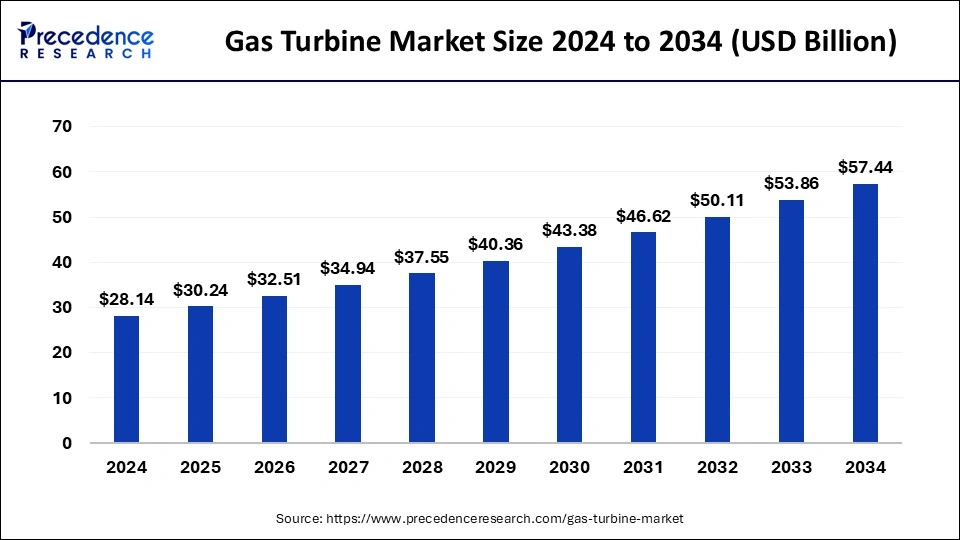

The global gas turbine market size is projected to grow from USD 28.14 billion in 2024 to USD 57.44 billion by 2034 at a CAGR of 7.48%

The Global Gas Turbine Market Key Takeaways

- Asia Pacific Remains the Largest Regional Market: Holding 37% of the total revenue share in 2023, Asia Pacific continues to dominate the gas turbine industry.

- >200 MW Capacity Segment Leads: The >200 MW segment accounted for 66% of total revenue in 2023.

- Combined Cycle Turbines Hold the Largest Share: With 74% of the total market revenue in 2023, combined cycle turbines remain the preferred technology.

- Power & Utility Sector Fuels Market Growth: The power & utility segment commanded an 82% revenue share in 2023.

- Aero-Derivative Turbines Set for Rapid Growth: Expected to expand at a 9% CAGR from 2024 to 2033, the aero-derivative segment is gaining traction.

Market Overview

The gas turbine market is a key segment of the global energy and power industry, providing efficient solutions for electricity generation, industrial applications, and aerospace propulsion. With increasing concerns over carbon emissions and the need for energy efficiency, gas turbines are being widely adopted in combined-cycle power plants and cogeneration systems. The demand for high-performance turbines with lower emissions has grown significantly, leading to technological advancements in turbine design and fuel flexibility. The market is expected to expand steadily, driven by urbanization, industrialization, and increasing energy demands across developing and developed nations.

Drivers

One of the major drivers of the gas turbine market is the shift toward natural gas-based power generation due to its lower carbon footprint compared to coal-fired power plants. Governments and utility companies are actively investing in gas-fired combined-cycle power plants, which offer higher efficiency and reduced emissions. The growing demand for aviation and aerospace applications is another key factor boosting the market, as gas turbines remain the primary propulsion system for commercial and military aircraft. Furthermore, technological advancements in digital control systems and turbine efficiency are enabling better performance and cost savings for power producers.

Opportunities in the Market

The market is experiencing several growth opportunities, particularly with the adoption of hydrogen-based gas turbines. As the world shifts toward cleaner energy, hydrogen-fueled turbines are being developed to reduce carbon emissions further. Another emerging trend is the integration of gas turbines with renewable energy sources, ensuring stable power supply even when wind and solar output fluctuates. Additionally, the rise of small-scale distributed power generation presents new avenues for market expansion, as industries and businesses seek independent power solutions. Retrofitting older gas turbines with advanced digital monitoring and efficiency-enhancing technologies is also a growing market segment.

Challenges Affecting Market Growth

Several challenges could impact the expansion of the gas turbine market. Volatility in natural gas prices directly affects the operating costs of gas turbine power plants, making them less competitive in some regions. The increasing penetration of renewable energy sources such as wind and solar, which have lower long-term costs, is creating competition for gas turbine-generated power. Additionally, regulatory concerns over greenhouse gas emissions are pushing turbine manufacturers to innovate rapidly or risk losing market share to cleaner alternatives. High capital investment requirements for gas turbine installations also pose financial challenges for new market entrants.

Regional Market Trends

- North America: The U.S. and Canada are actively upgrading their power generation infrastructure, shifting from coal to natural gas and hydrogen-ready gas turbines.

- Europe: The region is focusing on low-emission gas turbine technology, with several nations investing in hydrogen-based turbine systems to achieve climate goals.

- Asia-Pacific: Rapid industrialization in China, India, and Southeast Asia is increasing demand for gas turbines, particularly in energy and aerospace applications.

- Middle East & Africa: The region is witnessing significant investments in gas-fired power plants, with countries like Saudi Arabia and UAE modernizing their energy infrastructure.

Latest Industry Developments

The gas turbine industry has seen a wave of innovations and investments. Leading manufacturers are focusing on hydrogen-compatible gas turbines, aiming to support the global energy transition. Governments are implementing new policies to encourage gas-fired power plants and reduce coal dependency. Additionally, digital solutions for turbine monitoring and predictive maintenance are enhancing operational efficiency. The aviation sector is also witnessing advancements in lightweight, high-efficiency gas turbine engines, which improve fuel economy and reduce emissions.

Gas Turbine Market Companies

- Harbin Electric International Company

- Siemens AG

- Man Diesel & Turbo

- General Electric

- NPO Saturn

- Kawasaki Heavy Industries

- Solar Turbines

- Capstone Turbine

- Vericor Power Systems

Segments Covered in the Report

By Capacity Type

- > 500 kW to 1 MW

- > 1 MW to 30 MW

- < 50 kW

- 50 kW to 500 kW

- > 70 MW to 200 MW

- >30 MW to 70 MW

- > 200 MW

By Product Type

- Heavy Duty

- Aero-Derivative

By Technology Type

- Combined Cycle

- Open Cycle

By Application Type

- Process Plants

- Power Plants

- Oil & Gas

- Aviation

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/