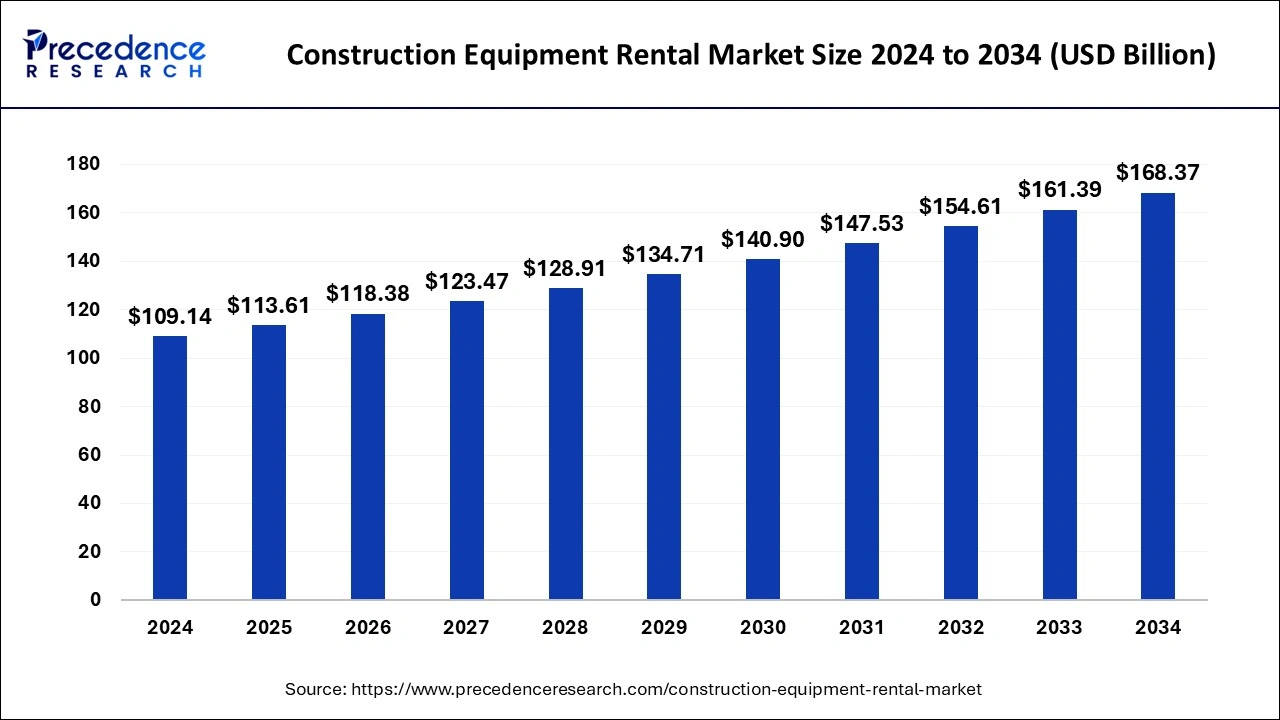

The construction equipment rental market is projected to grow from USD 109.14 billion in 2024 to USD 168.37 billion by 2034, with a CAGR of 4.43%.

Construction Equipment Rental Market Key Takeaways

- North America led the construction equipment rental market with a 31.64% share in 2024.

- North America is projected to grow at the highest CAGR between 2024 and 2034.

- The earthmoving machinery segment held the largest market share by product in 2024.

Market Overview

The construction equipment rental market is experiencing rapid growth, driven by the increasing demand for cost-effective and flexible solutions in the construction industry. Renting construction equipment provides companies with access to high-quality machinery without the need for heavy capital investment. This approach helps construction firms reduce operational costs, manage project timelines efficiently, and avoid equipment maintenance expenses. Construction equipment rental includes a wide range of machinery such as excavators, loaders, bulldozers, cranes, and aerial work platforms, catering to the diverse needs of residential, commercial, and industrial projects.

The growing adoption of advanced equipment with improved safety features and automation capabilities is further boosting the market. Additionally, the rising focus on infrastructure development, urbanization, and smart city initiatives across emerging economies is contributing to the expansion of the construction equipment rental market.

Drivers

- Cost Efficiency and Reduced Capital Investment

One of the primary drivers of the construction equipment rental market is the significant cost savings it offers to construction companies. Renting equipment eliminates the need for large upfront investments and reduces long-term ownership costs. Companies can allocate their financial resources more efficiently, focusing on core business operations while meeting project requirements. - Rising Infrastructure Development and Urbanization

The rapid pace of infrastructure development, particularly in emerging economies, is fueling the demand for construction equipment rental. Governments worldwide are investing in large-scale projects, including roads, highways, bridges, and residential complexes. Renting equipment allows construction firms to scale operations based on project demands without incurring heavy expenses. - Technological Advancements and Smart Equipment Adoption

The integration of smart technologies, telematics, and IoT in construction equipment is enhancing operational efficiency and safety. Rental companies are offering modern equipment with advanced features such as real-time monitoring, predictive maintenance, and automated controls. These advancements reduce downtime, improve productivity, and ensure compliance with safety regulations.

Opportunities

- Growing Demand for Green and Sustainable Construction Equipment

The increasing focus on environmental sustainability and green construction practices is creating opportunities for eco-friendly equipment rentals. Rental companies can capitalize on the growing demand for electric and hybrid construction machinery that reduces carbon emissions and minimizes environmental impact. - Expansion of Smart City Projects and Infrastructure Initiatives

Governments across the globe are launching smart city projects and large-scale infrastructure initiatives that require specialized construction equipment. Rental companies can leverage these opportunities by offering advanced machinery tailored to the specific needs of smart city construction. - Rising Adoption of Digital Platforms for Equipment Rental

The adoption of digital platforms and online marketplaces for construction equipment rental is revolutionizing the industry. These platforms provide greater transparency, streamlined processes, and easy access to a wide range of equipment, creating new revenue streams for rental companies.

Challenges

- High Maintenance and Operating Costs

Maintaining and servicing a diverse fleet of construction equipment involves high costs and resource allocation. Rental companies need to ensure the availability of well-maintained equipment to minimize downtime and deliver reliable services. - Fluctuations in Construction Industry Activity

The construction industry is highly cyclical and influenced by economic conditions, government policies, and seasonal factors. Fluctuations in construction activity can impact the demand for equipment rentals, leading to revenue volatility for rental companies. - Regulatory Compliance and Safety Standards

Ensuring compliance with stringent safety standards and environmental regulations is a critical challenge for rental companies. Non-compliance can lead to penalties, reputational damage, and operational disruptions.

Regional Insights

- North America

North America dominates the construction equipment rental market, driven by robust infrastructure development, increased investment in residential and commercial projects, and the adoption of advanced construction technologies. The United States and Canada are key contributors to market growth, with rental companies offering a wide range of equipment to meet diverse industry needs. - Europe

Europe is witnessing steady growth in the construction equipment rental market due to ongoing urban renewal projects, smart city initiatives, and the adoption of green construction practices. Countries such as Germany, the UK, and France are investing in sustainable infrastructure development, driving demand for eco-friendly equipment rentals. - Asia Pacific

Asia Pacific is expected to experience the highest growth rate in the construction equipment rental market. The region’s rapid industrialization, urbanization, and infrastructure expansion are driving the demand for construction equipment rentals. Countries such as China, India, and Japan are leading in the adoption of advanced construction technologies. - Latin America and Middle East & Africa

Latin America and the Middle East & Africa are gradually emerging as key markets for construction equipment rental, fueled by government initiatives and infrastructure investments. However, challenges such as political instability and regulatory complexities may hinder market growth in these regions.

Recent News on Construction Equipment Rental Market

- Launch of Digital Platforms to Enhance Equipment Rental Services

Leading rental companies have introduced digital platforms that streamline equipment booking, monitoring, and management processes, improving overall customer experience and operational efficiency. - Strategic Partnerships to Expand Fleet Capacity and Market Presence

Major players in the construction equipment rental market are entering into strategic partnerships and collaborations to expand their fleet capacity, strengthen market presence, and meet growing customer demands.

Construction Equipment Rental Market Companies

- JCB

- Zahid Group

- Industrial Supplies Development Co. Ltd

- Ahern Equipment Rentals

- John Deere

- Caterpillar Inc.

- Gemini Equipment and Rentals (GEAR)

- Hertz Equipment

- Komatsu Equipment

- Maxim Crane Works

- Neff Rental

Segments Covered in the Report

By Product

- Material Handling Machinery

- Shelves

- Bins

- Silos

- Conveyors

- Pallet trucks

- Fork lifts

- Frames

- Sliding racks

- Bulk containers

- Platform trucks

- Hand trucks

- Cranes

- Others

- Earth Moving Machinery Concrete

- Excavators

- Loading shovels

- Site dumpers

- Dump trucks

- Others

- Concrete and Road Construction Machinery

- Pavers

- Trenchers

- Planers

- Rollers

- Hot boxes

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa