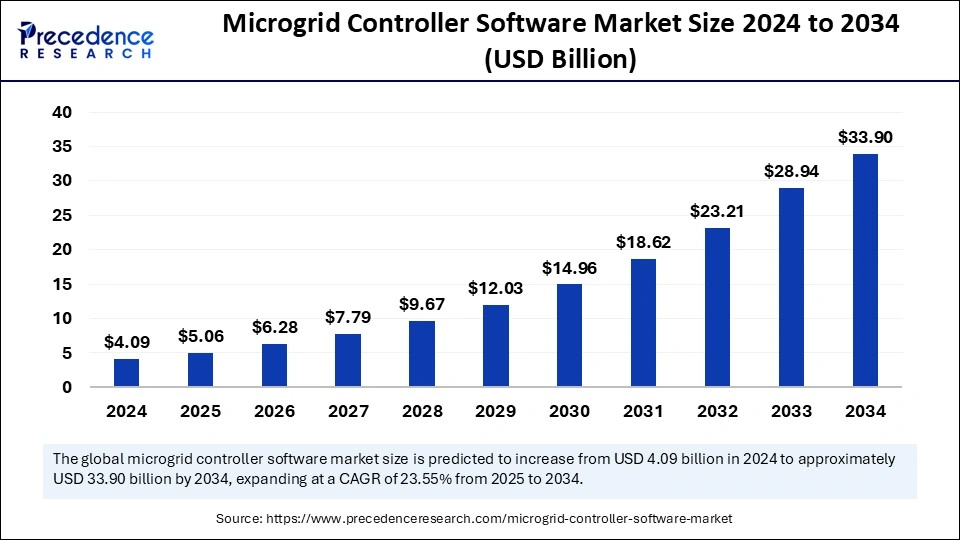

The global microgrid controller software market size expected to hit USD 33.90 billion by 2034, growing at a CAGR of 23.55% from 2024.

Microgrid Controller Software Market Key Takeaways

-

North America led the market with a 41% share in 2024.

-

Asia Pacific is forecasted to experience the fastest growth during the forecast period.

-

By end-use, the commercial and industrial segment dominated with a 37% share in 2024, while the residential sector is expected to witness the fastest growth.

-

The cloud-based segment accounted for the highest share of 59% by deployment mode in 2024, while the on-premise segment is projected to grow rapidly in the coming years.

Microgrid Controller Software Market Overview

The microgrid controller software market is growing at a rapid pace due to the increasing adoption of decentralized energy systems and the need for reliable energy management solutions in off-grid and grid-connected environments. Microgrid controller software plays a pivotal role in managing and optimizing the performance of microgrid systems by enabling real-time control, data monitoring, and efficient load management. The market is witnessing strong growth driven by the rising deployment of renewable energy sources, the need for grid modernization, and the growing emphasis on reducing carbon emissions.

The global market for microgrid controller software, valued at approximately USD 4.1 billion in 2024, is expected to expand at a compound annual growth rate (CAGR) of 12.5%, reaching around USD 13.2 billion by 2034. As governments and organizations worldwide strive to enhance energy resilience and promote clean energy adoption, microgrid controller software is emerging as a critical component in ensuring the efficient operation of modern energy systems.

Microgrid Controller Software Market Drivers

The increasing reliance on renewable energy sources, including solar, wind, and hydropower, is a major driver propelling the growth of the microgrid controller software market. As the share of renewable energy in the global energy mix continues to rise, microgrid controller software is becoming essential for balancing supply and demand, mitigating intermittency, and optimizing energy utilization. The growing need for resilient and reliable energy infrastructure, especially in remote and disaster-prone regions, is further driving the demand for microgrid controller solutions.

In addition, the increasing frequency of extreme weather events and natural disasters has highlighted the vulnerability of traditional power grids, prompting utilities and communities to invest in microgrid technologies. The growing adoption of distributed energy resources and the need for seamless integration with existing grid systems are also contributing to the rising demand for advanced microgrid controller software.

Microgrid Controller Software Market Opportunities

The microgrid controller software market presents significant opportunities for growth in the adoption of AI-powered and cloud-based solutions. AI-driven microgrid controllers can analyze real-time data, predict energy demand patterns, and optimize load management with greater accuracy, enhancing overall microgrid performance. The emergence of cloud-based platforms is enabling remote monitoring, predictive maintenance, and seamless integration of microgrid components, creating new opportunities for software providers.

Moreover, the growing adoption of electric vehicles and energy storage systems presents a unique opportunity for microgrid controller software vendors to expand their offerings. By integrating EVs and battery storage into microgrid systems, controllers can optimize energy usage, balance loads, and enhance grid stability. Emerging economies with increasing investments in renewable energy and decentralized energy systems offer untapped growth potential for microgrid controller software vendors seeking to expand their presence in new markets.

Microgrid Controller Software Market Challenges

Despite the favorable growth prospects, the microgrid controller software market faces several challenges that could potentially limit its expansion. One of the primary challenges is the high cost associated with microgrid deployment and the integration of advanced controller software solutions. The complexity of managing multiple distributed energy resources, diverse loads, and various control mechanisms requires sophisticated software solutions, which can be expensive to develop and implement.

Additionally, ensuring seamless interoperability and communication between different components of a microgrid ecosystem poses a technical challenge that requires continuous innovation and standardization. Regulatory and policy uncertainties in some regions also create obstacles for microgrid adoption, as inconsistent frameworks can delay project approvals and hinder market growth. The lack of awareness and technical expertise among end-users regarding the benefits and functionalities of microgrid controller software further limits widespread adoption, particularly in developing regions.

Regional Insights

The microgrid controller software market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the market, driven by increasing investments in renewable energy, advanced grid infrastructure, and government initiatives promoting clean energy adoption.

The United States is at the forefront of microgrid deployments, with several pilot projects and large-scale implementations across military installations, universities, and commercial facilities. Europe follows closely, with countries such as Germany, the United Kingdom, and the Netherlands demonstrating a strong commitment to grid modernization and the integration of decentralized energy systems.

Asia Pacific is expected to witness the highest growth rate during the forecast period, fueled by rapid urbanization, increasing energy demand, and rising investments in renewable energy infrastructure. China, India, and Japan are emerging as key markets for microgrid controller software, driven by government initiatives aimed at enhancing energy access and resilience. Latin America and the Middle East & Africa are also experiencing growing interest in microgrid technologies, particularly in remote and underserved regions where traditional grid infrastructure is limited.

Recent Developments

The microgrid controller software market has seen several notable developments in recent years, reflecting increasing adoption of advanced technologies and growing collaboration between industry players. Leading technology providers are focusing on developing AI-driven microgrid controller solutions that can enhance energy efficiency, minimize operational costs, and optimize load management. The adoption of cloud-based microgrid management platforms is gaining momentum, enabling remote control, data analytics, and predictive maintenance of microgrid systems. Strategic partnerships between microgrid technology companies and utilities are fostering innovation and expanding the scope of microgrid applications.

Moreover, the integration of blockchain technology in microgrid controller software is emerging as a transformative trend, enabling secure and transparent energy transactions within microgrid ecosystems. The increasing deployment of microgrid projects in regions vulnerable to power outages and grid failures is driving the demand for resilient and intelligent microgrid controller software solutions.

Microgrid Controller Software Market Companies

- ABB

- Caterpillar Inc.

- CleanSpark Eaton

- Encorp Emerson commercial and residential solutions

- General Electric

- Honeywell International

- Lockheed Martin

- Ontech Electric Corporation

- Opus One Solutions

- RTSoft, Princeton Power Systems

- S&C Electric

- Schweitzer Engineering Laboratories

- Siemens

- Spiral

Segments Covered in the Report

By Connectivity

- Grid Connected

- Off-grid Connected

By Offering

- Energy Management Systems (EMS)

- Advanced Distribution Management Systems (ADMS)

- Supervisory Control and Data Acquisition (SCADA)

- Others

By End-use

- Utility Providers

- Commercial and Industrial

- Residential

- Government and Military

- Educational Institutions

- Others

By Deployment Mode

- Cloud-Based

- On-Premise

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middles East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/