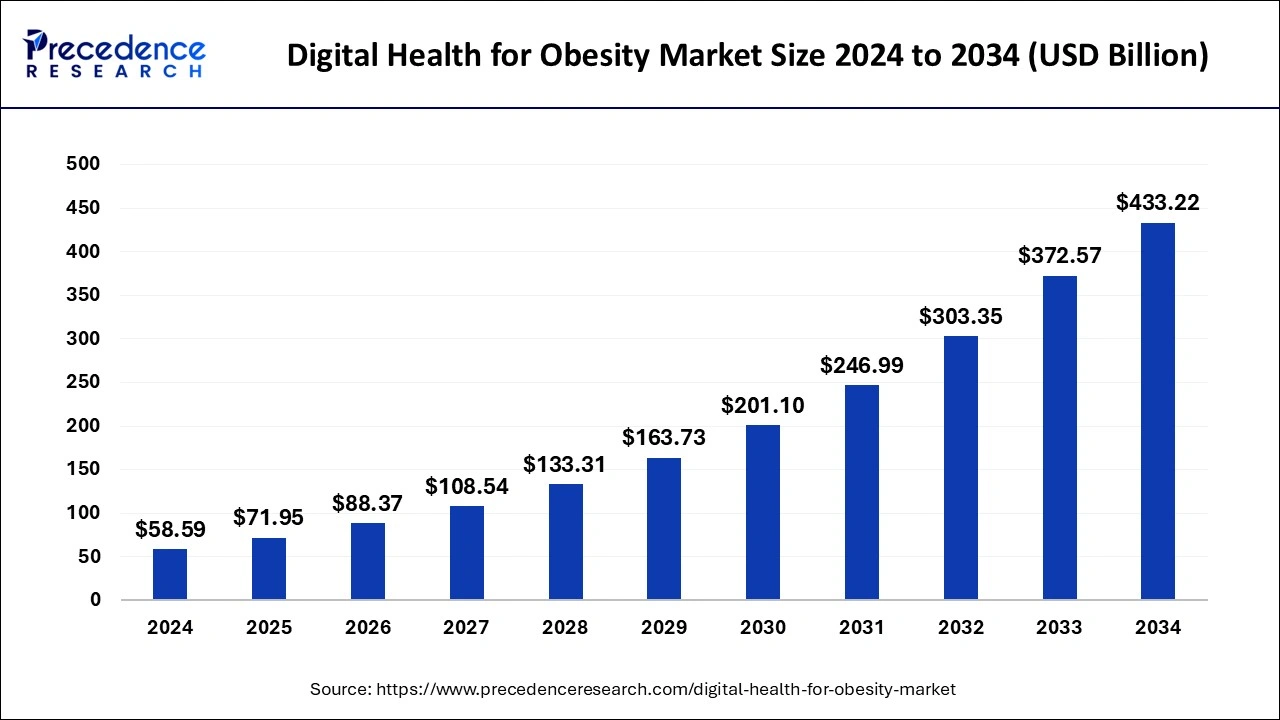

The global digital health for obesity market size accounted for USD 47.70 billion in 2023 and is predicted to attain around USD 372.57 billion by 2033, growing at a CAGR of 22.82% from 2024 to 2033.

Key Points

- The North America digital health for obesity market size accounted for USD 17.17 billion in 2023 and is expected to rise around USD 134.13 billion by 2033.

- North America dominated the market with the largest market share of 36% in 2023.

- Asia Pacific is expected to grow at the highest CAGR in the market by region during the forecast period.

- By component, the services segment dominated the market in 2023.

- By component, the software segment is expected to grow at a rapid pace in the market by component during the forecast period.

- By end-use, the patients segment dominated the market by end-use in 2023.

The digital health market for obesity is experiencing significant growth driven by technological advancements and rising global obesity rates. This market encompasses various digital solutions aimed at prevention, management, and treatment of obesity using innovative technologies such as mobile apps, wearable devices, telemedicine, and data analytics. Key stakeholders include healthcare providers, technology companies, insurers, and research institutions. The market shows promising potential with increasing adoption of digital health tools to address the obesity epidemic worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4245

Growth Factors

Several factors contribute to the growth of the digital health for obesity market. Technological innovations, particularly in wearable devices and mobile health apps, enable real-time monitoring of weight, physical activity, and dietary habits, empowering individuals to make informed lifestyle choices. Rising awareness about the health risks associated with obesity and the importance of preventive healthcare is driving demand for digital solutions. Moreover, supportive government initiatives and increased healthcare spending on chronic disease management further propel market growth.

Region Insights

The adoption of digital health solutions for obesity varies across regions. Developed countries like the United States and Europe lead in terms of market maturity and adoption due to advanced healthcare infrastructure and higher awareness levels. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth fueled by increasing disposable income, improving healthcare access, and growing smartphone penetration. Tailoring digital health interventions to regional cultural and demographic factors is critical for market success.

Digital Health for Obesity Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 22.82% |

| Digital Health for Obesity Market Size in 2023 | USD 47.70 Billion |

| Digital Health for Obesity Market Size in 2024 | USD 58.59 Billion |

| Digital Health for Obesity Market Size by 2033 | USD 372.57 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Health for Obesity Market Dynamics

Drivers

Key drivers of the digital health for obesity market include the growing prevalence of obesity globally, which has created a demand for effective and scalable solutions to manage weight and improve health outcomes. The integration of artificial intelligence and machine learning in digital health platforms enhances personalized interventions and predictive analytics, driving better patient engagement and adherence. Additionally, partnerships between technology companies, healthcare providers, and pharmaceutical firms facilitate innovative digital health solutions and services.

Opportunities

The market presents numerous opportunities for stakeholders. Collaborations between digital health startups and established healthcare organizations can accelerate product development and market penetration. Expanding into untapped markets, especially in developing regions, offers significant growth potential given the rising burden of obesity and increasing acceptance of telemedicine and remote monitoring. Furthermore, leveraging big data analytics to derive actionable insights and tailor interventions based on individual patient needs can unlock new opportunities for personalized obesity management.

Challenges

Despite growth prospects, the digital health for obesity market faces challenges. Data privacy concerns and regulatory complexities surrounding health data protection pose barriers to widespread adoption of digital health solutions. Limited reimbursement policies for digital health services and interoperability issues between different health IT systems can hinder seamless integration into existing healthcare workflows. Moreover, addressing disparities in digital literacy and access to technology among different population groups remains a challenge for ensuring equitable healthcare delivery.

Read Also: Medical Foods Market Size to Worth USD 38.90 Billion By 2033

Digital Health for Obesity Market Recent Developments

- In February 2024, Ease Healthcare, a leading women’s health ecosystem in Asia, launched Elevate, the latest digital health platform, which aims to address metabolic health and weight management issues specifically tailored for women. The platform integrates various elements, including modern medical practices, expert guidance, community support, and digital tools to provide women with effective solutions for sustainable weight loss and improved metabolic health

- In January 2024, Eli Lilly and Company announced LillyDirect™, a new digital healthcare experience for patients in the U.S. living with obesity, migraine, and diabetes. LillyDirect offers disease management resources, including access to independent healthcare providers*, tailored support, and direct home delivery of select Lilly medicines through third-party pharmacy dispensing services.

- In December 2023, Digital health company Hims & Hers launched its much-anticipated weight loss program this week, which includes digital tracking tools, educational content, and access to medications. The new offering, however, does not include prescriptions for the buzzy new weight loss medications known as GLP-1s, at least for now.

- In September 2022, Digital health specialist Kry teamed up with pharma group Novo Nordisk on the development of resources that can help people with obesity manage their condition and adhere to treatment. The partners anticipate that the digital obesity program will launch later this autumn in Sweden, ahead of a broader rollout in other European markets before the end of the year. It is estimated that more than half (53%) of the adults living in the EU are considered to be overweight or obese.

Digital Health for Obesity Market Companies

- WW International

- MyFitnessPal

- Teladoc Health, Inc.

- Fitnesskeeper Inc.

- Healthify (My Diet Coach)

- Fitbit, Inc.

- Noom

- PlateJoy HEALTH

- Tempus

- WellDoc

- Sidekick Health

- BioAge Labs

Segment Covered in the Report

By Component

- Software

- Hardware

- Services

By End-use

- Patients

- Providers

- Payers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/