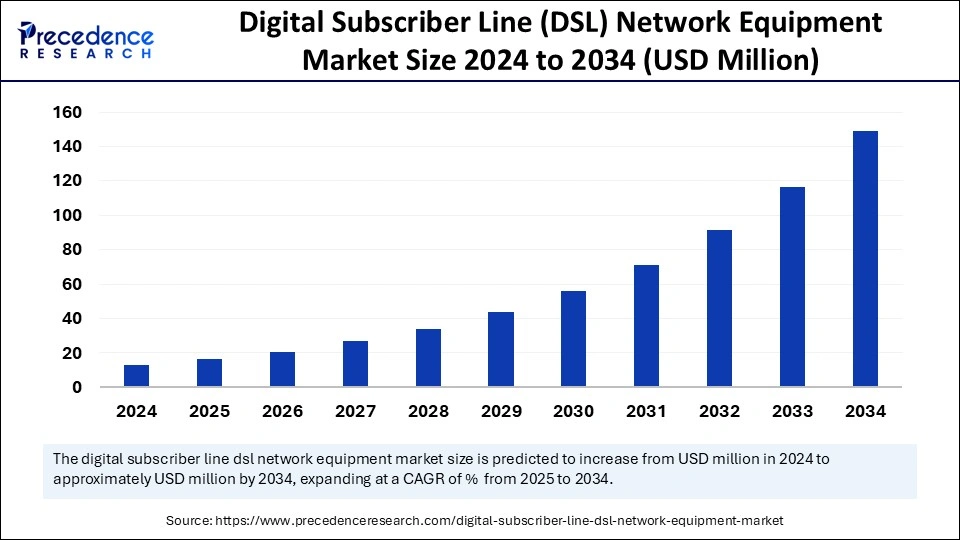

The digital subscriber line network equipment market is set to grow by 2034, fueled by cost-effective broadband demand, VDSL2 and G.fast advancements, and expanding access in emerging economies.

Digital Subscriber Line Network Equipment Market Key Takeaways

- North America dominated the digital subscriber line network equipment market in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the asymmetric digital subscriber line (ADSL) segment dominated the market with the largest share in 2024.

- By product type, the very high bit-rate digital subscriber line (VDSL) segment is predicted to grow at the fastest CAGR in the upcoming years.

- By application, the residential segment held a significant share of the market in 2024.

- By application, the large enterprises segment is expected to witness the fastest growth during the predicted timeframe.

Market Overview

The digital subscriber line network equipment market is experiencing a stable yet evolving phase as demand for cost-effective, high-speed internet access remains consistent across both developed and emerging economies. DSL technology, long considered a legacy solution, is undergoing significant upgrades with VDSL2 and G.fast standards enhancing speed and performance over existing copper lines.

Despite the global push toward fiber optics and wireless connectivity, DSL retains relevance due to its ability to leverage current infrastructure, making it a practical solution for areas where fiber installation is economically or logistically challenging. As a result, the digital subscriber line network equipment market continues to attract investment, especially from telecom operators seeking to maximize return on legacy assets while still improving user experience.

Drivers

Several critical factors are driving growth in the digital subscriber line network equipment market. One of the primary drivers is the affordability and accessibility of DSL compared to other broadband technologies. In many rural and semi-urban areas, DSL remains the most viable method for delivering internet connectivity due to pre-existing telephone line infrastructure.

The advent of advanced standards such as VDSL2 vectoring and G.fast has significantly enhanced DSL capabilities, allowing service providers to offer speeds comparable to entry-level fiber services. This makes DSL particularly attractive in regions with tight budgets and minimal fiber presence. Moreover, the increasing demand for stable internet in residential and small office applications fuels the digital subscriber line network equipment market, especially where consumers prioritize reliability and simplicity over ultra-high-speed options.

Opportunities

Numerous opportunities exist for stakeholders within the digital subscriber line network equipment market. One of the most significant lies in modernizing outdated DSL infrastructure. Equipment vendors and service providers have the opportunity to roll out upgraded solutions that extend the lifespan of copper networks, reducing the need for full fiber deployments. Additionally, markets in Asia-Pacific, Latin America, and parts of Africa present growth potential due to growing digital adoption and infrastructure gaps. In such regions, DSL equipment provides a stepping-stone toward digital inclusion at a lower cost.

Furthermore, hybrid solutions that combine DSL with LTE or fiber backbones are becoming more common, providing vendors with the chance to develop innovative products that bridge old and new network technologies. These innovations are expected to stimulate the digital subscriber line network equipment market as providers aim to meet the needs of underserved users with scalable connectivity.

Challenges

Despite its ongoing relevance, the digital subscriber line network equipment market faces a range of challenges that could inhibit growth. The most prominent is the global trend toward fiber-to-the-home (FTTH) and wireless 5G connectivity. Many governments and telecom operators are prioritizing investment in next-generation broadband infrastructure, which often leaves DSL out of long-term plans.

Another challenge lies in the aging copper infrastructure, which in some regions is deteriorating and expensive to maintain. While advanced technologies like G.fast can deliver high speeds over short distances, performance often suffers over longer loops, creating service consistency issues. Additionally, regulatory pressures and environmental concerns over legacy hardware disposal further complicate operational planning in the digital subscriber line network equipment market. These obstacles make it essential for stakeholders to innovate continually and adapt to the changing broadband landscape.

Regional Insights

The digital subscriber line network equipment market shows differing dynamics across various geographic regions. In North America, DSL has seen a decline in new installations, but there’s still a substantial installed base that requires maintenance and gradual upgrades. Europe continues to invest in VDSL2 infrastructure, particularly in countries like Germany and the UK, where legacy systems remain widespread.

Asia-Pacific represents one of the most promising regions for DSL technology, with large populations in India, Indonesia, and the Philippines still depending on copper-based services. Governments in these areas are prioritizing digital expansion, and DSL provides an affordable, interim solution before full fiber transitions.

Latin America and Africa are emerging regions in the digital subscriber line network equipment market, where the lack of extensive telecom infrastructure gives DSL a valuable role in bridging the digital divide. Overall, regional investments and government policies continue to shape the outlook of the market.

Recent Developments

Recent developments in the digital subscriber line network equipment market highlight a shift toward modernization and convergence. Equipment manufacturers are introducing DSL routers and modems with built-in vectoring support, backward compatibility, and enhanced energy efficiency. Telecom operators are adopting hybrid DSL-fiber solutions to balance cost and performance in competitive service landscapes. Notably, several collaborations between telecom providers and governments have launched public-private initiatives aimed at expanding rural connectivity through DSL and similar technologies.

Additionally, market consolidation is occurring, with larger network equipment providers acquiring smaller players to expand their portfolio of DSL solutions. These movements reflect a pragmatic approach to sustaining the digital subscriber line network equipment market amidst intense technological competition. As long as there remains a gap between full fiber coverage and internet demand, DSL will continue to evolve and find its place in the broadband ecosystem.

Digital Subscriber Line Network Equipment Market Companies

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Nokia Networks

- Telefonaktiebolaget LM Ericsson

- Cisco Systems, Inc.

- Alcatel-Lucent S.A.

- ADC Telecommunications

- Westell Technologies, Inc.

Segments Covered in the Report

By Product Type

- Digital Subscriber Line (IDSL)

- Asymmetric Digital Subscriber Line (ADSL)

- Rate-Adaptive Digital Subscriber Line (RADSL)

- Symmetric Digital Subscriber Line (SDSL)

- High Bit-Rate Digital Subscriber Line (HDSL)

- ISDN Digital Subscriber Line (IDSL)

- Symmetric Digital Subscriber Line (SDSL)

- Very High Bit-rate Digital Subscriber Line (VDSL)

By Application

- Large Enterprises

- Residential

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/