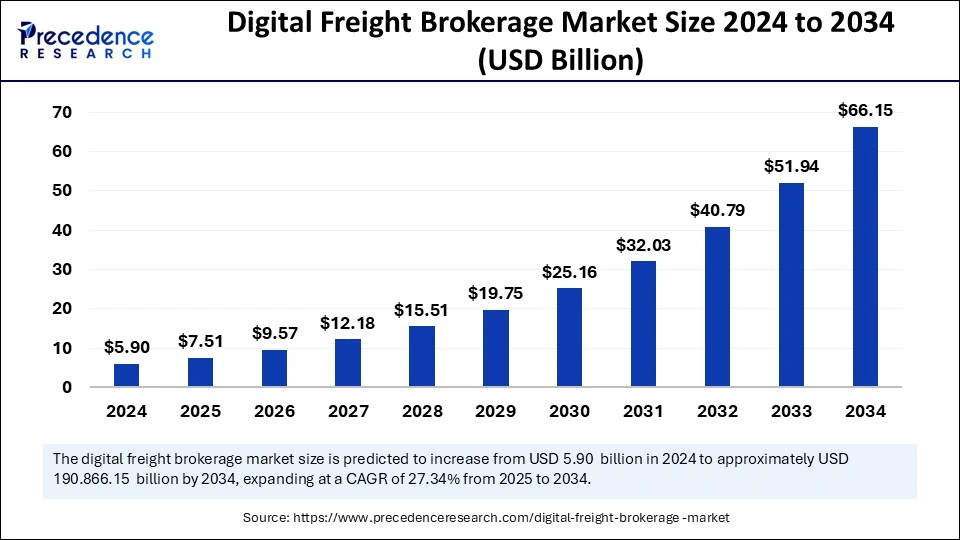

The global digital freight brokerage market was valued at USD 5.9 billion in 2024 and is expected to soar to USD 66.15 billion by 2034, growing at a CAGR of 27.34% from 2025 to 2034.

Digital Freight Brokerage Market Key Takeaways

- North America dominated the global market with the largest market share around 43% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By transportation mode, the road freight segment captured the more than 75% market share in 2024.

- By transportation mode, the air freight segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By service type, the full-truckload (FTL) brokerage segment accounted for a considerable share in 2024.

- By service type, the refrigerated freight (temp-controlled) segment is anticipated to expand at significant CAGR over the studied years.

- By customer type, the business-to-business (B2B) segment held the biggest market share in 2024.

- By customer type, the business-to-consumer (B2C) segment is projected to expand rapidly in the coming years.

- By end-user, the retail and e-commerce segment dominated the market in 2024.

- By end-user, the healthcare and pharmaceutical segment is expected to grow at a significant CAGR during the projection period.

Market Overview

The digital freight brokerage market is experiencing transformative growth, reshaping traditional logistics through the integration of advanced technologies. At its core, digital freight brokerage refers to the use of digital platforms to connect shippers with freight service providers. Unlike traditional freight brokers who rely on manual processes and telephonic negotiations, digital freight brokers utilize automated platforms powered by artificial intelligence, data analytics, and real-time tracking systems. These platforms streamline freight matching, pricing, and route optimization, leading to cost savings, greater efficiency, and improved transparency across the logistics value chain.

As e-commerce continues to thrive and consumer expectations shift toward faster and more reliable deliveries, the demand for agile and technologically adept logistics solutions has intensified. This surge is fueling the growth of the digital freight brokerage market, particularly in North America, Europe, and Asia-Pacific.

Companies within this market are evolving from mere intermediaries into full-scale logistics partners, offering end-to-end services including real-time freight tracking, predictive analytics, and digital documentation. The digital freight brokerage market is rapidly becoming an indispensable component of the global supply chain ecosystem.

Drivers

Several key drivers are propelling the expansion of the digital freight brokerage market. Foremost among these is the rapid proliferation of e-commerce and direct-to-consumer delivery models. As online shopping becomes the norm, businesses require agile, scalable, and technology-driven logistics solutions to handle increasing shipment volumes. Digital freight platforms offer real-time capacity insights and faster freight matching, making them an essential tool in handling this surge.

Another major driver is the growing need for transparency and real-time visibility in freight operations. Shippers are increasingly demanding granular tracking and predictive ETAs, especially for high-value or time-sensitive goods. The digital freight brokerage market addresses these needs with advanced telematics and AI-driven tracking systems that enhance operational control and minimize uncertainties. Additionally, the shift from static pricing models to dynamic, demand-responsive pricing has further fueled adoption.

Cost optimization is also a compelling factor contributing to the growth of the digital freight brokerage market. Traditional freight brokers often lack efficiency and scalability, leading to higher brokerage fees and operational inefficiencies. Digital platforms automate the process of load matching, reducing overhead and eliminating unnecessary intermediaries. This results in cost savings for both shippers and carriers, increasing the overall appeal of the digital freight brokerage market to a wider range of businesses.

Opportunities

The digital freight brokerage market is brimming with opportunities, particularly in emerging economies where digital transformation is accelerating. As logistics infrastructure improves in countries like India, Brazil, and Indonesia, digital freight platforms are becoming more viable and attractive. These markets, which previously relied heavily on fragmented and manual freight processes, present fertile ground for digital brokerage platforms that promise efficiency and scalability.

There is also an untapped opportunity in offering value-added services within the digital freight brokerage market. These services include freight insurance, customs clearance, temperature-controlled shipping, and multi-modal transport solutions. As customers seek one-stop solutions for their logistics needs, companies that can offer bundled services through a single platform will have a significant competitive advantage.

Another major opportunity lies in leveraging advanced data analytics and machine learning. By analyzing vast datasets on routes, delivery times, traffic patterns, and pricing trends, companies in the digital freight brokerage market can offer predictive freight solutions that optimize delivery times and reduce empty miles. This enhances not only profitability but also sustainability by reducing fuel consumption and carbon emissions. As environmental concerns continue to influence supply chain decisions, the digital freight brokerage market stands poised to deliver both economic and ecological value.

Challenges

Despite its immense potential, the digital freight brokerage market faces several challenges that could hamper its growth trajectory. A key concern is resistance to change within the logistics industry. Many traditional freight operators remain hesitant to adopt digital platforms due to the learning curve involved and skepticism about data security and automation. Overcoming this cultural and operational inertia requires targeted education and trust-building efforts from digital freight brokerage providers.

Another significant challenge is the high level of competition in the digital freight brokerage market. The market is flooded with numerous players, ranging from startups to large-scale logistics firms, all vying for market share. This has led to price wars, margin pressures, and customer churn. Companies must therefore differentiate themselves through superior technology, customer service, and value-added offerings to retain clients and ensure long-term sustainability.

Cybersecurity threats also loom large in the digital freight brokerage market, given the vast amounts of sensitive data involved. Digital platforms handle everything from shipment details to financial transactions, making them attractive targets for hackers. Ensuring end-to-end data protection and compliance with global cybersecurity standards is imperative for all players in the digital freight brokerage market to maintain trust and credibility.

In addition, regulatory complexities in cross-border freight present a significant hurdle. Customs regulations, documentation requirements, and compliance norms vary widely by region, adding layers of complexity to digital freight operations. Market players must invest in building robust regulatory compliance systems to operate effectively in the global digital freight brokerage market.

Regional Insights

Geographically, the digital freight brokerage market exhibits strong regional diversification, with North America leading in terms of technological maturity and market adoption. The United States, in particular, has seen a surge in digital freight startups and established logistics firms embracing digital platforms. High internet penetration, strong transport infrastructure, and early adoption of technologies like AI and IoT have given North America a competitive edge in the digital freight brokerage market.

Europe follows closely, with countries like Germany, France, and the UK embracing digital freight solutions to optimize cross-border logistics within the EU. The push for greener transportation and carbon-neutral supply chains has further bolstered digital adoption in this region. Digital freight brokers in Europe are aligning their services with sustainability goals, leveraging data to reduce emissions and improve logistics planning.

Asia-Pacific represents the fastest-growing region in the digital freight brokerage market, fueled by booming e-commerce, rising disposable incomes, and urbanization. China and India are at the forefront of this transformation, with numerous tech-driven logistics startups emerging to fill market gaps. Governments in the region are also investing heavily in digital infrastructure and smart logistics hubs, laying the foundation for sustained growth in the digital freight brokerage market.

Latin America and the Middle East are emerging as potential hotspots, driven by regional trade growth and increasing digital penetration. Although these regions currently face logistical and infrastructural challenges, the potential for long-term growth in the digital freight brokerage market remains high. Companies entering these markets are focusing on localization strategies, including language customization and regional compliance features, to maximize adoption.

Recent Developments

Recent developments in the digital freight brokerage market reflect a rapidly evolving landscape marked by innovation and strategic partnerships. A notable trend is the integration of artificial intelligence and predictive analytics into freight platforms. These tools enable dynamic pricing, intelligent load matching, and proactive risk management, enhancing both user experience and operational efficiency.

Another major development is the increasing number of strategic mergers and acquisitions. Large logistics firms are acquiring digital freight startups to expand their technological capabilities and customer base. This consolidation trend is reshaping the competitive dynamics of the digital freight brokerage market, enabling stronger players to offer more integrated and scalable solutions.

Blockchain technology is also gaining traction within the digital freight brokerage market, particularly for secure documentation, smart contracts, and transparent shipment tracking. Blockchain enhances trust and reduces the risk of fraud, especially in high-value or cross-border freight transactions. As more logistics firms explore decentralized ledger technologies, the digital freight brokerage market is likely to witness a shift toward more secure and tamper-proof systems.

Additionally, sustainability has become a focal point in recent product developments. Digital freight platforms are introducing features that help customers calculate and minimize their carbon footprints. This aligns with global climate goals and caters to environmentally conscious clients, adding another layer of value to digital freight services in the digital freight brokerage market.

Digital Freight Brokerage Market Companies

- C.H. Robinson Worldwide, Inc.

- Coyote Logistics, LLC (a subsidiary of RXO, Inc.)

- Echo Global Logistics, Inc.

- J.B. Hunt Transport Services, Inc.

- Landstar System Holdings, Inc.

- Mode Global

- Schneider National, Inc.

- Total Quality Logistics, LLC

- Uber Freight (a subsidiary of Uber Technologies, Inc.)

- WWEX Group

Segments Covered in the Report

By Transportation Mode

- Air Freight

- Road Freight

- Rail Freight

- Ocean Freight

By Service Type

- Less-than Truckload (LTL) Brokerage

- Full-truckload (FTL) Brokerage

- Intermodal Brokerage

- Expedited Freight

- Cross-border Freight Brokerage

- Refrigerated Freight (Temp-controlled)

- Others

By Customer Type

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

By End-user

- Manufacturing

- Automotive

- Retail & E-commerce

- Food & Beverages

- Oil & Gas

- Healthcare & Pharmaceutical

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!