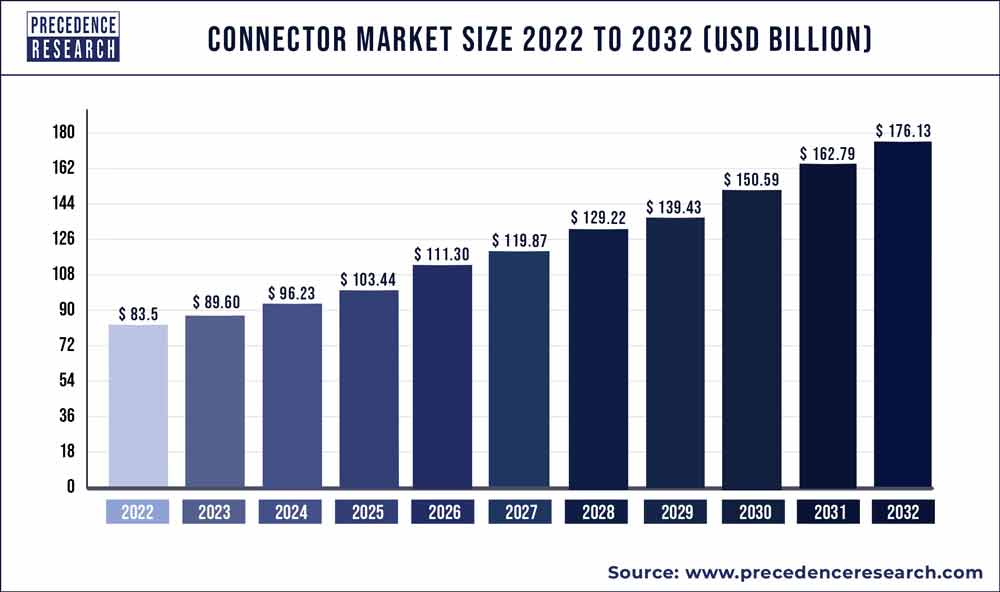

The global connector market size was estimated at USD 83.5 billion in 2022 and is projected to hit around USD 176.13 billion by 2032, registering a CAGR of 7.80% during the forecast period from 2023 to 2032.

Key Takeaways

- Asia Pacific contributed more than 41% of revenue share in 2022.

- Europe is estimated to expand the fastest CAGR between 2023 and 2032.

- By product, the PCB connectors segment has held the largest market share of 31% in 2022.

- By product, the I/O connectors segment is anticipated to grow at a remarkable CAGR of 8.2% between 2023 and 2032.

- By end user, the telecom segment generated over 32% of revenue share in 2022.

- By end user, the aerospace and defense segment is expected to expand at the fastest CAGR over the projected period.

Overview

A connector functions as a specialized bridge, seamlessly uniting diverse elements. These components act as junctions, linking items across various domains such as electronics, automotive, or machinery. In the electronic realm, connectors play the role of intricate puzzle pieces, bringing together wires and components for the exchange of power and data. They come in various configurations, each tailored to specific requirements, emphasizing the importance of precision for a harmonious connection. Connectors are typically categorized as male and female counterparts; the male side features pins or prongs that neatly fit into corresponding slots or receptacles on the female side.

The selection of the appropriate connector and its meticulous maintenance are crucial, ensuring the smooth flow of information and power while preventing system malfunctions. Essentially, connectors act as essential conduits, fostering collaboration among distinct elements and enhancing the efficacy of the interconnected system.

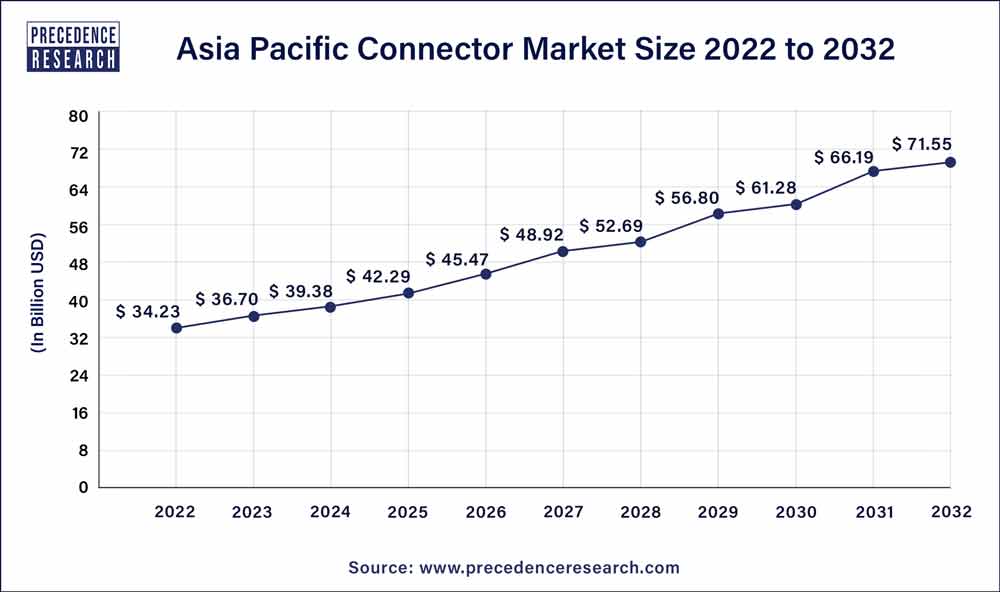

Asia Pacific Connector Market in 2023 To 2032

The Asia Pacific connector market size accounted for USD 34.23 billion in 2022 and is projected to hit USD 71.55 billion by 2032, at a CAGR of 7.70% from 2023 to 2032.

In 2022, the Asia Pacific region dominated with the highest revenue share, accounting for 41%. The influence it exerts on the connector market is significant, driven by unique factors. This region, particularly led by technological powerhouses like China, Japan, and South Korea, serves as a hub for electronic manufacturing. The rapid urbanization and industrial growth in Asia Pacific contribute to the increased demand for connectors in various sectors, including automotive, telecommunications, and consumer electronics.

The rising adoption of 5G technology, the Internet of Things (IoT), and intelligent devices further amplifies the need for connectors. Asia Pacific’s robust manufacturing capabilities, extensive consumer base, and substantial investments in technological infrastructure firmly establish it as a key player in the global connector market.

Connector Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 7.80% |

| Market Size in 2023 | USD 89.60 Billion |

| Market Size by 2032 | USD 176.13 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Medical Billing Outsourcing Market Size, Report By 2032

By Product:

The Connector Market is diverse, encompassing a wide range of products tailored to meet the connectivity needs of various industries. From traditional electrical connectors facilitating power and signal transmission to advanced data connectors, the market has evolved significantly. High demand exists for connectors like USB, HDMI, and Ethernet in the consumer electronics sector, while industries such as automotive and aerospace rely heavily on specialized connectors for complex applications. Additionally, there’s a growing market for fiber optic connectors as the demand for high-speed data transmission continues to rise across sectors.

By End User:

The end-user landscape of the Connector Market is vast and includes industries such as automotive, telecommunications, healthcare, aerospace, and more. In the automotive sector, connectors play a crucial role in modern vehicles, facilitating electronic control systems and in-vehicle communication. Telecommunications heavily relies on connectors for network infrastructure, with the advent of 5G driving further demand. The healthcare industry utilizes connectors in medical devices and equipment, ensuring precision and reliability. Aerospace applications range from avionics to in-flight entertainment systems, showcasing the diverse applications of connectors across various end-user industries. The increasing integration of electronic components in almost every industry ensures a continuous and expanding demand for connectors.

Recent Developments

- In March 2023, Amphenol introduced a reverse bayonet coupling connector designed for easy field installation, simplifying maintenance tasks. The GTC-E Series, an iteration of Amphenol’s GT Reverse Bayonet Coupling Connector Series, proves highly suitable for various applications, including rail, heavy machinery, machine tools, and factory automation. Notably, this connector boasts a UL94-V0 hard plastic insert and features user-friendly crimp contacts, ensuring straightforward on-site repairs with industry-standard crimp tools.

- In March 2023, Hirose Electric unveiled the IT14 Series, a unique hermaphroditic board-to-board connector capable of supporting lightning-fast 112Gbps PAM4 data transmission.

- In January 2022, TE Connectivity (TE) presented the DBAS 9 connector, tailored for harsh military and space environments. It offers increased configuration flexibility, providing designers with greater creative freedom in challenging applications.

Connector Market Players

- Amphenol

- TE Connectivity

- Molex

- Hirose Electric

- Delphi Technologies

- ITT Inc.

- Yazaki Corporation

- Foxconn Technology Group

- Rosenberger

- LEMO

- Phoenix Contact

- Samtec

- JST

- Cinch Connectivity Solutions

- Aptiv

Segments Covered in the Report

By Product

- PCB Connectors

- I/O Connectors

- Circular Connectors

- Fiber Optic Connectors

- RF Coaxial Connectors

- Others

By End User

- Consumer Electronics

- Telecom

- Automotive

- Energy and Power

- Aerospace and Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Table of Contact:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Connector Market

5.1. COVID-19 Landscape: Connector Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Connector Market, By Product

8.1. Connector Market Revenue and Volume, by Product, 2023-2032

8.1.1. PCB Connectors

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. I/O Connectors

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

8.1.3. Circular Connectors

8.1.3.1. Market Revenue and Volume Forecast (2020-2032)

8.1.4. Fiber Optic Connectors

8.1.4.1. Market Revenue and Volume Forecast (2020-2032)

8.1.5. RF Coaxial Connectors

8.1.5.1. Market Revenue and Volume Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Connector Market, By End User

9.1. Connector Market Revenue and Volume, by End User, 2023-2032

9.1.1. Consumer Electronics

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Telecom

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Automotive

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

9.1.4. Energy and Power

9.1.4.1. Market Revenue and Volume Forecast (2020-2032)

9.1.5. Aerospace and Defense

9.1.5.1. Market Revenue and Volume Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Connector Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Volume Forecast, by End User (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Volume Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Volume Forecast, by End User (2020-2032)

Chapter 11. Company Profiles

11.1. Amphenol

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. TE Connectivity

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Molex

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hirose Electric

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Delphi Technologies

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ITT Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Yazaki Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Foxconn Technology Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rosenberger

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. LEMO

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308