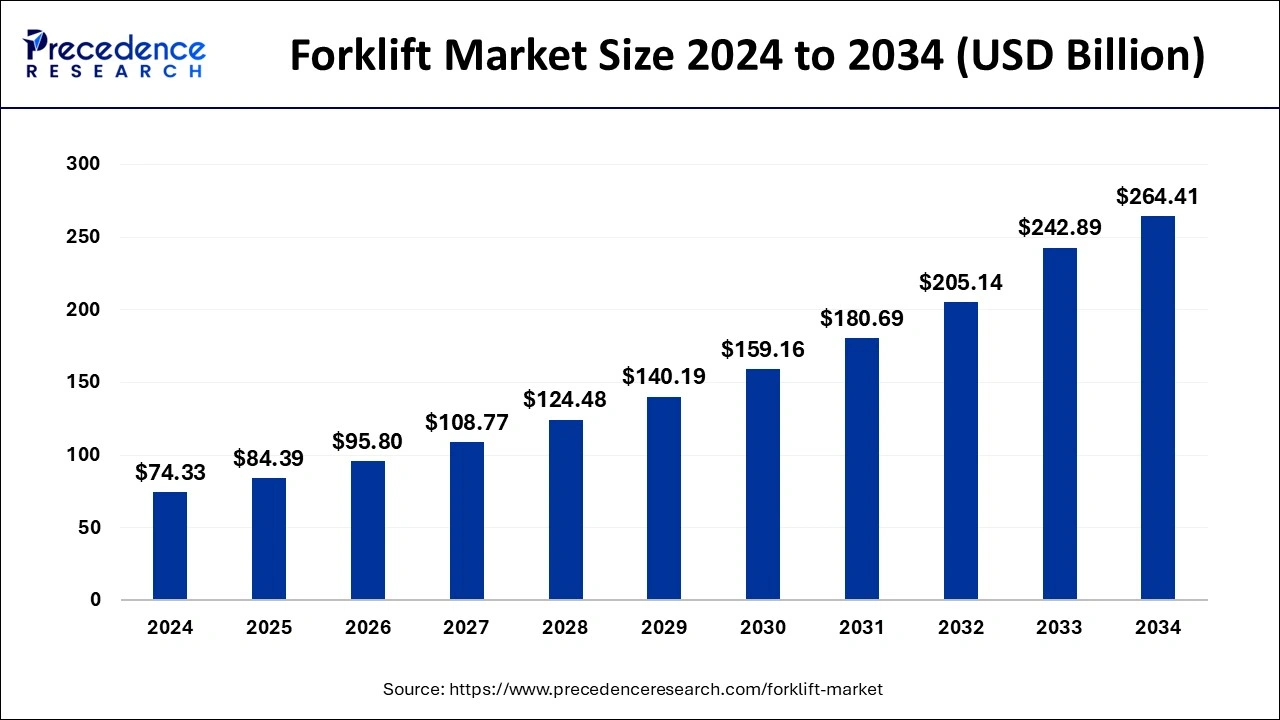

Forklift market size to reach USD 264.41 billion by 2034, expanding at a CAGR of 13.53% from USD 74.33 billion in 2024.

Forklift Market Key Takeaways

- Asia-Pacific dominated the forklift market in 2024, holding 48% of the total market share, driven by rapid industrialization and expansion in logistics and warehousing.

- The Class 3 forklift segment led the market, capturing 44% of the total share in 2024, due to its growing demand for material handling in warehouses and distribution centers.

- Electric forklifts gained prominence, securing the largest market share in 2024, as industries shift towards eco-friendly and cost-efficient power solutions.

- The 5-15 ton load capacity segment accounted for a major share, reflecting increased demand for mid-sized forklifts in various industries.

- Lead-acid batteries remained the preferred choice, holding 67% of the electric forklift battery market, due to their cost-effectiveness and reliability.

- The industrial sector emerged as the leading end-user, capturing over 25% of the market share in 2024, fueled by automation and increased production activities.

Forklift Market Overview

The forklift market is witnessing strong growth, fueled by increasing industrialization, expansion of warehousing facilities, and the rapid development of logistics and supply chain networks. Forklifts are a crucial part of material-handling operations, helping businesses enhance efficiency and reduce labor costs. The transition toward electric forklifts, automation, and smart technology integration is reshaping the industry, making forklifts safer, more energy-efficient, and easier to operate. As industries prioritize operational efficiency and sustainability, demand for next-generation forklifts is expected to rise.

Market Drivers

The primary driver of the forklift market is the rapid growth of the logistics and warehousing sector, especially with the surge in e-commerce. Retailers and logistics providers are investing heavily in warehouse automation, increasing the need for forklifts with advanced lifting capabilities. The push for sustainability and lower emissions is also driving demand for electric forklifts, which offer reduced operating costs and comply with stringent environmental regulations. Additionally, the need for higher productivity and workplace safety has encouraged companies to adopt smart forklifts with features such as collision detection, remote monitoring, and AI-based navigation.

Opportunities

Technological advancements are creating new opportunities in the forklift market. The rise of automated forklifts and AGVs is helping businesses reduce labor costs and improve warehouse efficiency. The increasing adoption of lithium-ion batteries in forklifts presents another growth avenue, as these batteries offer faster charging times and longer operational life compared to traditional lead-acid batteries. Emerging economies in Southeast Asia, Africa, and Latin America are also becoming key markets for forklifts due to increasing industrial activity and infrastructure development. The growing interest in hydrogen-powered forklifts provides a promising alternative for businesses looking to adopt sustainable material-handling solutions.

Challenges

One of the biggest challenges facing the forklift market is the high cost of electric and automated models, making them less accessible to small businesses. The need for proper charging infrastructure for electric forklifts is another hurdle, as companies must invest in charging stations to support fleet operations. Additionally, supply chain disruptions and semiconductor shortages can impact forklift production and availability. Operator training and safety concerns also pose challenges, as businesses need skilled personnel to operate and maintain forklifts efficiently.

Regional Insights

Asia-Pacific remains the dominant region in the forklift market, with China, Japan, and India leading in production and consumption. North America is experiencing steady growth, particularly in electric and automated forklifts, driven by warehouse modernization initiatives. Europe is focusing on sustainability, pushing the adoption of eco-friendly forklifts to comply with strict emission regulations. The Middle East and Africa, as well as Latin America, are seeing increased demand for forklifts in construction, mining, and logistics industries. The expansion of manufacturing sectors in these regions is expected to drive forklift market growth in the coming years.

Recent News

The forklift market is evolving with advancements in telematics and AI-powered fleet management systems, allowing real-time tracking and predictive maintenance. Leading manufacturers are investing in hydrogen fuel cell technology, aiming to develop forklifts with zero emissions and faster refueling times. The demand for compact and versatile forklifts is also increasing, catering to businesses with space constraints. Companies are forming strategic partnerships with technology firms to integrate automation solutions into forklift operations, further improving warehouse efficiency and safety.

Forklift Market Companies

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha

- Forklift Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

Segments covered in the report

By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source

- ICE

- Electric

By Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Electric Battery Type

- Li-ion

- Lead Acid

By End Use

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others

By Regional Outlook

- North America

- U.S.

- Rest of North America

- Europe

- U.K.

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America- Middle East & Africa

- Brazil

- Mexico

- Argentina

- Colombia

- South Africa

- Saudi Arabia

- UAE

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/