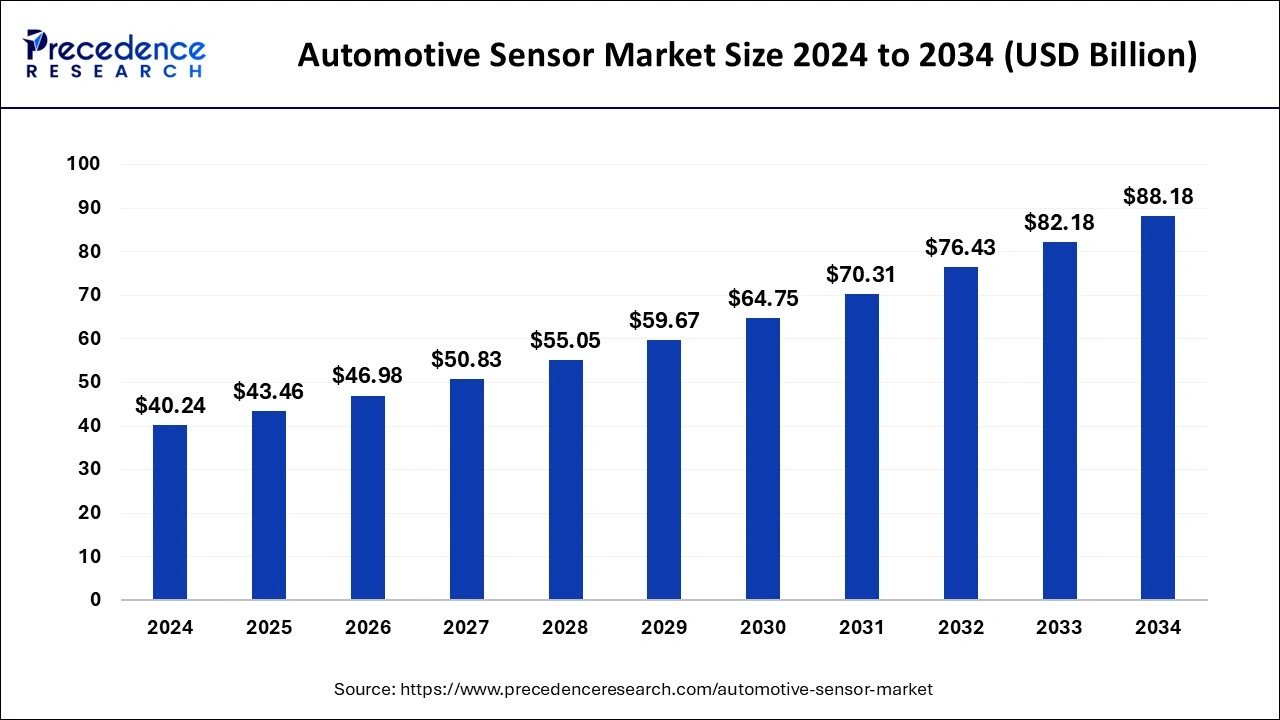

Automotive sensor market size to reach USD 88.18 billion by 2034, expanding at a CAGR of 8.16% from USD 40.24 billion in 2024.

Automotive Sensor Market Key Takeaway

- With a 56.11% revenue share in 2024, Asia Pacific emerged as the leading region in the automotive sensor market, supported by strong manufacturing hubs and technological advancements in vehicle automation.

- The ADAS & safety system segment captured a 42% market share in 2024, driven by stricter safety regulations and the growing adoption of autonomous driving technologies.

- Passenger vehicles dominated the market by vehicle type, securing 86% of total revenue in 2024, as automakers focus on integrating smart sensors to enhance driving experiences.

- Image sensors held a significant 17% share in 2024, reflecting the increasing role of vision-based technologies in improving vehicle navigation, obstacle detection, and driver assistance systems.

Automotive Sensor Market Overview

The automotive sensor market is evolving rapidly as vehicles become more intelligent, automated, and connected. Automotive sensors enhance vehicle safety, fuel efficiency, and overall performance by monitoring critical parameters such as engine temperature, tire pressure, speed, and fuel consumption. With the increasing adoption of ADAS, vehicle electrification, and self-driving technologies, the need for advanced sensors is growing significantly. Rising consumer demand for enhanced driving experiences and real-time vehicle diagnostics is further propelling the market forward.

Market Drivers

A key driver of the automotive sensor market is the rising focus on vehicle safety and emissions control. Governments across the globe are implementing strict safety and environmental regulations, requiring automakers to integrate sophisticated sensors for compliance. The expansion of the electric vehicle (EV) market is another major growth factor, as EVs rely heavily on sensors for battery management, regenerative braking, and powertrain efficiency. Additionally, the increasing penetration of AI and machine learning in automotive applications is driving advancements in sensor technology, enabling smarter decision-making in autonomous and semi-autonomous vehicles.

Opportunities

The growing demand for vehicle connectivity and V2X (vehicle-to-everything) communication offers significant opportunities for automotive sensor manufacturers. Sensors are playing a crucial role in enabling real-time data exchange between vehicles, infrastructure, and cloud-based systems, enhancing traffic management and road safety. Another opportunity lies in the development of advanced thermal and infrared sensors, which improve night vision and pedestrian detection in modern vehicles. Furthermore, the shift towards wireless sensor technologies and MEMS-based sensors is expected to revolutionize automotive applications by reducing wiring complexity and improving sensor efficiency.

Challenges

One of the major challenges in the automotive sensor market is the high cost of advanced sensor technologies, which can impact affordability in mass-market vehicles. Integration issues and interoperability concerns between different sensor systems can also create complexities in vehicle design and manufacturing. Additionally, the increasing threat of cybersecurity attacks on connected vehicles raises concerns about data security and privacy. The market also faces supply chain disruptions and semiconductor shortages, which can impact the availability and pricing of critical sensor components.

Regional Insights

North America is at the forefront of the automotive sensor market due to high consumer demand for smart and autonomous vehicles, strong R&D investments, and government regulations promoting vehicle safety. Europe is also a significant player, driven by advancements in ADAS technologies and the presence of premium automakers investing in high-performance sensors. The Asia-Pacific region is emerging as a high-growth market, particularly due to the expansion of the automotive sector, increasing EV adoption, and government support for smart transportation initiatives in China, Japan, and India. Meanwhile, Latin America and the Middle East are witnessing gradual adoption of advanced vehicle technologies, creating growth opportunities in the coming years.

Recent News

Recent trends in the automotive sensor market include the rise of smart sensors with AI-powered capabilities, enhancing predictive maintenance and vehicle diagnostics. Companies are investing in next-generation radar and ultrasonic sensors to improve autonomous driving capabilities. The development of solid-state LiDAR technology is also gaining momentum, offering enhanced perception at lower costs. Additionally, regulatory bodies worldwide are pushing for stricter emissions monitoring, leading to the adoption of advanced sensors for exhaust and fuel efficiency optimization.

Automotive Sensor Market Companies

- Robert Bosch

- AUTOLIV INC

- DENSO Corporation

- Valeo

- Continental AG

- Sensata Technologies

- Delphi Automotive Company

Segments Covered in the Report

By Type

- Position Sensors

- Clutch Position Sensors

- Gear Position Sensors

- Throttle Position Sensors

- Crankshaft Position Sensors

- Steering Angle Position Sensors

- Camshaft Position Sensors

- Safety Sensors

- Seat Belt Sensors

- Brake Switch Sensors

- Door Switch Sensors

- ADAS Sensors

- Blind Spot Detection

- Night Vision Sensors

- Light Sensors

- Parking Sensors

- Cruise Control

- Impact Sensors

- Anti-theft Sensors

- Knock Detection Sensors

- Level Sensors

- Fuel Level Sensors

- Coolant Level Sensors

- Oil Level Sensors

- Oxygen Sensors

- Pressure Sensors

- Tire Pressure Sensors

- EGR Pressure Sensors

- Airflow Rate Sensors

- Temperature Sensors

- Engine Coolant Temperature Sensors

- Rain/humidity Sensors

- Oil/Fuel Temperature Sensors

- Battery Temperature Sensors

- Air Temperature Sensors

- Speed Sensors

- Wheel Speed Sensors

- Speedometer

By Application

- Powertrain

- Safety & Security

- Body Electronics

- Steering system

- Chassis system

- Others

- ADAS & safety system

- Health, wellness, wellbeing (HWW)

- Telematics

By Vehicle

- Passenger Cars

- Compact

- Midsize

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Engine Type

- Gasoline

- Diesel

- Hybrid

- Battery electric vehicles

- Fuel cell

By Sales Channel

- Original Equipment Manufacturers

- Original Equipment Supplier Spare Parts

- Independent Aftermarket

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/