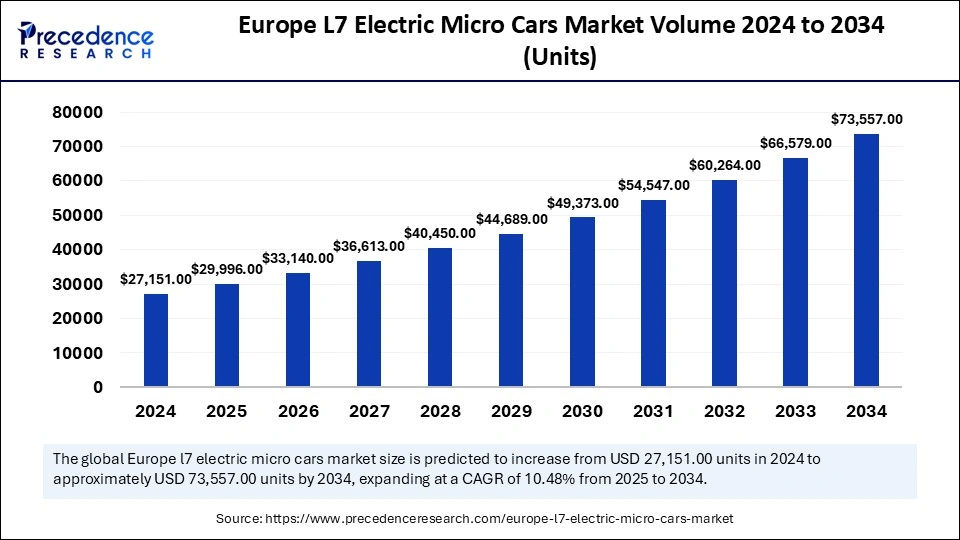

Europe L7 electric micro cars market volume to grow from 29,996 units in 2025 to 73,556 units by 2034, registering a CAGR of 10.48% during the forecast period.

Europe L7 Electric Micro Cars Market Key Takeaways

-

Germany dominated the market with the highest share in 2024.

-

The UK is anticipated to register the fastest CAGR in the coming period.

-

The medium range (61-100KM) segment captured 45.55% of the market in 2024.

-

The extended range (Above 100KM) segment is set to expand at a notable CAGR.

-

The lithium-ion battery segment held 72.31% of the market share in 2024.

-

The 2-seater segment secured the highest market share of 54.34% in 2024.

Europe L7 Electric Micro Cars Market Overview

The Europe L7 electric micro cars market is witnessing robust growth, driven by rising environmental concerns, technological advancements, and supportive government policies. These micro cars, classified as L7e vehicles under European regulations, are compact and lightweight, designed for urban environments. Their zero-emission nature makes them a preferred choice for environmentally conscious consumers. Additionally, the increasing adoption of smart mobility solutions and car-sharing platforms further accelerates the demand for electric micro cars across European cities.

Market Drivers

-

Growing Environmental Awareness: Increasing concerns over climate change and air pollution have spurred interest in electric micro cars, which contribute to reducing greenhouse gas emissions.

-

Favorable Government Policies: European governments are providing incentives, including tax benefits and purchase subsidies, to encourage the adoption of electric vehicles, positively impacting the L7 micro car segment.

-

Expansion of Urban Mobility Solutions: The rising adoption of mobility-as-a-service (MaaS) and car-sharing services has created a favorable environment for L7 electric micro cars, which are ideally suited for short trips within urban areas.

-

Advancements in Electric Propulsion Systems: Innovations in electric propulsion technology have improved the efficiency, reliability, and safety of electric micro cars, making them more appealing to consumers.

-

Traffic Congestion and Parking Constraints: The compact size and maneuverability of L7 electric micro cars address the challenges of traffic congestion and limited parking space in major European cities.

Market Opportunities

-

Development of Autonomous Micro Cars: The integration of autonomous driving capabilities in L7 electric micro cars can revolutionize urban mobility by reducing human error and enhancing road safety.

-

Partnerships with Ride-Hailing Companies: Collaborations between electric micro car manufacturers and ride-hailing platforms can create new revenue streams and accelerate market penetration.

-

Introduction of Subscription-Based Models: Subscription services for electric micro cars can attract a broader customer base by offering flexible ownership options and reducing financial barriers.

-

Diversification of Vehicle Offerings: Expanding the range of models and features available in the L7 electric micro car segment can cater to varying consumer preferences and enhance market growth.

Market Challenges

-

Inadequate Charging Infrastructure: Although charging networks are expanding, gaps in infrastructure can hinder the widespread adoption of electric micro cars.

-

Consumer Skepticism About Performance: Potential buyers often hesitate to invest in electric micro cars due to concerns about range, charging time, and long-term performance.

-

Intense Market Competition: The growing number of electric vehicle manufacturers in Europe creates a highly competitive landscape, making it challenging for new entrants to establish a foothold.

-

Compliance with Diverse Regulations: Different regulatory standards across European nations create complexity for manufacturers seeking to expand their footprint.

Regional Insights

-

Germany: As a frontrunner in the electric mobility space, Germany commands a substantial share of the L7 electric micro cars market, backed by strong infrastructure and policy support.

-

France: France’s focus on reducing urban pollution and promoting electric mobility has contributed to significant growth in the L7 electric micro car segment.

-

United Kingdom: The UK is emerging as a key market due to rising demand for sustainable urban transport solutions and government-backed initiatives.

-

Scandinavia: Scandinavian countries, known for their progressive environmental policies, exhibit strong potential for L7 electric micro car adoption.

Recent News

-

March 2025: A prominent electric vehicle startup secured funding to develop next-generation L7 electric micro cars with AI-enabled driving assistance systems.

-

January 2025: The European Union announced a new initiative to enhance charging infrastructure for electric micro cars, aiming to eliminate charging gaps across member states.

Europe L7 Electric Micro Cars Market Companies

- Citroen

- Renault

- Fiat

- Aixam

- Volkswagen

- Micro Mobility System AG

- TAZZARI EV

- Renault Group

- Space Options Limited (Siticars.com)

- Ariel Motor Company Ltd.

Segment covered in the report

By Range Per Charge

- Short Range (30-60KM)

- Medium Range (61-100KM)

- Extended Range (Above 100KM)

By Battery Type

- Lead Acid Battery

- Lithium-Ion Battery

- Others (Nickel-Cadmium Battery, etc.)

By Seats

- 2 Seats

- 4 Seats

Ready for more? Dive into the full experience on our website!