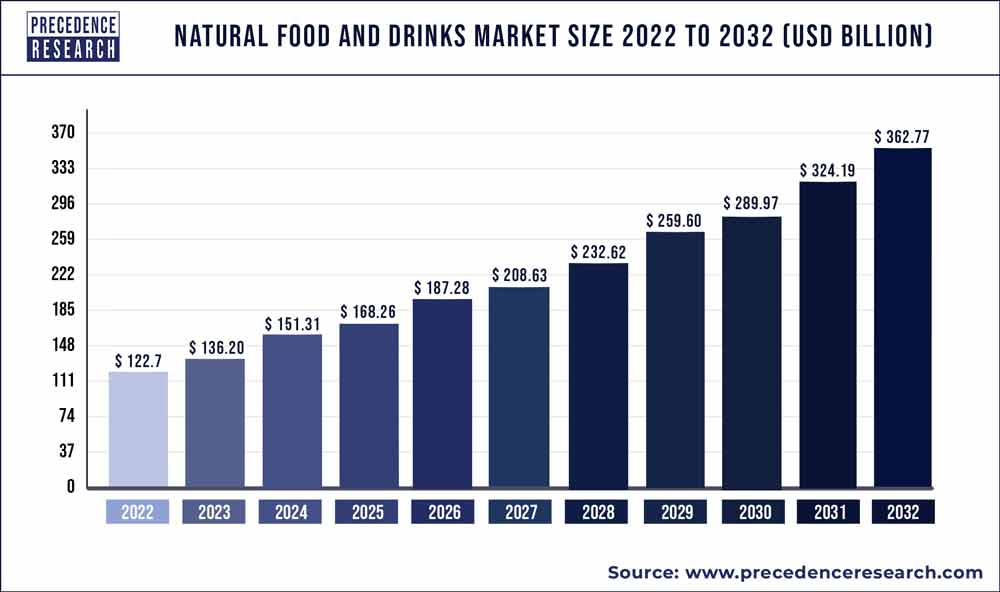

The global natural food and drinks market size accounted for US$ 122.7 billion in 2022. It is projected to reach US$ 362.77 billion by 2032, indicating a CAGR of 11.50% from 2023 to 2032.

Key Takeaways

- North America contributed more than 40% of revenue share in 2022.

- Asia Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By product type, the natural food segment has held the largest market share of 55% in 2022.

- By product type, the natural drinks segment is anticipated to grow at a remarkable CAGR of 11.2% between 2023 and 2032.

- By packaging, the cans segment generated over 60% of revenue share in 2022.

- By packaging, the paperboard segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the supermarkets/hypermarkets segment generated over 31% of revenue share in 2022.

- By distribution channel, the others segment is expected to expand at the fastest CAGR over the projected period.

The Natural Food and Drinks Market has experienced significant growth in recent years, driven by a global shift towards healthier and more sustainable lifestyles. Consumers are increasingly seeking natural and organic alternatives, driven by concerns about the environment, health, and the desire for transparency in food sourcing and production.

Get a Sample: https://www.precedenceresearch.com/sample/3514

Growth Factors

One of the key growth factors for the Natural Food and Drinks Market is the rising awareness of the health benefits associated with consuming natural and organic products. As more people become conscious of the impact of their diet on overall well-being, there is a growing demand for foods and beverages that are free from artificial additives, preservatives, and pesticides. This trend is fueled by an increasing emphasis on preventive healthcare and a preference for clean-label products.

Moreover, the growing popularity of environmentally friendly and sustainable practices has contributed to the expansion of the market. Consumers are not only looking for products that promote personal health but also align with their ethical and environmental values. This has led to a surge in demand for products with eco-friendly packaging, fair trade practices, and a focus on responsible sourcing of ingredients.

The Natural Food and Drinks Market has also benefited from a shift in consumer preferences towards unique and exotic flavors. As consumers become more adventurous in their culinary choices, there is an increasing demand for natural products that offer diverse and authentic taste experiences. This has paved the way for innovation in product development, with companies introducing a wide range of natural and organic options to cater to evolving taste preferences.

Additionally, the digital age has played a crucial role in the market’s growth, providing consumers with easy access to information about products, ingredients, and the companies behind them. Online platforms and social media have become powerful tools for brands to communicate their values, share stories, and engage with a growing community of health-conscious consumers.

Natural Food and Drinks Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 11.50% |

| Market Size in 2023 | USD 136.20 Billion |

| Market Size by 2032 | USD 362.77 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product Type, By Packaging, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Membrane Switch Market Size To Hit USD 12.36 Bn By 2032

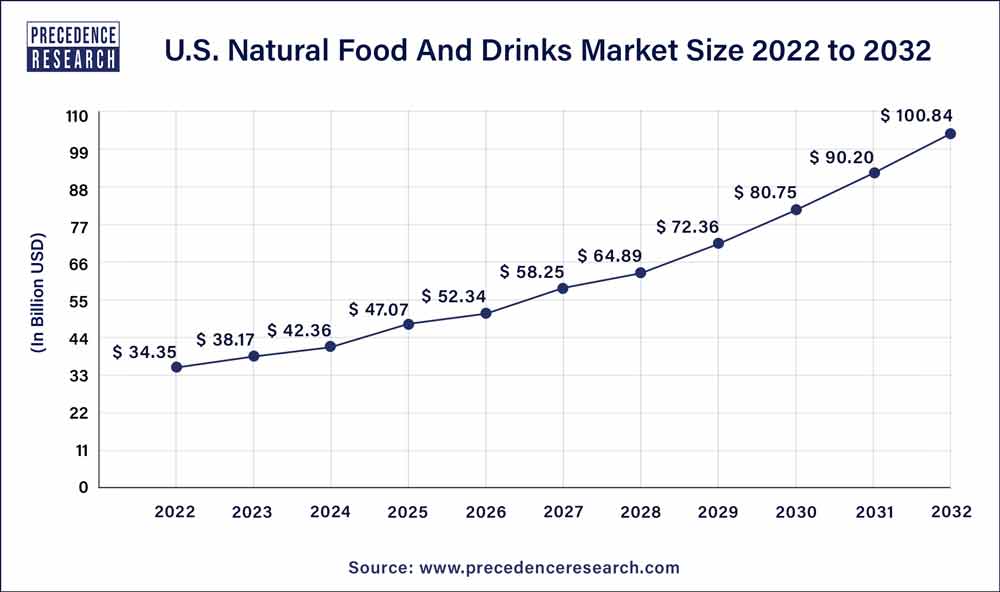

Natural Food and Drinks Market in the U.S. 2023 To 2032

The U.S. natural food and drinks market size reached USD 34.35 billion in 2022 and is projected to grow USD 100.84 billion by 2032, at a CAGR of 11.40% from 2023 to 2032.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Natural Food and Drinks Market Players

- Whole Foods Market

- Organic Valley

- The Hain Celestial Group

- General Mills

- Nestlé

- The Coca-Cola Company

- PepsiCo

- Danone

- Kellogg Company

- Tyson Foods

- Archer-Daniels-Midland

- Nature’s Path

Segments Covered in the Report

By Product Type

- Natural Food

- Natural Drinks

By Packaging

- Paperboard

- Cans

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Natural Or Health Food Store

- Convenience Stores

- Online Retails

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Natural Food and Drinks Market

5.1. COVID-19 Landscape: Natural Food and Drinks Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Natural Food and Drinks Market, By Product Type

8.1. Natural Food and Drinks Market Revenue and Volume, by Product Type, 2023-2032

8.1.1 Natural Food

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Natural Drinks

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Natural Food and Drinks Market, By Packaging

9.1. Natural Food and Drinks Market Revenue and Volume, by Packaging, 2023-2032

9.1.1. Paperboard

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Cans

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Natural Food and Drinks Market, By Distribution Channel

10.1. Natural Food and Drinks Market Revenue and Volume, by Distribution Channel, 2023-2032

10.1.1. Supermarkets/Hypermarkets

10.1.1.1. Market Revenue and Volume Forecast (2020-2032)

10.1.2. Natural Or Health Food Store

10.1.2.1. Market Revenue and Volume Forecast (2020-2032)

10.1.3. Convenience Stores

10.1.3.1. Market Revenue and Volume Forecast (2020-2032)

10.1.4. Online Retails

10.1.4.1. Market Revenue and Volume Forecast (2020-2032)

10.1.5. Others

10.1.5.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 11. Global Natural Food and Drinks Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.1.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.1.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.1.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.1.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.1.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.1.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.2.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.2.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.2.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.2.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.2.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.2.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.2.6.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.2.6.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.2.7.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.2.7.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.3.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.3.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.3.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.3.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.3.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.3.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.3.6.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.3.6.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.3.7.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.3.7.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.4.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.4.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.4.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.4.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.4.6.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.4.6.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.4.7.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.4.7.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.5.4.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.5.4.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

11.5.5.2. Market Revenue and Volume Forecast, by Packaging (2020-2032)

11.5.5.3. Market Revenue and Volume Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Whole Foods Market

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Organic Valley

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. The Hain Celestial Group

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. General Mills

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Nestlé

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. The Coca-Cola Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PepsiCo

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Danone

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Kellogg Company

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tyson Foods

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/