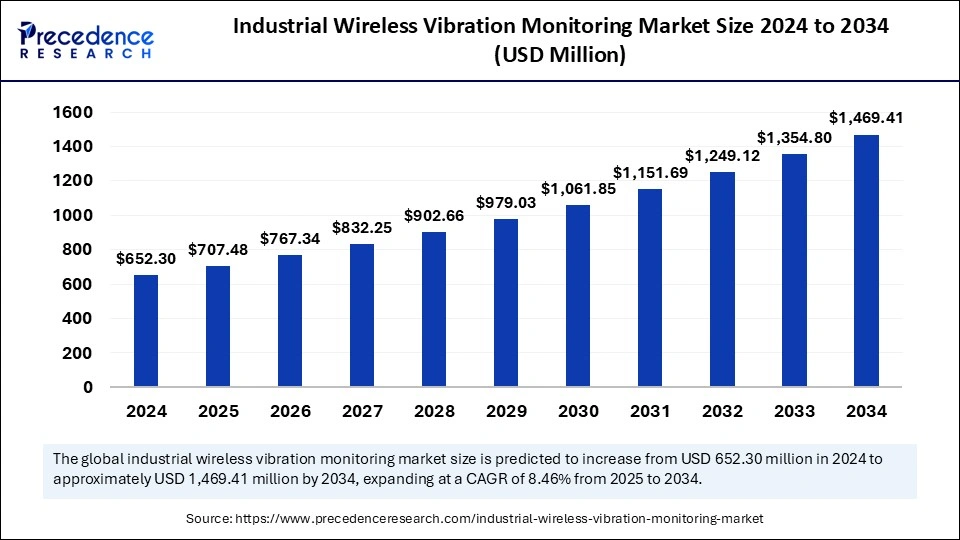

industrial wireless vibration monitoring market size is expected to grow from USD 652.30 million in 2024 to approximately USD 1,469.41 million by 2034, reflecting a CAGR of 8.46% during the forecast period.

Table of Contents

ToggleIndustrial Wireless Vibration Monitoring Market Key Takeaways

-

North America led the market with a 36% share in 2024.

-

Europe is expected to experience the fastest growth in the coming years.

-

The wireless sensors segment accounted for the largest share of 37% by type in 2024.

-

The data acquisition systems segment is projected to witness the highest growth rate during the forecast period.

-

The condition monitoring segment captured the highest share of 42% by application in 2024.

-

The predictive maintenance segment is anticipated to expand rapidly throughout the projection period.

Industrial Wireless Vibration Monitoring Market Overview

The global industrial wireless vibration monitoring market is poised for substantial growth between 2024 and 2034, driven by the growing demand for automated maintenance solutions, increasing integration of IIoT technologies, and rising concerns about industrial safety. Wireless vibration monitoring systems are increasingly being deployed in industries such as manufacturing, oil and gas, energy, and aerospace to enhance asset management and ensure uninterrupted production processes. The incorporation of AI and data analytics is further improving the efficiency and accuracy of these systems, making them indispensable for modern industrial operations.

Drivers

-

Growing Need for Minimizing Downtime and Maintenance Costs:

Industries are seeking reliable solutions to reduce operational downtime and maintenance expenses. Wireless vibration monitoring systems enable real-time monitoring, early fault detection, and timely maintenance, thereby preventing unexpected breakdowns. -

Increased Adoption of Smart Sensors and IIoT Technologies:

The proliferation of IIoT technologies has enabled the seamless integration of wireless vibration monitoring systems with industrial equipment. Smart sensors equipped with wireless capabilities facilitate continuous monitoring and data-driven decision-making. -

Regulatory Compliance and Safety Standards:

Stringent industrial safety standards and regulations are driving the adoption of vibration monitoring systems to ensure compliance and protect critical assets. These systems help industries adhere to safety protocols and mitigate potential risks. -

Rising Demand for Remote Monitoring Solutions:

The ability to remotely monitor and analyze equipment health has become essential, particularly for industries operating in remote or hazardous environments. Wireless vibration monitoring systems offer a cost-effective solution for real-time equipment monitoring and fault detection.

Opportunities

-

Emergence of Cloud-Based Predictive Maintenance Platforms:

The integration of cloud computing and predictive maintenance platforms with wireless vibration monitoring systems is creating new opportunities for market growth. These platforms offer real-time analytics and data storage, enhancing the scalability and efficiency of vibration monitoring solutions. -

Expansion of Industrial Automation and Digital Twins:

The adoption of digital twins and industrial automation technologies is opening avenues for the widespread deployment of wireless vibration monitoring systems. These technologies enable the simulation and analysis of real-world conditions, optimizing equipment performance. -

Increased Penetration of Wireless Technologies in Developing Regions:

Developing regions are witnessing increased adoption of wireless technologies, presenting opportunities for the expansion of wireless vibration monitoring solutions. Governments in these regions are also promoting industrial automation initiatives to improve efficiency.

Challenges

-

Complexity of System Integration and Data Management:

Integrating wireless vibration monitoring systems with existing industrial infrastructure can be complex and requires seamless coordination between hardware, software, and communication protocols. -

High Cost of Advanced Vibration Monitoring Systems:

The initial setup and maintenance costs associated with advanced wireless vibration monitoring solutions can be prohibitive, particularly for small and medium-sized enterprises. -

Data Latency and Connectivity Issues in Remote Locations:

Wireless communication in remote or challenging environments can be subject to data latency and connectivity challenges, impacting the reliability and effectiveness of monitoring systems.

Regional Analysis

North America:

North America is leading the market with a strong focus on adopting advanced industrial automation technologies. The United States and Canada are at the forefront of deploying wireless vibration monitoring systems to enhance industrial safety and efficiency.

Europe:

Europe is witnessing rapid growth in the industrial wireless vibration monitoring market due to the increasing implementation of Industry 4.0 solutions and smart factory concepts. Germany, the UK, and France are key contributors to market growth in this region.

Asia Pacific:

Asia Pacific is expected to experience the highest growth rate in the industrial wireless vibration monitoring market, driven by the rapid industrialization of countries such as China, India, and Japan. The increasing adoption of smart manufacturing technologies and IIoT solutions is fueling market expansion.

Middle East and Africa:

The Middle East and Africa region is gradually adopting wireless vibration monitoring solutions, particularly in the oil and gas and power generation sectors. The need for enhanced safety and operational efficiency is driving market growth in this region.

Recent News in the Industrial Wireless Vibration Monitoring Market

-

In February 2025, a global technology company introduced a cloud-based vibration monitoring solution that leverages AI for predictive maintenance.

-

In March 2025, a leading sensor manufacturer announced the development of wireless vibration monitoring sensors designed for harsh industrial environments.

-

In January 2025, an industrial automation company partnered with a vibration monitoring solutions provider to enhance condition monitoring capabilities in smart factories.

Industrial Wireless Vibration Monitoring Market Companies

- GE Vernova

- Honeywell

- Siemens

- Fluke Corporation

- SKF Group

Segments Covered in the Report

By Type

- Wireless Sensors

- Wireless Controllers

- Vibration Transmitters

- Data Acquisition Systems

- Vibration Analysis Software

By Application

- Condition Monitoring

- Asset Management

- Predictive Maintenance

- Machine Health

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa (MEA)