

- Luxury Travel Operators

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/