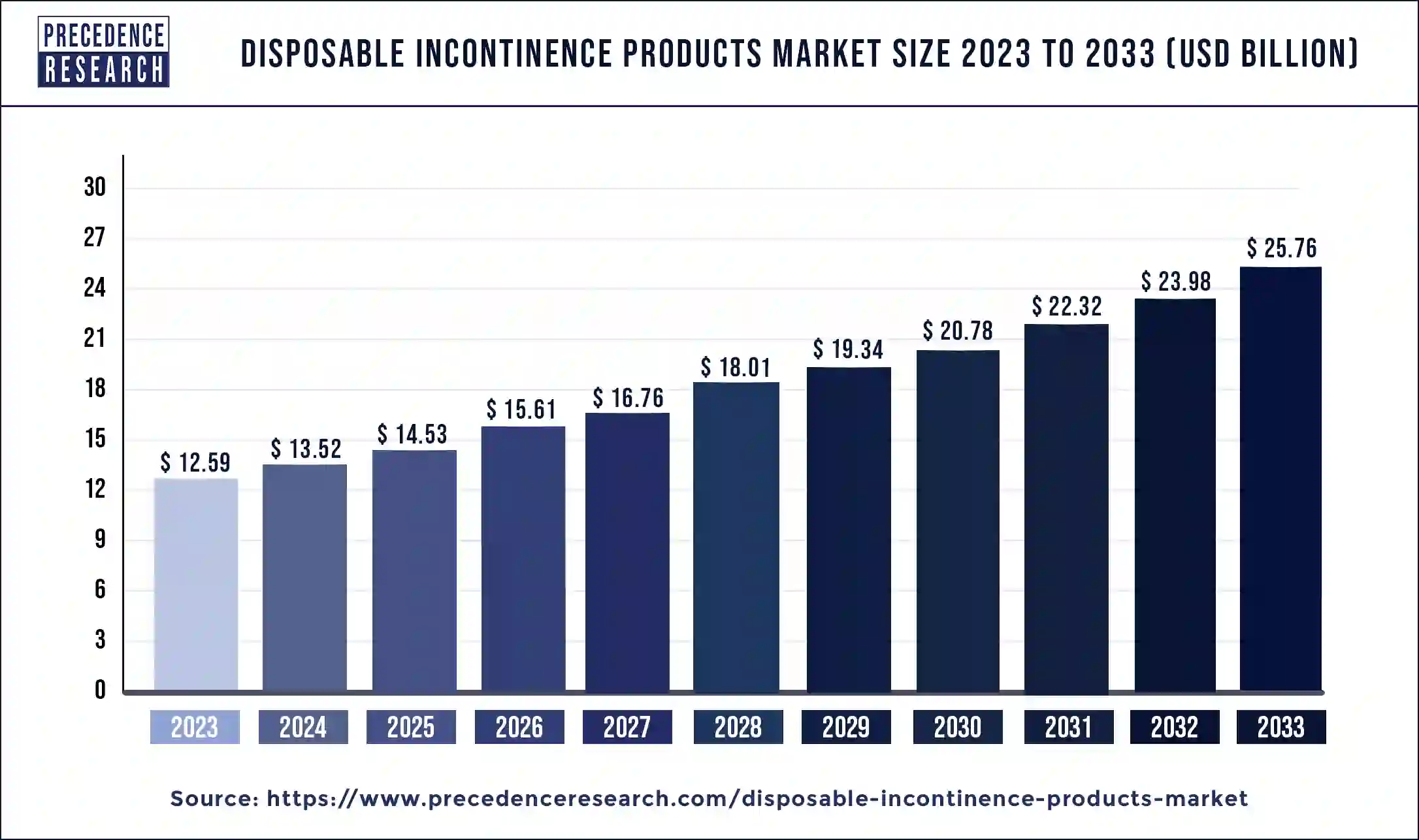

The global disposable incontinence products market size accounted for USD 12.59 billion in 2023 and is projected to attain USD 25.76 billion by 2033, expanding at a CAGR of 7.42% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest share of 35% in 2023.

- By product, the protective incontinence garments segment has held the largest market share of 85% in 2023.

- By application, the fecal incontinence segment has contributed more than 25% of market share in 2023.

- By incontinence type, the mixed segment dominated the market with the largest share in 2023.

- By disease, the chronic disease segment has accounted for more than 26% of the market share in 2023.

- By material, the cotton fabrics segment dominated the market’s largest revenue share in 2023.

- By gender, the female segment dominated the disposable incontinence products market in 2023.

- By age, the 60 to 79 years segment dominated the market in 2023.

- By distribution channel, the retail stores segment dominated the market in 2023.

- By end-use, the ambulatory surgical centers segment held the largest share of the market in 2023.

The disposable incontinence products market is experiencing substantial growth globally, driven by the rising prevalence of urinary and fecal incontinence among aging populations, increasing awareness about personal hygiene, and advancements in product design and technology. Disposable incontinence products, including adult diapers, pads, and protective underwear, offer convenience, comfort, and discretion to individuals managing incontinence, thereby enhancing their quality of life. With changing demographics and evolving consumer preferences, the demand for disposable incontinence products is expected to continue growing, fueling market expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3980

Growth Factors:

Several factors contribute to the robust growth of the disposable incontinence products market. One key driver is the aging population demographic trend, particularly in developed countries. As the elderly population grows, the prevalence of urinary and fecal incontinence increases, driving demand for effective and discreet incontinence management solutions. Disposable incontinence products offer convenience and dignity to individuals experiencing incontinence, promoting their adoption and usage across different age groups and demographic segments.

Moreover, increasing awareness about personal hygiene and healthcare management drives market growth. Healthcare initiatives, public awareness campaigns, and educational efforts aimed at destigmatizing incontinence and promoting preventive measures encourage individuals to seek appropriate incontinence management solutions. Disposable incontinence products provide a hygienic and convenient alternative to traditional cloth-based solutions, contributing to market adoption and expansion.

Furthermore, advancements in product design, materials, and technology enhance the performance and comfort of disposable incontinence products, driving consumer satisfaction and loyalty. Innovations such as superabsorbent polymers, odor control technologies, and breathable materials improve product efficacy, leakage protection, and skin health, addressing key consumer needs and preferences. Additionally, the availability of a wide range of product options, including gender-specific designs and discreet packaging, caters to diverse consumer preferences and contributes to market growth.

Region Insights:

The disposable incontinence products market exhibits a global presence, with North America, Europe, Asia-Pacific, and other regions representing key growth markets. North America dominates the market due to the high prevalence of urinary and fecal incontinence, well-established healthcare infrastructure, and strong consumer awareness about incontinence management solutions. The region’s aging population demographic and increasing healthcare expenditure drive market demand for disposable incontinence products.

In Europe, changing demographic trends and government initiatives to promote healthy aging contribute to market growth. The region’s aging population, coupled with rising healthcare awareness and reimbursement policies, fuels demand for disposable incontinence products. Moreover, the presence of prominent manufacturers and technological advancements in product design and innovation support market expansion across European countries.

Asia-Pacific emerges as a rapidly growing market for disposable incontinence products, propelled by the aging population demographic and improving healthcare infrastructure in countries such as China, Japan, and India. The region’s increasing healthcare expenditure, changing lifestyle patterns, and growing awareness about personal hygiene drive market demand for disposable incontinence products. Additionally, rising disposable incomes and urbanization further accelerate market growth in Asia-Pacific.

Disposable Incontinence Products Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.42% |

| Global Market Size in 2023 | USD 12.59 Billion |

| Global Market Size by 2033 | USD 25.76 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Incontinence Type, By Disease, By Material, By Gender, By Distribution Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Disposable Incontinence Products Market Dynamics

Drivers:

Several factors drive the adoption and utilization of disposable incontinence products worldwide. One primary driver is the increasing prevalence of urinary and fecal incontinence, particularly among aging populations. Age-related factors such as weakened pelvic floor muscles, chronic health conditions, and cognitive impairment contribute to the incidence of incontinence, necessitating effective management solutions. Disposable incontinence products offer convenience, comfort, and discretion to individuals managing incontinence, addressing their specific needs and improving quality of life.

Moreover, changing lifestyle patterns, including sedentary behavior, obesity, and dietary factors, contribute to the prevalence of incontinence across different age groups and demographic segments. Lifestyle modifications and preventive measures alone may not be sufficient to manage incontinence effectively, leading individuals to seek alternative solutions such as disposable incontinence products. The availability of a wide range of product options and the discretion afforded by disposable designs encourage consumer adoption and usage, driving market growth.

Furthermore, increasing awareness about personal hygiene and healthcare management plays a critical role in driving market demand for disposable incontinence products. Healthcare providers, advocacy groups, and media campaigns raise awareness about incontinence as a common health condition and promote the importance of timely intervention and management. Disposable incontinence products offer practical and hygienic solutions for individuals managing incontinence, empowering them to maintain independence and dignity in their daily lives.

Opportunities:

The disposable incontinence products market presents numerous opportunities for innovation and expansion. One significant opportunity lies in the development of eco-friendly and sustainable product alternatives to address environmental concerns and consumer preferences. With growing awareness about environmental sustainability and the impact of single-use plastics, there is increasing demand for biodegradable and compostable materials in disposable incontinence products. Manufacturers can capitalize on this trend by investing in research and development of sustainable materials and production processes, catering to environmentally conscious consumers and regulatory requirements.

Moreover, there is a growing opportunity to leverage digital health technologies and telemedicine platforms to enhance incontinence management and patient support. Mobile applications, wearable devices, and remote monitoring solutions enable individuals to track bladder and bowel habits, receive personalized care plans, and access virtual consultations with healthcare providers. Integrating disposable incontinence products with digital health platforms offers a holistic approach to incontinence management, promoting self-care and empowering individuals to take control of their health.

Furthermore, expanding market access and distribution channels in emerging economies represent significant growth opportunities for disposable incontinence product manufacturers. As healthcare infrastructure improves and consumer awareness grows in developing countries, there is increasing demand for affordable and accessible incontinence management solutions. Strategic partnerships, distribution agreements, and localized marketing efforts can facilitate market entry and penetration in emerging markets, tapping into underserved population segments and driving revenue growth.

Challenges:

Despite the promising growth prospects, the disposable incontinence products market faces several challenges that could impact its trajectory. One such challenge is the stigma and embarrassment associated with incontinence, which may deter individuals from seeking appropriate management solutions. Overcoming social taboos and destigmatizing incontinence requires targeted education, awareness campaigns, and advocacy efforts to empower individuals to seek help and access effective treatment options, including disposable incontinence products.

Additionally, cost considerations and affordability constraints pose challenges to market adoption, particularly among economically disadvantaged populations and in resource-constrained healthcare settings. Disposable incontinence products may impose financial burdens on individuals and caregivers, leading to compromised product choices or inadequate management practices. Addressing affordability concerns requires innovative pricing strategies, reimbursement mechanisms, and access programs to ensure equitable access to disposable incontinence products for all individuals in need.

Moreover, regulatory compliance and quality standards present challenges for manufacturers in ensuring product safety, efficacy, and performance. Regulatory requirements vary across different geographic regions, necessitating comprehensive testing, certification, and compliance with relevant standards and guidelines. Manufacturers must invest in quality assurance processes, product testing, and regulatory submissions to meet market requirements and maintain consumer trust and confidence in disposable incontinence products.

Read Also: Cold Chain Monitoring Market Size to Attain USD 229.61 Bn by 2033

Recent Developments

- In September 2022, Attindas Hygiene Partners proudly presents its cutting-edge, new adults disposable incontinence underwear line in North America. The latest product, which is invisible beneath clothes and offers 100% leak-free protection, uses Maxi Comfort ultrasonic bonding tech to create a more elastic material that can fit a variety of body shapes. The product comes in three skin-friendly, cottony-soft colors for both men and women.

Disposable Incontinence Products Market Companies

- Essity AB

- Kimberly-Clark Corporation

- Coloplast Ltd.

- Unicharm Corporation

- Paul Hartmann AG

- Ontex

- First Quality Enterprises

- Medline Industries Inc.

Segments Covered in the Report

By Product

- Protective Incontinence Garments

- Disposable Adult Diaper

- Disposable Protective Underwear

- Cloth Adult Diaper

- Disposable Pads and Liners

- Male Guards

- Bladder Control Pads

- Incontinence Liners

- Belted and Beltless Under Garments

- Disposable Under Pads

- Urine Bag

- Leg Urine Bag

- Bedside Urine Bag

- Urinary Catheter

- Indwelling (Foley) Catheter

- Intermittent Catheter

- External Catheter

By Application

- Urine Incontinence

- Fecal Incontinence

- Dual Incontinence

By Incontinence Type

- Stress

- Urge

- Mixed

- Others

By Disease

- Feminine Health

- Pregnancy and Childbirth

- Menopause

- Hysterectomy

- Others

- Chronic Disease

- Benign Prostatic Hyperplasia

- Bladder Cancer

- Mental Disorders

- Others

By Material

- Plastic

- Cotton Fabrics

- Super Absorbents

- Latex

- Others

By Gender

- Male

- Female

By Age

- Below 20 years

- 20 to 39 years

- 40 to 59 years

- 60 to 79 years

- 80+ years

By Distribution Channel

- Retail Stores

- E-commerce

By End-use

- Hospital

- Ambulatory Surgical Centers

- Nursing Facilities

- Long term Care Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/