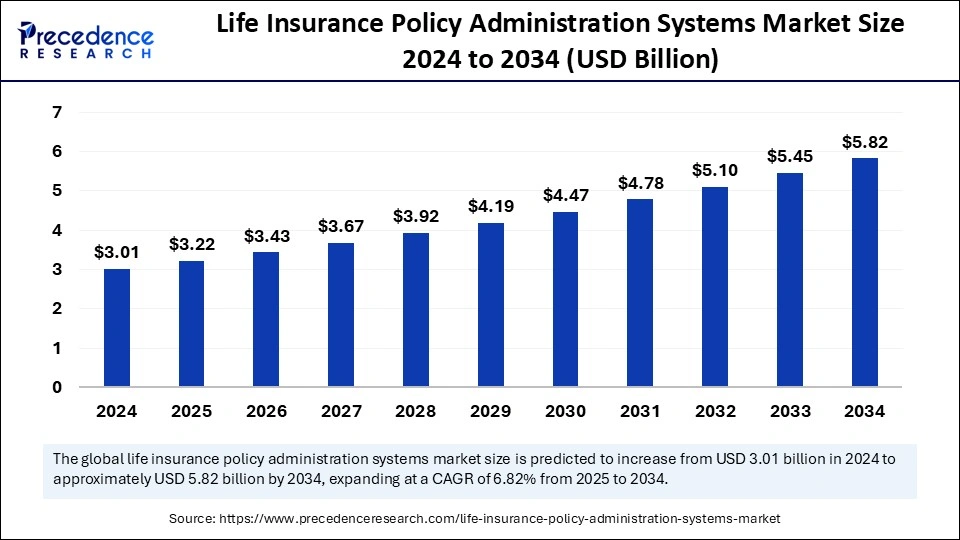

Life insurance policy administration systems market is set to expand at a 6.82% CAGR, increasing from $3.01 billion in 2024 to $5.82 billion by 2034

Life Insurance Policy Administration Systems Key Takeaways

- North America dominated the life insurance policy administration systems market in 2024.

- Asia Pacific is expected to grow rapidly during the forecast period.

- Europe is considered to be a notably growing area in the upcoming period.

- By technology, the cloud-based segment led the market in 2024.

- By technology, the on-premise segment is anticipated to expand rapidly in the coming years.

- By type, the individual life insurance segment contributed the highest market share in 2024.

- By type, the group life insurance segment is expected to grow rapidly during the forecast period.

- By application, the new business processing segment captured the biggest market share in 2024.

- By application, the underwriting segment is expected to grow the fastest throughout the forecast period.

- By deployment, the single-tenant segment generated the major market share in 2024.

- By deployment, the multi-tenant segment is anticipated to be the fastest-growing in the coming years.

Market Overview

The Life Insurance Policy Administration Systems market is experiencing significant growth, driven by the increasing adoption of digital solutions in the insurance sector. These systems help insurers manage policies, automate workflows, and enhance customer experience. The market was valued at USD 3.01 billion in 2024 and is projected to reach USD 5.82 billion by 2034, growing at a CAGR of 6.82%.

The rising demand for cloud-based solutions, policy automation, and regulatory compliance is pushing insurers toward advanced policy administration platforms. Insurers are focusing on streamlining their operations and integrating AI-driven analytics to improve efficiency and decision-making.

Market Drivers

One of the primary drivers of the Life Insurance Policy Administration Systems market is the increasing need for automation and digitization in the insurance industry. As customer expectations evolve, insurance providers are investing in technology to deliver seamless experiences. The demand for improved policy lifecycle management, including underwriting, policy issuance, and claims processing, is boosting the market.

Additionally, regulatory compliance requirements are prompting insurers to upgrade their systems to ensure transparency and adherence to global insurance standards. The integration of AI, big data analytics, and blockchain is also accelerating the market’s growth, making policy administration more secure and efficient.

Market Opportunities

The rapid advancements in cloud computing and AI-driven solutions present significant opportunities for the Life Insurance Policy Administration Systems market. Cloud-based policy administration platforms offer insurers scalability, cost-effectiveness, and flexibility in managing policies across geographies. Emerging markets, particularly in Asia-Pacific and Latin America, provide growth potential as insurance penetration rises in these regions.

Additionally, the growing trend of InsurTech collaborations is enabling insurers to integrate innovative features such as predictive analytics, chatbot-driven customer support, and real-time risk assessment. These technological advancements are creating new revenue streams for insurers and software providers.

Market Challenges

Despite the promising growth, the Life Insurance Policy Administration Systems market faces several challenges. The high implementation costs and complexity of integrating new systems with legacy infrastructure pose a significant hurdle for insurers. Many companies struggle with data migration, system interoperability, and cybersecurity risks when upgrading their policy administration systems.

Additionally, regulatory changes across different regions make it difficult for insurers to maintain compliance while ensuring smooth operations. The lack of skilled professionals with expertise in insurance technology also presents a challenge, as companies require trained personnel to manage and optimize these platforms effectively.

Regional Insights

The Life Insurance Policy Administration Systems market exhibits strong growth across multiple regions, with North America leading due to its high insurance penetration and technological advancements. The presence of major insurance companies and regulatory frameworks supporting digital transformation are driving market expansion in the region. Europe follows closely, with increasing investments in policy automation and compliance-driven solutions.

The Asia-Pacific region is expected to witness the fastest growth due to rising life insurance adoption in countries like India, China, and Japan. Latin America and the Middle East are also emerging markets, fueled by the demand for modernized insurance infrastructure and growing awareness about digital insurance solutions.

Recent Developments

The Life Insurance Policy Administration Systems market has seen several recent developments aimed at enhancing efficiency and customer experience. Key industry players are launching AI-powered policy administration platforms that offer real-time analytics and automated policy management. Cloud-based solutions are becoming the preferred choice, with major insurers migrating their operations to digital platforms. Companies are also focusing on cybersecurity measures to ensure data protection and regulatory compliance.

Additionally, partnerships between insurance firms and InsurTech companies are fostering innovation, leading to the introduction of blockchain-based policy administration and automated claims processing. These advancements are reshaping the industry, making life insurance administration more efficient and customer-centric.

Life Insurance Policy Administration Systems Market Companies

- Majesco

- Accenture Life Insurance Solutions Group

- Accenture Plc

- Oracle

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

Segments Covered In the Market

By Technology

- Cloud-Based

- On-Premise

- Hybrid

By Type

- Individual Life Insurance

- Group Life Insurance

By Application

- New Business Processing

- Underwriting

- Policy Administration

- Claims Management

- Billing and Accounting

By Deployment

- Single-Tenant

- Multi-Tenant

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/