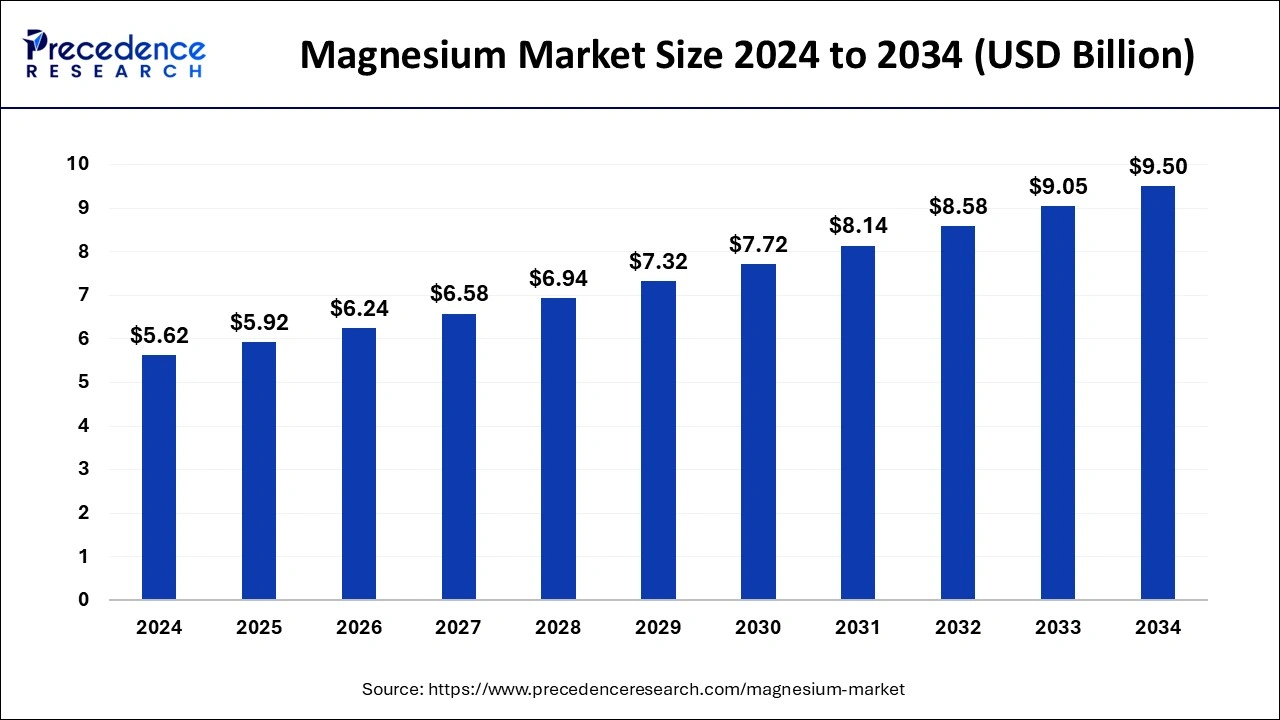

The global magnesium market size accounted for USD 5.33 billion in 2023 and is anticipated to attain around USD 9.05 billion by 2033, growing at a CAGR of 5.44% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest market share of 35% in 2023.

- Europe is projected to witness significant growth in the market over the estimated period.

- By application, the aluminum alloying segment dominated the market in 2023

- By application, the die casting segment is anticipated to witness substantial growth during the forecast period.

The global magnesium market is experiencing steady growth driven by its diverse applications across various industries such as automotive, aerospace, electronics, healthcare, and construction. Magnesium, known for its lightweight, high strength-to-weight ratio, and excellent corrosion resistance properties, plays a vital role in the production of alloys, die-casting components, and structural materials. As industries seek lightweight and environmentally sustainable materials to enhance product performance and fuel efficiency, the demand for magnesium continues to rise. Additionally, the increasing focus on renewable energy sources and the electrification of vehicles further bolster the demand for magnesium-based materials in battery technologies and lightweight components. With ongoing technological advancements and expanding applications, the global magnesium market is poised for continued growth in the foreseeable future.

Get a Sample: https://www.precedenceresearch.com/sample/4047

Growth Factors:

Several key factors are driving the growth of the global magnesium market. Firstly, the automotive industry represents a significant market for magnesium due to its lightweight properties, which contribute to fuel efficiency and reduce emissions. With stringent regulations aimed at reducing vehicle emissions and improving fuel economy, automakers are increasingly incorporating magnesium alloys in automotive components such as engine blocks, transmission cases, and structural parts. Moreover, the aerospace industry relies on magnesium alloys for their high strength-to-weight ratio and resistance to elevated temperatures, making them ideal for aircraft components and structural materials. Additionally, the electronics industry utilizes magnesium for lightweight casings, heat sinks, and battery enclosures in electronic devices such as laptops, smartphones, and tablets. Furthermore, the healthcare sector employs magnesium alloys in medical implants, surgical instruments, and orthopedic devices due to their biocompatibility and corrosion resistance properties.

Region Insights:

The global magnesium market exhibits regional variations in terms of production, consumption, and market dynamics. China dominates the production of magnesium globally, accounting for a significant share of the market due to its abundant reserves of magnesium ore and established manufacturing infrastructure. Chinese magnesium producers benefit from lower production costs, economies of scale, and government support, enabling them to maintain a competitive edge in the global market. In terms of consumption, North America and Europe represent key markets for magnesium, driven by the automotive, aerospace, and electronics industries. The Asia-Pacific region, including countries like Japan, South Korea, and India, also contributes to the demand for magnesium, particularly in automotive manufacturing and industrial applications.

Trends

Several trends are shaping the evolution of the global magnesium market. One prominent trend is the increasing adoption of magnesium alloys in the automotive industry to reduce vehicle weight and improve fuel efficiency. Automakers are exploring innovative ways to incorporate magnesium components in vehicle design, including body panels, chassis components, and interior trim, to meet regulatory requirements and consumer preferences for lightweight vehicles. Another trend is the growing use of magnesium in battery technologies for electric vehicles and renewable energy storage systems. Magnesium-based batteries offer advantages such as high energy density, fast charging capabilities, and lower environmental impact compared to conventional lithium-ion batteries, driving research and development efforts in this space. Moreover, advancements in magnesium processing technologies, such as improved casting techniques and alloy formulations, are enhancing the performance and cost-effectiveness of magnesium-based materials, further fueling market growth.

Magnesium Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.44% |

| Global Market Size in 2023 | USD 5.33 Billion |

| Global Market Size in 2024 | USD 5.62 Billion |

| Global Market Size by 2033 | USD 9.05 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Magnesium Market Dynamics

Drivers

Several drivers are propelling the growth of the global magnesium market. Firstly, the automotive industry’s shift towards lightweight materials to improve fuel efficiency and reduce emissions is driving the demand for magnesium alloys. Automakers are under pressure to meet stringent regulatory requirements for fuel economy and emissions, prompting them to explore alternative materials such as magnesium to achieve weight savings without compromising performance or safety. Additionally, the aerospace industry’s demand for lightweight materials with high strength-to-weight ratio properties is driving the adoption of magnesium alloys in aircraft manufacturing. Magnesium’s excellent mechanical properties and resistance to corrosion make it an attractive choice for aerospace applications, including aircraft fuselage components, engine parts, and landing gear. Furthermore, the increasing use of magnesium in electronics manufacturing, particularly for lightweight casings and heat sinks in consumer electronic devices, is driven by the demand for thinner and lighter products with enhanced thermal management capabilities.

Opportunities:

The global magnesium market presents numerous opportunities for stakeholders across the value chain. Magnesium producers have the opportunity to capitalize on the growing demand for lightweight materials in automotive, aerospace, and electronics industries by expanding production capacity, optimizing manufacturing processes, and investing in research and development. Automotive suppliers can leverage magnesium alloys to differentiate their products and gain a competitive edge in the market by offering lightweight solutions that meet regulatory requirements and consumer expectations for fuel-efficient vehicles. Moreover, advancements in magnesium processing technologies, such as recycling and alloy development, offer opportunities to enhance the sustainability and cost-effectiveness of magnesium-based materials. Additionally, the growing emphasis on renewable energy sources and energy storage solutions presents opportunities for magnesium in battery technologies and lightweight components for electric vehicles and renewable energy systems.

Challenges:

Despite the promising growth prospects, the global magnesium market faces several challenges that could impact its expansion. One of the primary challenges is the volatility of magnesium prices, which are influenced by factors such as raw material costs, production capacity, and global economic conditions. Fluctuations in magnesium prices can pose challenges for manufacturers and end-users in terms of budgeting, pricing strategies, and supply chain management. Additionally, concerns regarding the flammability of magnesium alloys and their susceptibility to corrosion in certain environments pose challenges for their widespread adoption in automotive and aerospace applications. Moreover, environmental and regulatory challenges related to magnesium production, including energy consumption, emissions, and waste disposal, require sustainable solutions to minimize the environmental impact of magnesium extraction and processing. Addressing these challenges will require collaboration among stakeholders to overcome technical barriers, enhance product quality and performance, and ensure the sustainable growth of the global magnesium market.

Read Also: Electric Construction Equipment Market Size, Share, Report by 2033

Recent Developments

- In February 2023, Western Magnesium Corporation announced its plan to build a new production facility for magnesium metal with an initial annual capacity of 25,000 metric tons and a new research and development center in Nevada. With the help of this new production facility, the company aims to serve automotive, aerospace, airline, eco-friendly technology companies, and defense contractors through this expansion.

- In July 2022, Chongqing Boao Magnesium-Aluminum Metal Manufacturing Co. Ltd (a wholly owned subsidiary of RSM Group/ Nanjing Yunhai Special Metals Co. Ltd) announced the completion of a high-performance magnesium-aluminum alloy and deep processing project (Phase II project) located in Pingshan Industrial Park, Chongqing City. The new production facilities could have various workshops, including a magnesium particle production workshop with a 7,200 tons/year capacity.

- In January 2022, VSMPO-AVISMA Corporation (VSMPO) announced the extension of a long-term agreement with Barnes Aerospace (Barnes) until December 2026, with an approximate value of $35M. Under the amended contract, VSMPO intends to provide Barnes with an agreed-upon range of alloys and sizes of titanium mill products to support their commercial aircraft manufacturing programs.

- In April 2022, Western Magnesium Corporation announced a non-brokered private placement of USD 3,000,000 in principal amount of unsecured convertible notes.

Magnesium Market Companies

- U.S. Magnesium LLC

- Mag Specialties Inc.

- RIMA Group

- China Magnesium Corporation Ltd.

- Taiyuan Tongxiangyuan Fine Material Co., Ltd.

- POSCO Magnesium Corporation

- Norsk Hydro ASA

- Dead Sea Magnesium Ltd.

- Wenxi YinGuang Magnesium Industry (Group) Co., Ltd.

- Yinguang Magnesium Industry (Group) Co., Ltd.

- Shanxi Wenxi Hongfu Magnesium Co., Ltd.

- Taiyuan Yiwei Magnesium Co., Ltd.

- Shanxi Credit Magnesium Co., Ltd.

- Shanxi Fugu Tianyu Mineral Industry Co., Ltd.

- Shanxi Xinghua Magnesium Co., Ltd.

- Shanxi Yinguang Huasheng Magnesium Co., Ltd.

- Solikamsk Magnesium Works OAO (SMW)

- Timminco Limited

- Ningxia Hui-Ye Magnesium Marketing Group Co., Ltd.

- JSC Magnezit Group

Segments Covered in the Report

By Application

- Aluminum Alloying

- Die casting

- Desulfurization

- Metal Reduction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/