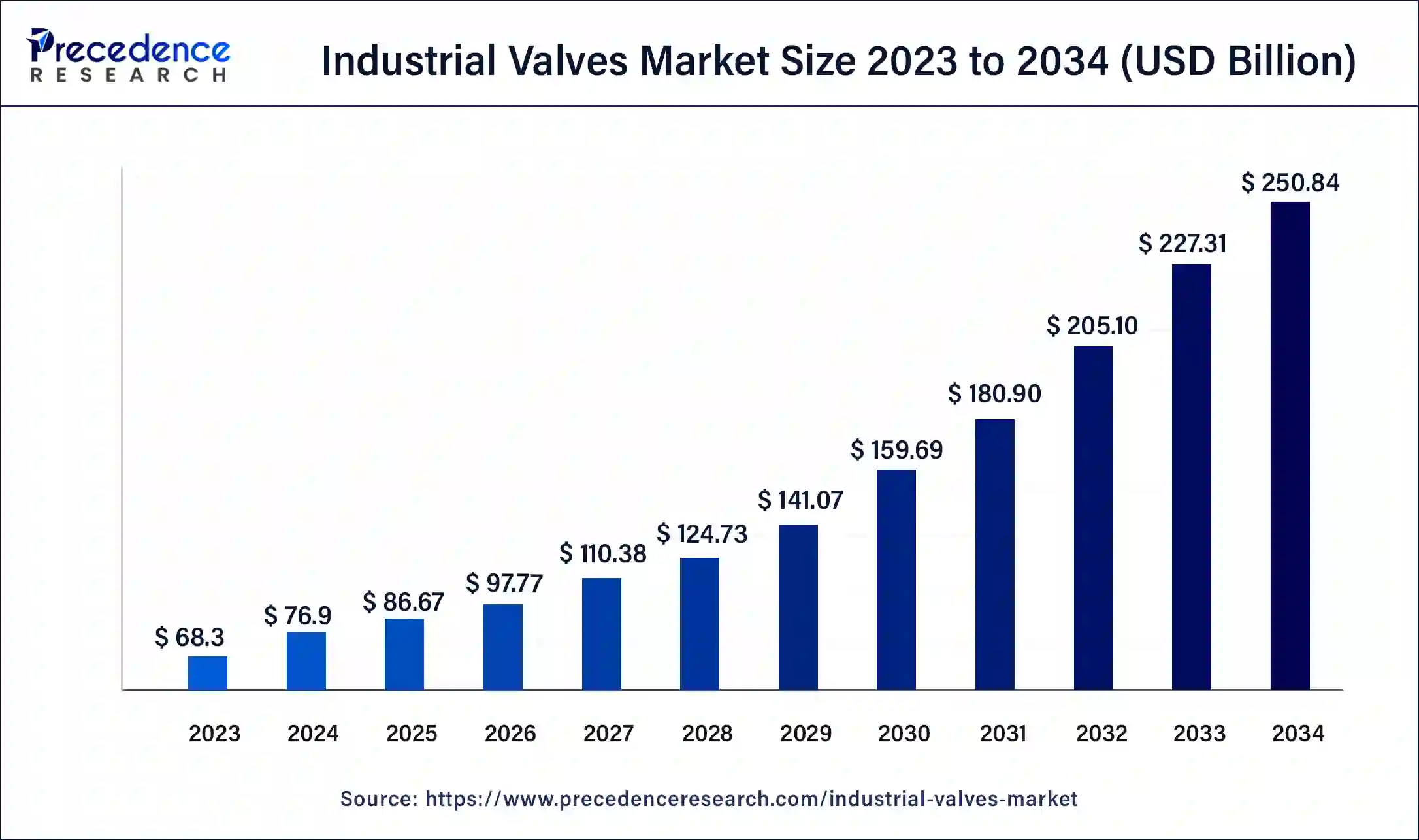

The industrial valves market is projected to grow from USD 76.9 billion in 2023 to USD 250.84 billion by 2034, with a CAGR of 12.6%.

Industrial Valves Market Key Takeaways

- Asia Pacific dominated the industrial valves market with a 36% share in 2023.

- The steel industrial valves segment accounted for the highest market share by material type in 2023.

- The oil and gas segment contributed the largest revenue share by application in 2023.

- The water and wastewater segment is expected to grow at a 6% CAGR during the forecast period.

Overview

The industrial valves market is witnessing substantial growth, driven by the increasing demand for flow control solutions in industries such as oil and gas, water treatment, power generation, and chemical processing. Industrial valves are essential components used to regulate, direct, and control the flow of liquids, gases, and slurries within a system. These valves come in various types, including gate valves, ball valves, globe valves, and butterfly valves, each catering to specific industrial applications. The ongoing expansion of industrial infrastructure, growing investment in oil and gas exploration, and rising focus on water and wastewater management are contributing to the growth of the industrial valves market. Additionally, the integration of smart valve technologies and automation is further enhancing operational efficiency and reliability, driving market adoption.

Drivers

- Increasing Demand from Oil and Gas Industry

The oil and gas industry is a major consumer of industrial valves, with applications ranging from upstream exploration and production to downstream refining and distribution. The rising global demand for energy and ongoing exploration of new oil and gas reserves are driving the need for reliable and high-performance valves. - Expansion of Water and Wastewater Treatment Facilities

Growing concerns about water scarcity and environmental sustainability have led to increased investments in water and wastewater treatment infrastructure. Industrial valves play a critical role in controlling the flow of water, chemicals, and sludge in treatment plants, thereby driving market growth. - Rising Focus on Power Generation and Renewable Energy Projects

The growing demand for electricity and the shift toward renewable energy sources, such as wind and solar power, are driving the installation of new power generation plants. Industrial valves are used extensively in power plants to regulate steam, water, and gas flows, ensuring efficient energy generation.

Opportunities

- Integration of Smart Valve Technologies and IoT

The integration of smart technologies, such as IoT and AI, in industrial valves is creating new opportunities for market growth. Smart valves enable real-time monitoring, predictive maintenance, and remote control, enhancing overall operational efficiency and reducing downtime. - Growing Demand for Customized Valve Solutions

Industries with specialized requirements are increasingly seeking customized valve solutions tailored to their specific operational needs. Manufacturers offering customized and application-specific valve solutions have the opportunity to capture a significant share of the market. - Emerging Applications in Industrial Automation and Process Control

The adoption of industrial automation and process control technologies is driving the demand for advanced valve solutions that offer high precision and reliability. Industrial valves equipped with automation features enhance process efficiency and minimize operational risks.

Challenges

- High Costs Associated with Advanced Valve Technologies

The implementation of smart and automated valve solutions involves high initial costs, including hardware, software, and integration expenses. These costs can be a barrier to adoption, particularly for small and medium-sized enterprises. - Stringent Regulatory and Environmental Compliance Requirements

Industrial valve manufacturers are required to comply with strict regulatory standards and environmental regulations. Meeting these requirements often involves rigorous testing and certification processes, which can increase production costs and timelines. - Operational Challenges in Harsh and Corrosive Environments

Industrial valves used in extreme operating conditions, such as high-pressure and corrosive environments, face challenges related to durability and performance. Ensuring the longevity and reliability of valves in such conditions remains a significant challenge for manufacturers.

Regional Insights

- North America

North America holds a significant share of the industrial valves market due to the strong presence of oil and gas, chemical, and power generation industries. The region’s focus on modernizing aging infrastructure and adopting smart technologies is driving market growth. - Europe

Europe is witnessing steady growth in the industrial valves market, driven by increasing investments in water treatment projects and renewable energy initiatives. Countries such as Germany, the UK, and France are investing in advanced valve technologies to enhance operational efficiency. - Asia Pacific

Asia Pacific is expected to experience the highest growth rate in the industrial valves market. The region’s rapid industrialization, urbanization, and expanding energy sector are driving the demand for industrial valves. Countries such as China, India, and Japan are leading in the adoption of advanced valve solutions. - Latin America and Middle East & Africa

Latin America and the Middle East & Africa are gradually emerging as key markets for industrial valves, driven by investments in oil and gas exploration, infrastructure development, and water management projects. However, challenges such as political instability and regulatory complexities may limit growth.

Recent News

- Introduction of Smart Valves with IoT Integration

Leading valve manufacturers have introduced smart valve solutions equipped with IoT technology to enable real-time monitoring and predictive maintenance. These innovations are expected to enhance the efficiency and reliability of industrial processes. - Strategic Partnerships and Acquisitions to Strengthen Market Presence

Major players in the industrial valves market are entering into strategic partnerships and acquiring regional valve manufacturers to expand their product portfolios and strengthen their market presence globally.

Industrial Valves Market Companies

- Avcon Controls Private Limited

- AVK Holding A/S

- Crane Co.

- Metso Corporation

- Schlumberger Limited

- Flowserve Corporation

- Emerson Electric Co.

- IMI plc

- Forbes Marshall

- The Weir Group plc.

Segments Covered in the Report

By Valve

- Butterfly Valves

- Ball Valves

- Globe Valves

- Gate Valves

- Check Valves

- Plug Valves

- Diaphragm Valves

By Material

- Cast Iron

- Alloy-Based

- Steel

- Others

By Application

- Water & Wastewater

- Oil & Power

- Food & Beverages

- Chemical

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World