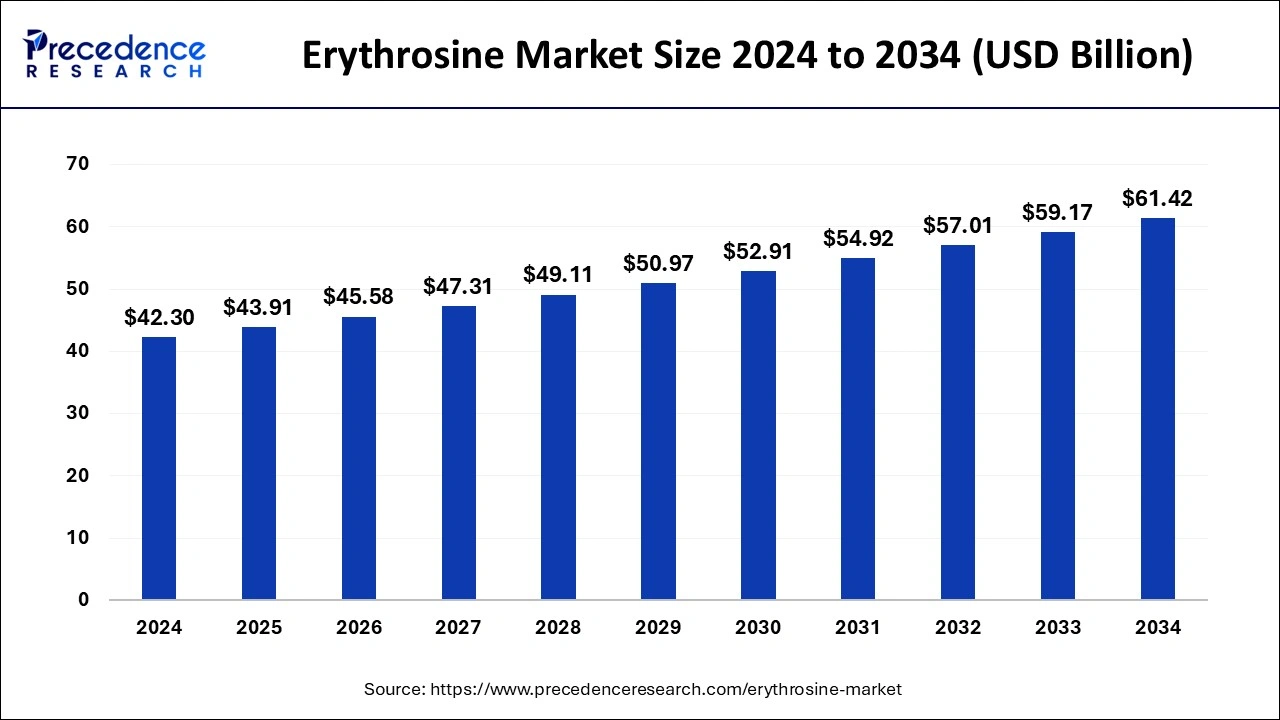

The global erythrosine market was valued at USD 42.30 billion in 2024 and is projected to reach USD 61.42 billion by 2034, expanding at a CAGR of 3.80% during the forecast period.

Erythrosine Market Key Takeaways

- North America accounted for the largest share of the erythrosine market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the liquid segment noted the largest market share in 2024.

- By type, the powder segment is projected to witness the fastest growth during the forecast period.

- By end-use, the food and beverages segment contributed the largest share market in 2024.

- By end-use, the pharmaceutical segment is projected to witness the fastest growth during the forecast period.

Market Overview

The global erythrosine market is growing due to growth, supported by technological advancements in production processes and increasing consumer awareness of food safety and quality. Moreover, there is a growing trend for bright-colored food products in markets, and thus, food producers are using erythrosine in product formulations to meet consumer tastes and preferences. This growth is mainly attributed to the rising use of food color in confectioneries, dairy products, and in the preparation of several beverages.

Erythrosine, also known as Red No. 3, is a synthetic red dye widely used in the food, pharmaceutical, and cosmetic industries. Its vibrant color and chemical stability have made it a staple for coloring candies, baked goods, popsicles, mouthwashes, and tablets. As consumer demand continues to shift toward more vibrant and visually appealing products, the erythrosine market is expected to maintain a solid growth trajectory.

Drivers

The erythrosine market is primarily driven by the rising demand for processed and packaged food and beverages, particularly in developing economies. Growing urbanization and changing lifestyles have led to an increase in the consumption of visually appealing edible items, where food-grade dyes like erythrosine play a significant role.

Additionally, erythrosine’s application in pharmaceuticals for coating pills and capsules contributes to its sustained demand. Its effectiveness in producing long-lasting color in cosmetics and personal care products also continues to support market growth.

Opportunities

Significant opportunities lie in expanding erythrosine applications beyond traditional sectors. With growing demand for vibrantly colored cosmetics and evolving product innovation in confectionery and bakery segments, manufacturers can leverage the dye’s visual appeal to create standout products.

The emerging trend of natural and synthetic dye blends presents a chance for market players to offer hybrid solutions that balance performance with perceived health consciousness. Regulatory approvals in new markets can also open up previously untapped regions for erythrosine-based product distribution.

Challenges

Despite its wide applications, the erythrosine market faces notable challenges. Regulatory scrutiny surrounding synthetic dyes has prompted concerns about potential health impacts, limiting its use in some regions. T

he rising consumer shift toward natural colorants is also putting pressure on synthetic dye manufacturers. Furthermore, competition from natural alternatives such as beetroot red and lycopene adds complexity to maintaining market share, especially in the clean-label food movement.

Regional Insights

Asia Pacific is anticipated to dominate the erythrosine market due to its vast food processing industry and increasing demand for packaged foods. Countries like China and India are significant contributors to this growth, thanks to a growing middle-class population and expanding pharmaceutical manufacturing.

North America and Europe are relatively mature markets but continue to show steady demand, particularly in pharmaceutical and personal care sectors. Regulatory frameworks in these regions are stringent, pushing manufacturers to comply with high-quality standards.

Recent Developments

In recent years, companies have been investing in research to improve the safety profiles of synthetic dyes, including erythrosine. Manufacturers are exploring more sustainable production processes and seeking to improve dye stability for wider applications. Partnerships between food processing firms and dye suppliers are growing, as companies look to co-develop tailor-made colorants.

Additionally, ongoing debates and studies around synthetic dyes are prompting regulatory bodies to reassess safety limits, which may lead to revised compliance standards in the near future.

Erythrosine Market Companies

- Cargill, Incorporated

- CJ CheilJedang Corp.

- Ingredion Incorporated

- Mitsubishi Chemical Corporation

- Jungbunzlauer Suisse AG

- Shandong Sanyuan Biotechnology Co., Ltd.

Segments Covered in the Report

By Type

- Liquid

- Powder

- Granules

By End-Use

- Food and Beverages

- Cosmetics

- Pharmaceutical

- Chemical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/